Bitcoin Poised to Enter Lenghty Re-Accumulation Phase as Pullback Hits 18%

Bitcoin has now retreated 18% from its all-time high of $73,737 on March 14, tapping $60,000 during late trading on April 17.

Corrections are a healthy part of market cycles, however, and analysts agree that this one may not be over yet despite the halving being just a couple of days away.

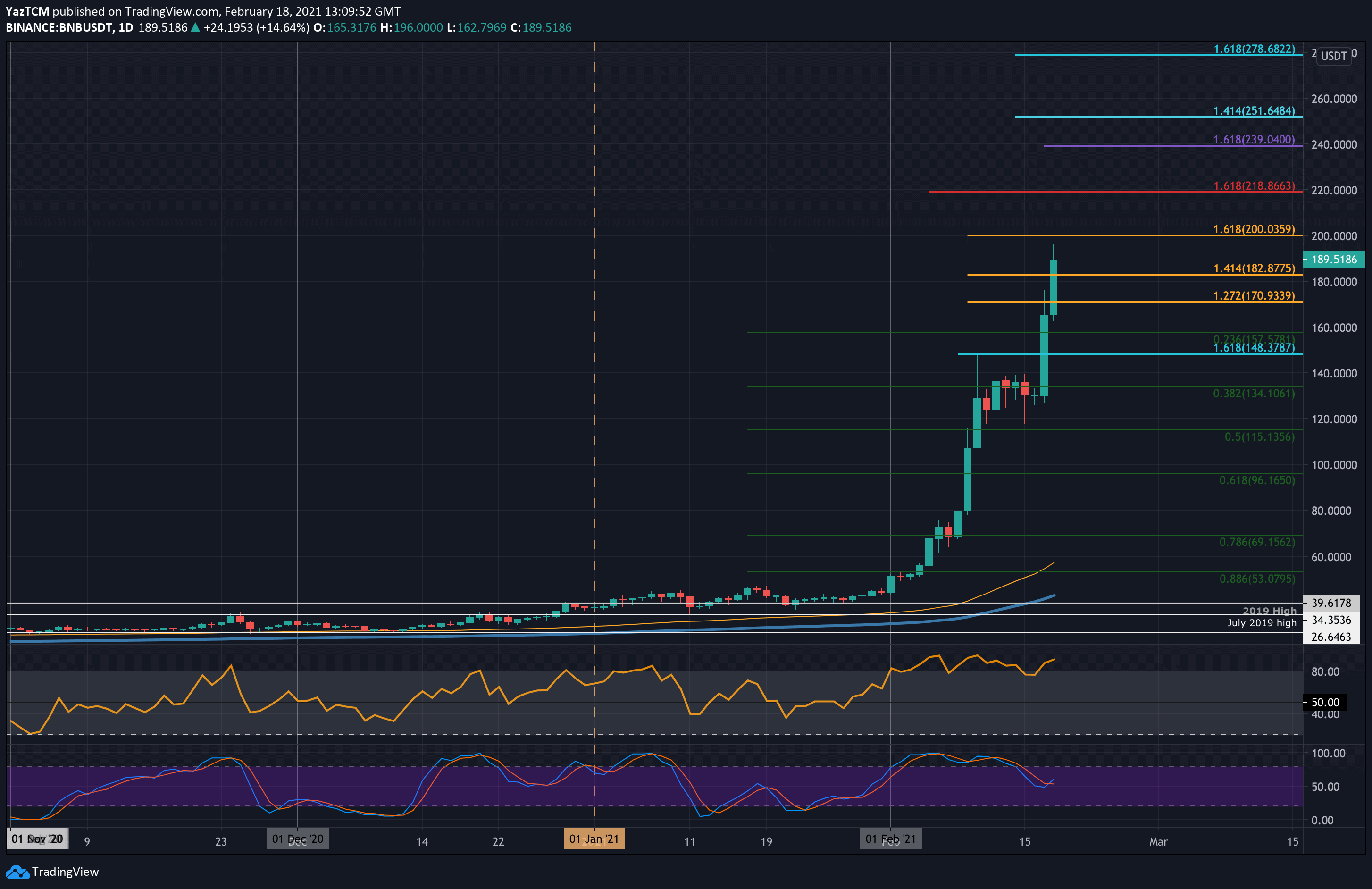

On April 17, trader and analyst ‘Rekt Capital’ highlighted three market phases around the halving event, predicting a move into a re-accumulation phase.

Bitcoin Re-Accumulation Phase

Bitcoin has produced two 18% retraces prior to the halving in the span of just over a month, the analyst observed.

“This downside is typical just before the halving,” he said before comparing this cycle to previous ones. In 2016, the pre-halving retrace was 38% deep, and in 2020, it was 19% deep.

Now that the correction may be coming to a conclusion, markets will enter a re-accumulation phase after the halving, he predicted.

During this phase, Bitcoin will establish a range low and then move sideways, going into the halving and beyond. However, the re-accumulation phase has historically lasted for several months.

Bitcoin traded sideways for around five months following the 2016 and 2020 halving events, so if history rhymes, markets could remain range-bound at high $50k levels until around October this year.

“Many investors get shaken out in this stage due to boredom, impatience, and disappointment with lack of major results in their BTC investment in the immediate aftermath of the halving,”

#BTC

3 Phases of The Bitcoin Halving

1. Final Pre-Halving Retrace

Bitcoin has produced two -18% retraces prior to the Halving in the span of just over a month

In mid-March, BTC pulled back -18% before recovering to $70000 and now in mid-April BTC has retraced -18% again

This… pic.twitter.com/2BKBQXpPOV

— Rekt Capital (@rektcapital) April 17, 2024

On-chain analytics firm Santiment painted a bleaker picture, reporting that social sentient was sinking on April 18.

“According to the crypto crowd, the bull market has essentially come to an end,” following the Bitcoin correction from an all-time high. Additionally, bear market mentions are increasing, it noted before adding, “Historically, prices move the opposite direction of mass traders’ expectations.”

Elsewhere on Crypto Markets

Bitcoin prices dumped to $60,000 during late trading on Wednesday but recovered to $62,000 during the Thursday morning Asian trading session.

Ethereum lost the $3,000 level again but also recovered slightly to reach $3,027 at the time of writing.

The altcoins were mostly in the red again, with larger losses for Dogecoin, Toncoin, and Polygon.

The post Bitcoin Poised to Enter Lenghty Re-Accumulation Phase as Pullback Hits 18% appeared first on CryptoPotato.