Bitcoin Dumps to $32K as China’s Third-Largest Bank Announced a Ban on Crypto Usage

Bitcoin’s price has dumped to a two-week low of just over $32,000 as more negative news has emerged from China. This time, one of the largest state-run banks has reportedly prohibited its clients from dealing with any digital assets.

- According to a report from June 21st, the Agricultural Bank of China has published a statement outlining a ban that will prohibit its customers from doing any business with cryptocurrencies.

- It’s worth noting that the Agricultural Bank of China is also one of the largest banks in the world in general.

- Clients’ accounts will be terminated immediately if the bank discovers that they have had any interactions with bitcoin and other digital assets.

- The bank also plans to report all suspicious transactions to the relevant authorities “in a timely manner.”

- Thus, the world’s most populated nation continues with its crackdown on cryptocurrencies.

- As previously reported, the country officially banned BTC within its borders nearly a decade ago but likes to reiterate its stance frequently.

- This time, though, China’s actions are even more aggressive, as it also targetted Bitcoin mining by prohibiting such operations in many of its regions.

- The crypto community speculates that China has upped its game now because of the incoming digital yuan, which will work entirely different from the decentralized nature of bitcoin. It’s worth noting that the Agricultural Bank of China is actually working on the CBDC and has participated in previous tests.

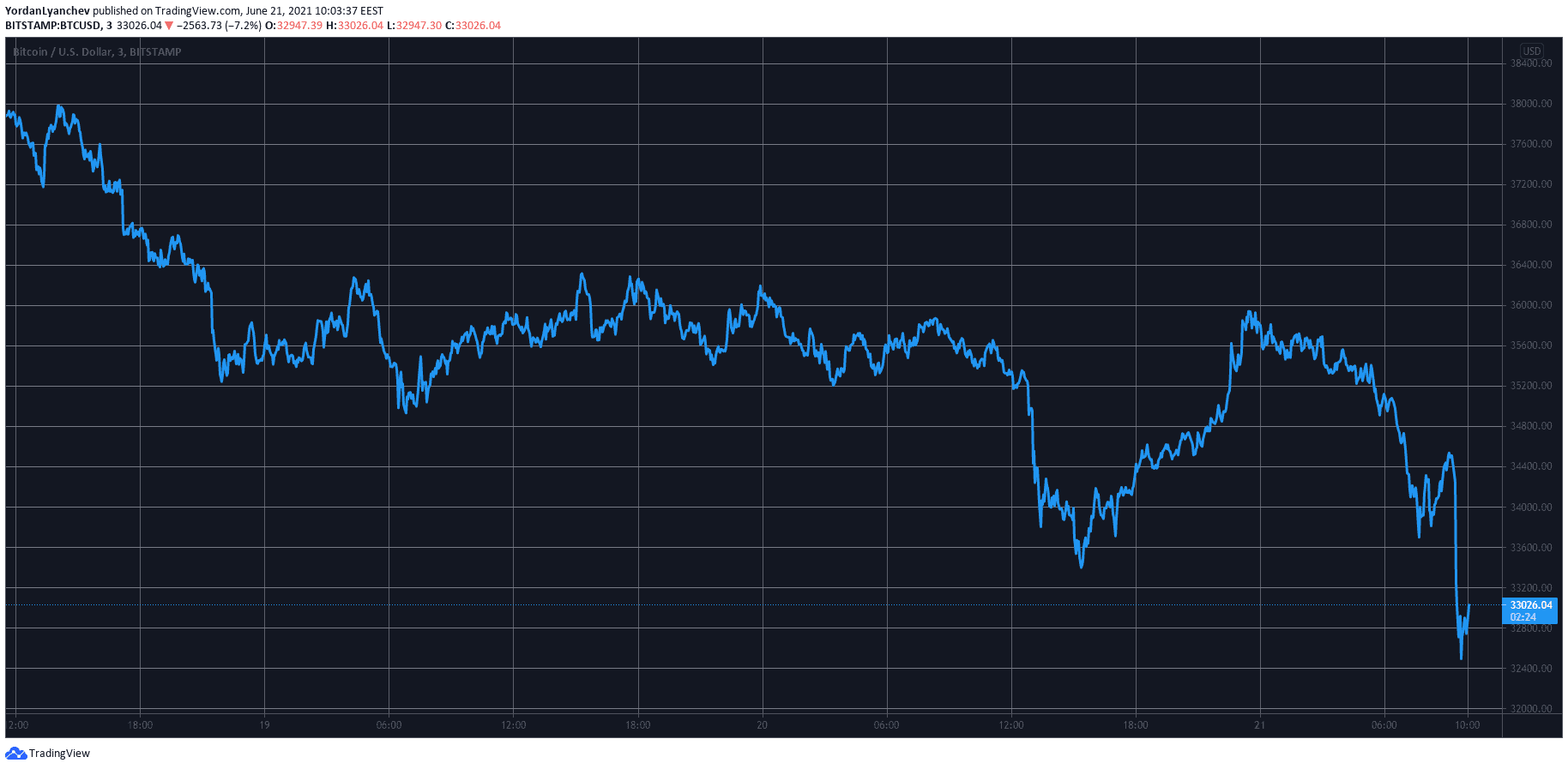

- Nevertheless, today’s announcement from the giant bank has impacted the markets immediately.

- In a matter of hours, BTC dumped by more than $2,000 after the statement to a two-week low of $32,300 (on Bitstamp). On a 24-hour scale, bitcoin went down by nearly $4,000. The situation with the altcoins is even worse, with double-digit price slumps coming from left and right.

- It’s also worth noting that according to a Twitter user, the bank has supposedly deleted the notice shortly after publishing it.

Quick explainer for those confused re AGbank

The agricultural bank of china released an announcement saying any customers dealing with crypto will have accounts closed

15 mins later it appears they deleted the notice

2021 getting rugged by the third largest bank in the world pic.twitter.com/qXax70lqgA

— db (@tier10k) June 21, 2021