Crypto Market Sell-Off Was Driven by Retail Investors, JPMorgan Says

-

JPMorgan maintained its cautious view on crypto markets.

-

The bank said retail investors have been taking profits in recent weeks.

-

The market is still faced with headwinds such as elevated positioning, the report said.

Wall Street giant JPMorgan (JPM) said it’s keeping its cautious stance on cryptocurrency markets in the near term due to a lack of positive catalysts and because the retail impulse is disappearing.

The bank notes that retail investors sold both crypto and equity assets in April and spot bitcoin exchange-traded funds (ETFs) have seen outflows. The three headwinds the bank has already identified – elevated positioning, high bitcoin prices versus gold and versus the estimated bitcoin production cost, and subdued crypto venture capital (VC) funding – are also still in place.

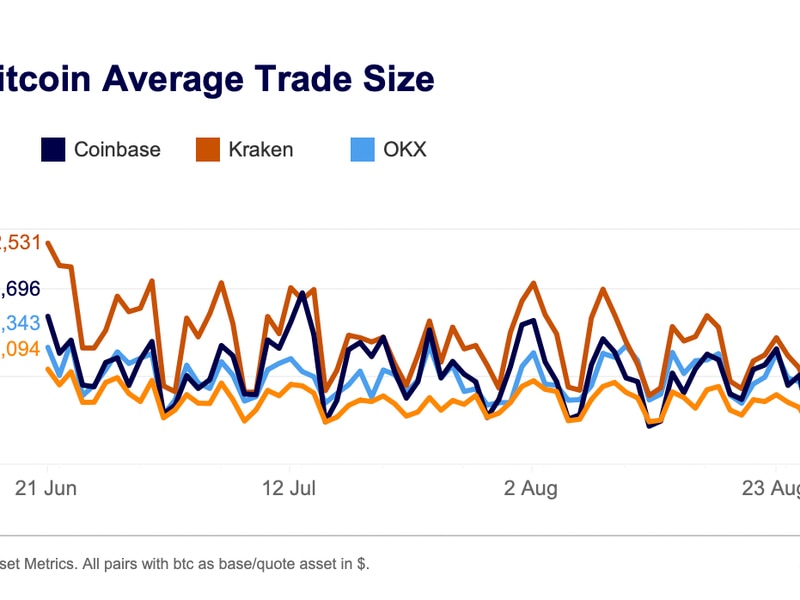

Cryptocurrency markets have seen significant profit taking in recent weeks, with retail investors playing a bigger part in the sell-off than institutional investors, the report said. Bitcoin fell 16% in April, the biggest monthly decline since June 2022.

Investors sold U.S.-based spot bitcoin ETFs at the fastest pace ever on Wednesday. The 11 ETFs saw a cumulative net outflow of $563.7 million, the largest since the funds started trading on Jan. 11.

With regards to institutional investors, “it has been mostly momentum traders such as commodity trading advisors (CTAs) or other quantitative funds taking profit on previous extreme long positions in both bitcoin and gold,” analysts led by Nikolaos Panigirtzoglou wrote.

Still, analysis of the futures market suggests a “more limited position reduction by other institutional investors outside quantitative funds and CTAs,” the authors wrote.

Edited by Sheldon Reback.