Ether’s Bull Momentum Is Strongest Since May 2021

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

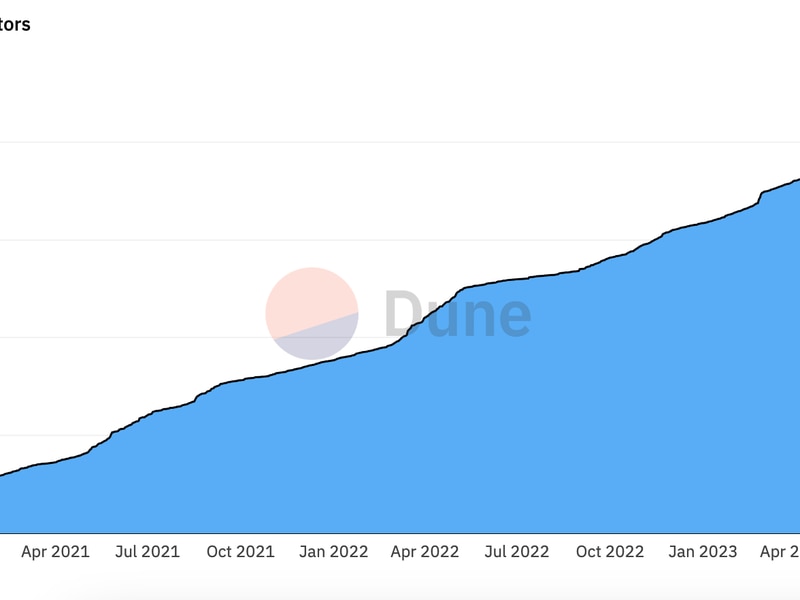

A popular technical study says ether’s ongoing uptrend is as strong as the one in May 2021.

-

Other indicators like the RSI suggest the same, with immediate resistance lined up at $4,090.

What’s the opposite of the famous market phrase “don’t catch the falling knife?” That’s the current state of the ether market, where prices are exhibiting the strongest upward momentum in three years.

A week ago, well before the spot ETH ETF speculation gathered steam, CoinDesk reported the possibility of ether’s (ETH) price bouncing off a key bullish trendline support. Since then, it has surged at least 18% to $3,800, chalking out a bigger-than-expected increase.

More importantly, the second-largest cryptocurrency’s momentum indicator, which measures the rate of change in prices over 10 days, has jumped to $880, the highest since May 2021, according to charting platform TradingView.

In other words, the bullish trend is strong; bears looking to sell, if there are any, could easily be run over. It also means that picking a top right now is as risky as attempting to pick a bottom – catching that falling knife – when an asset is experiencing a strong decline.

Traders use the momentum indicator to confirm market trends and spot divergences. A bearish divergence occurs when the indicator decouples from rising prices, hinting at bullish exhaustion and potential correction, or drop.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/COOJMT6RT5ELPNNR4FHBQGBHVU.png)

As of writing, ether’s daily price chart (left) shows the momentum indicator rising along with the price, confirming the uptrend.

The 14-day RSI (lower pane) has crossed above 70, which is also a sign of strengthening bullish momentum. The indicator oscillates between 0 and 100. Readings above 70 indicate a strong upward momentum, not as popularly perceived, overbought conditions . Readings below 30 show an acceleration in price sell-off.

The 14-week RSI (right) is fast closing on the 70 level, a threshold that has marked previous parabolic bull runs.

The immediate resistance is seen at $4,090, the high hit in April, followed by the record price of $4,692 reached during the bull run of 2021. Options traders from the decentralized marketplace Lyra are positioned for a rally to $5,000 by the end of the second quarter.

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.