Robinhood’s Q1 Crypto Trading Volume Surged 224% as SEC Action Looms

Robinhood (HOOD) saw first quarter notional crypto trading volume of $36 billion, up 224% from year-ago levels.

That led to a 232% increase in crypto-related a revenue to $126 million, a primary factor, said the company, in driving overall first quarter transaction-based revenue up 59% year-over-year to $329 million.

20:00

What Happens if ETH Is Deemed a Security?

02:13

Binance CEO Calls on Nigeria to Release Detained Executive; Galaxis Raises $10M

02:23

Robinhood Shares Fall After Wells Notice From SEC; Crypto’s Guard Against Hacks

02:09

Bee Movie Script Buzzing on Ethereum; Robinhood Benefits From ‘Monster’ Crypto Cycle

Robinhood had $26.2 billion in user’s crypto in custody as of March 31, a 78% jump from the end of 2023.

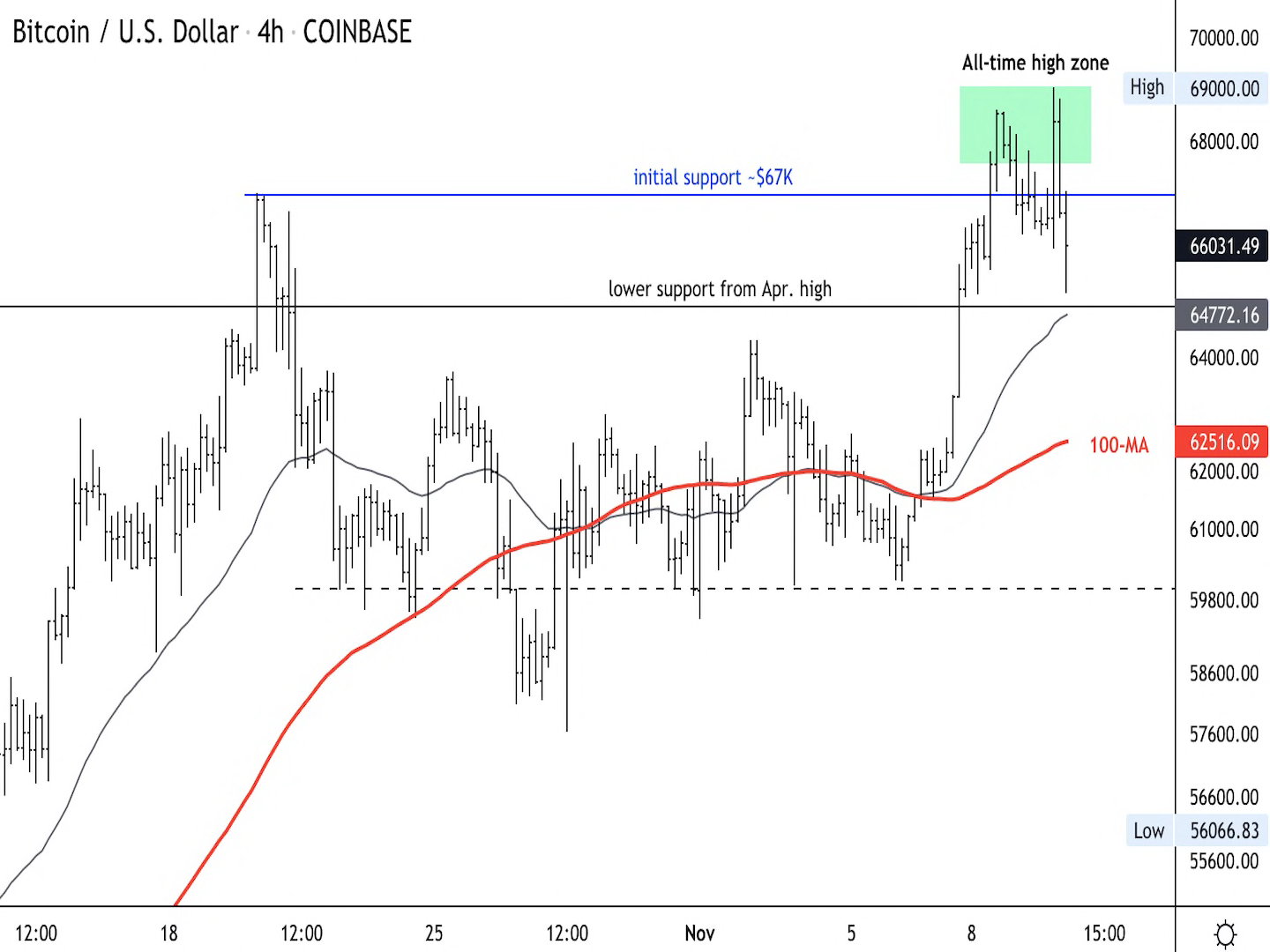

The larger transaction revenue due to crypto trading isn’t surprising as another publicly traded crypto peer, Coinbase (COIN), also reported “blowout” first quarter numbers due to improving crypto market conditions.

Robinhood also handily beat its first-quarter sales and earnings estimates. The company reported $618 million in revenue in the quarter, ahead of analyst estimates of $552.7 million, according to FactSet data. First quarter earnings were $0.18 per share, topping the average analyst expectation of $0.06.

Shares of Robinhood were up about 7% in post-market trading on Wednesday, while Coinbase shares were down slightly. HOOD stock has risen about 40% for the year, while COIN has gained 22%.

The company last week disclosed receipt of a Wells Notice from the U.S. Securities and Exchange commission for its crypto unit.

Edited by Stephen Alpher.