BTC Liquidity Crisis? Bitcoins on Exchanges Decrease as Whales Continue Accumulating

The number of bitcoins stored on cryptocurrency exchanges has been gradually decreasing while the number of BTC whales keeps increases. Having also in mind the aftermath of the halving and institutions purchasing massive quantities of the asset, it could lead to a significant liquidity crisis.

Bitcoin Whales Behavior And BTC On Exchanges

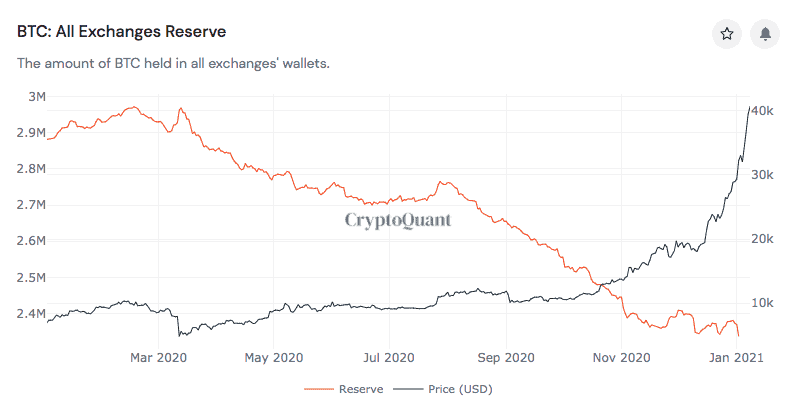

Data from the monitoring resource CryptoQuant informs that the number of bitcoins kept on crypto exchanges has been continuously dropping for nearly a year.

As the graph below demonstrates, BTC held in exchanges’ wallets peaked at nearly three million during and after the liquidity crisis in mid-March 2020 when the asset price plummeted below $4,000.

As the cryptocurrency started to recover its lost value, many investors began withdrawing their BTC holdings from exchanges. This has led to the recent numbers of beneath 2.4 million held on trading venues.

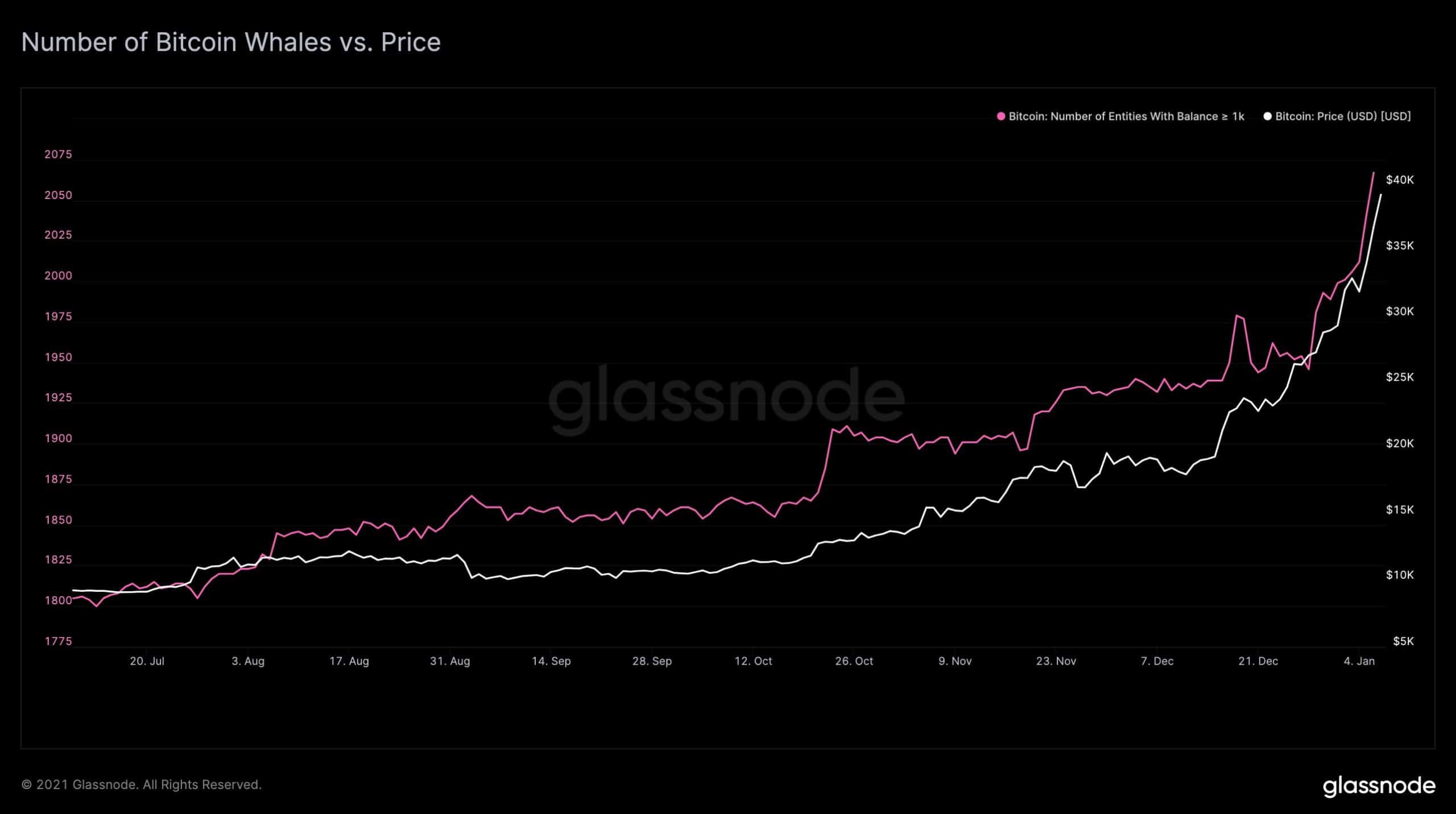

At the same time, Glassnode’s CTO highlighted the correlation between BTC’s price and the growing number of addresses holding at least 1,000 bitcoins (also known as whales).

Glassnode’s graph illustrates that BTC whales have been gradually expanding their holdings during the same period to north of 2,000 such addresses. The price has performed quite similarly, exploding to new highs of over $40,000.

Both of these metrics point out to a topic that has been growing in popularity within the cryptocurrency community – a liquidity crisis.

Is There A BTC Liquidity Crisis Indeed?

CryptoPotato recently reported another angle that explored different metrics that suggest an ongoing liquidity crisis for the cryptocurrency. Apart from the whales, it breached the estimated three million lost coins and the game-charger of 2020 – the start of institutional adoption.

Last year saw the grand entrance of numerous large corporations and institutions. Michael Saylor’s business intelligence giant MicroStrategy led the charge. The NASDAQ-listed company made several BTC purchases in a matter of months for that equaled over $1.1 billion allocated in total.

Jack Dorsey’s Square followed with a $50 million buy. The insurance giant MassMutual, the hedge funds One Asset River Management and Ruffer Investment, and the Wall Street behemoth Guggenheim Partners also allocated billions of dollars in total in BTC.

The largest digital asset manager, Grayscale, has also enjoyed massive growth of institutional customers leading to record-breaking results.

Consequently, these developments have drained the liquid supply of bitcoins. Adding the slashed in half production of news coins to 6.25 BTC per block after the 2020 halving, one can see merit in the theory that the cryptocurrency is indeed in a liquidity crisis.