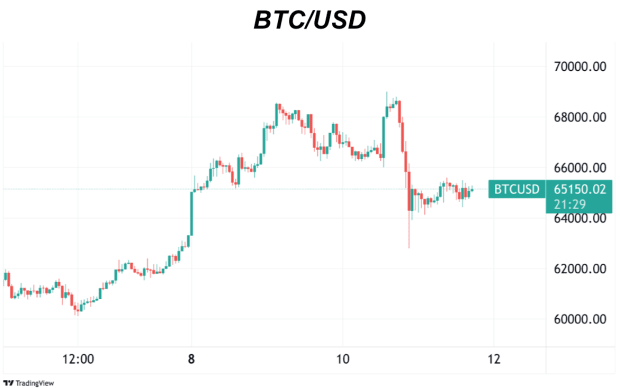

Wells Fargo, America’s Third Largest Bank, Owns Spot Bitcoin ETFs: SEC Filing

In a recent filing with the Securities and Exchange Commission (SEC), Wells Fargo, one of the largest banks in the United States, disclosed its exposure to spot Bitcoin Exchange-Traded Funds (ETFs).

JUST IN: 🇺🇸 Wells Fargo bank reveals it has spot #Bitcoin ETF exposure in new SEC filing 👀 pic.twitter.com/H1iY9puKVb

— Bitcoin Magazine (@BitcoinMagazine) May 10, 2024

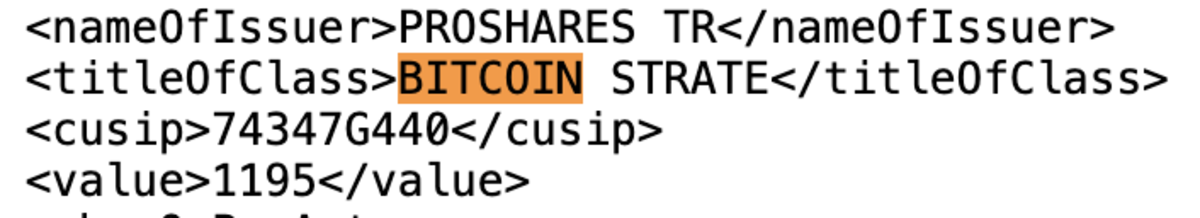

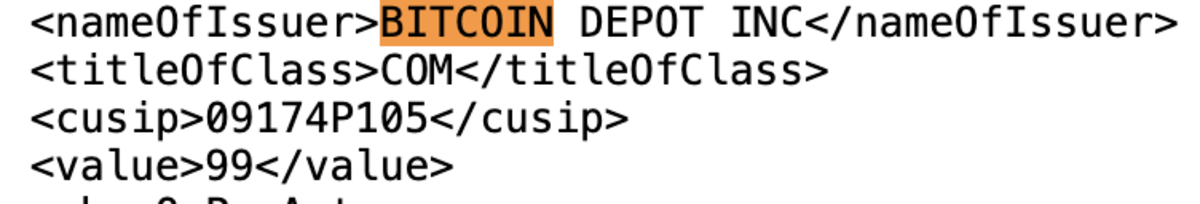

According to the filing, Wells Fargo holds positions in Grayscale’s spot Bitcoin ETF, ProShares Bitcoin Strategy futures ETF, and shares in Bitcoin Depot Inc., marking a notable entry into the Bitcoin market. Spot Bitcoin ETFs enable investors to gain exposure to Bitcoin’s price movements without directly owning the asset, making them a popular choice among institutional investors seeking a more regulated investment vehicle for BTC.

The news of Wells Fargo’s spot Bitcoin ETF exposure comes amid a broader trend of institutional adoption of Bitcoin, with several major banks and financial institutions exploring ways to incorporate BTC into their offerings and get exposure to the asset.

Earlier this week, investment firm giant Susquehanna International Group, LLP revealed in an SEC filing that it holds $1.8 billion in spot Bitcoin and other Bitcoin ETFs, joining the wave of massive financial institutions disclosing their exposure to BTC.