Bitcoin Cash Prices Bump Ahead of ‘CashTokens’ Upgrade

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

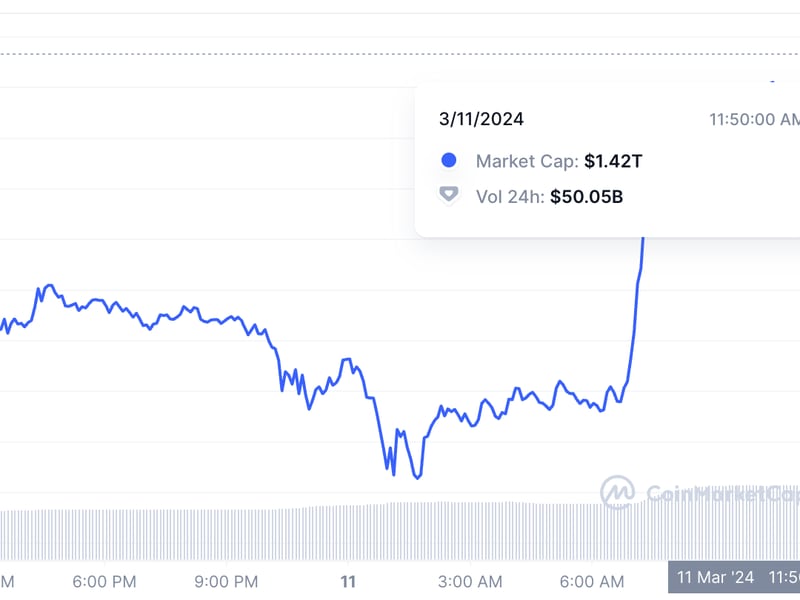

Bitcoin Cash (BCH) prices jumped as much as 6% ahead of a mainnet upgrade that will allow developers to issue tokens atop the network, among other enhancements.

The ‘hard fork’ is scheduled for about noon time UTC on Monday. A hard fork refers to an upgrade in any blockchain network. Bitcoin Cash’s May hard fork is set to bring added security and privacy to the fledgling network, with plans for “CashTokens” – which would enable decentralized applications directly on Bitcoin Cash, as per developers.

Other proposed improvements already locked in include smaller transaction sizes – which help speed up transactional times – and smart contracts functionality that could allow Bitcoin Cash-based applications built that offer recurring payments, derivatives trading, and crowdfunding opportunities, among other uses, to Bitcoin Cash users.

This development comes on the back of growing interest in tokens issued on Bitcoin: The recently-launched ‘Bitcoin Request for Comment’ (BRC20) tokens.

These standards allow developers to issue tokens – and DeFi applications – natively on Bitcoin – which has spurred a collection of digital artwork and meme tokens built on Bitcoin in recent weeks.

Data from OrdSpace, which tracks BRC-20 data, shows over 11,000 tokens issued on Bitcoin are available on the open market as of Monday with a cumulative market capitalization of $500 million, down from a $1.5 billion figure earlier this week.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.