3AC Massive Liquidation Rumors Run Rampant: ETH Crashes to 17-Month Low

The cryptocurrency market continues to take a beating as Bitcoin is approaching $21K whereas ETH is tumbling towards $1.1K. Various accounts on Twitter have shared analytics information pointing out that one of the industry’s largest funds – Three Arrow Capital – is facing liquidations.

- Rumors of Three Arrow Capital (3AC), led by the well-known crypto proponent Zhu Su being insolvent, are ramping up within the community.

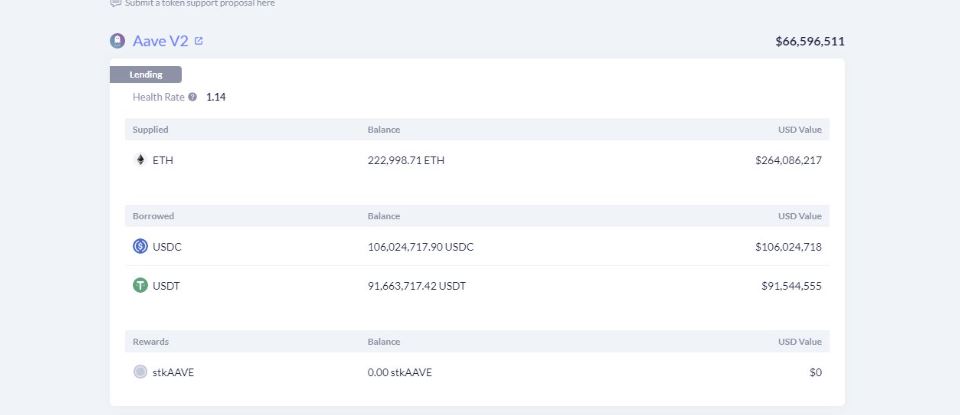

- According to on-chain data, an address that was tagged to belong to 3AC by analytics provider Nansen has been aggressively paying back AAVE debt against a position worth some $264 million (223K ETH) to avoid liquidation.

- On-chain Wizard – a well-known analyst – concluded that if ETH goes to $1042, the position would be liquidated:

- At the time of this writing, ETH is trading at its lowest point since January 2021, charting a 17-month low at slightly above $1,100.

- This means that the above position is some 7% away from being liquidated if no collateral is added or if the loan is not repaid.

- Zhu Su, co-founder at 3AC, took it to Twitter a few hours ago to share some light, albeit limited and without revealing any precise information:

We are in the process of communicating with relevant parties and fully commited to working this out.