MicroStrategy Acquires More Bitcoin Amid Revenue Decline and Net Loss

Business intelligence company MicroStrategy continues to increase its bitcoin stash, with a recent purchase of 122 BTC for nearly $8 million. In 2024 alone, the NASDAQ-listed giant has bought over 25,000 BTC.

The company, which continues to remain the world’s largest corporate holder of Bitcoin, also reported a net loss and a decline in revenue in the first quarter of 2024.

In April, @MicroStrategy acquired an additional 122 BTC for $7.8 million and now holds 214,400 BTC. Please join us at 5pm ET as we discuss our Q1 2024 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/h40yyrgEb0

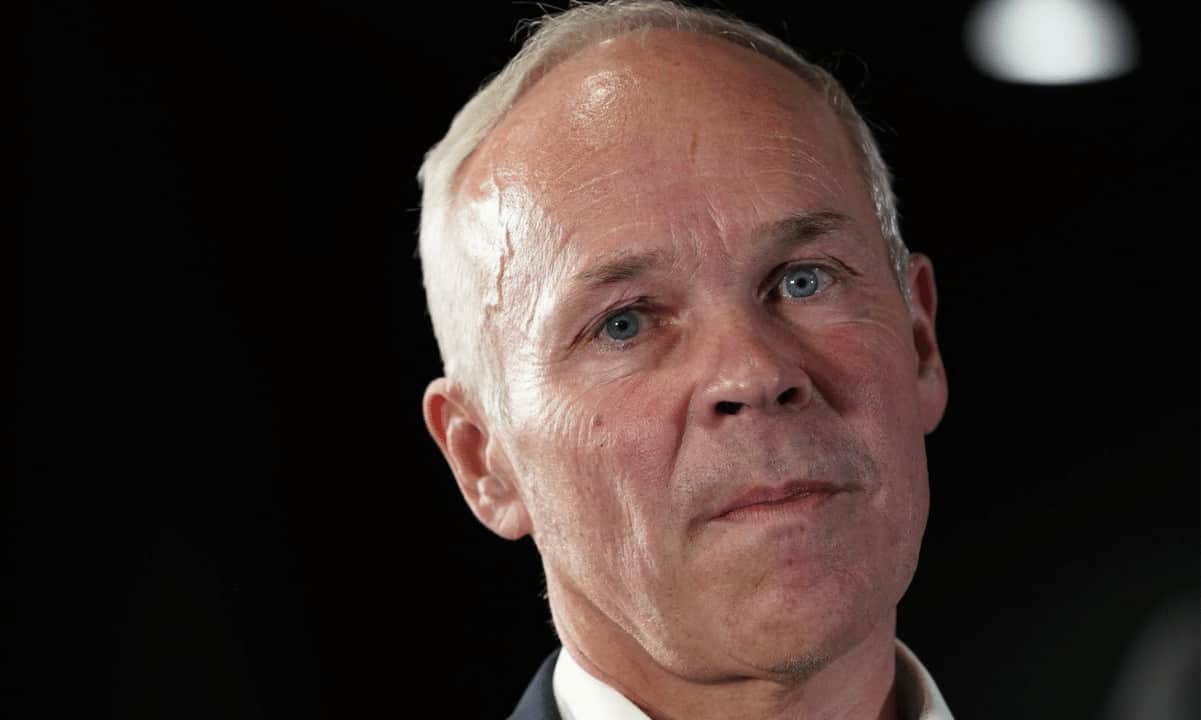

— Michael Saylor

(@saylor) April 29, 2024

- MicroStrategy, in its Q1 2024 financial results, revealed that its Bitcoin holdings have grown to 214,400 following the acquisition of 122 BTC in April for $7.8 million, with the firm taking advantage of the dip.

- While the purchase is small compared to its previous BTC acquisitions, MicroStrategy maintains its dedication to continue adding to its Bitcoin pot, even despite the crypto’s recent price decline.

- Bitcoin hit a new price record of over $73,000 in 2024 in March but has since declined more than 13%, currently trading at $63,400, according to Coingecko.

- MicroStrategy also revealed it had bought a total of 25,250 BTC – with most of the proceeds from two successful convertible debt offerings – since the end of Q4 2023 for $1.65 billion, or at an average cost of $65,232 per coin.

- The firm’s current Bitcoin pot of 214,400, meanwhile, is valued at approximately $13.6 billion and was purchased for $7.5 billion as of April 26, 2024, at an average price of $35,164, as stated in the report.

- While MicroStrategy continues to increase its BTC holdings, the business intelligence company’s Q1 2024 results recorded a 5.5% decrease in revenue at $115.2 million compared to the same period in 2023.

- Also, the report noted a net loss of $53.1 million in Q1 2024, or $3.01 per share, as against a net income of $461.2 million in the same quarter in 2023. The net loss came after a digital asset impairment loss of $191.6 million in the first quarter of 2024.

The post MicroStrategy Acquires More Bitcoin Amid Revenue Decline and Net Loss appeared first on CryptoPotato.