Bitcoin Price Analysis: BTC Consolidation – ATH or $16K Next?

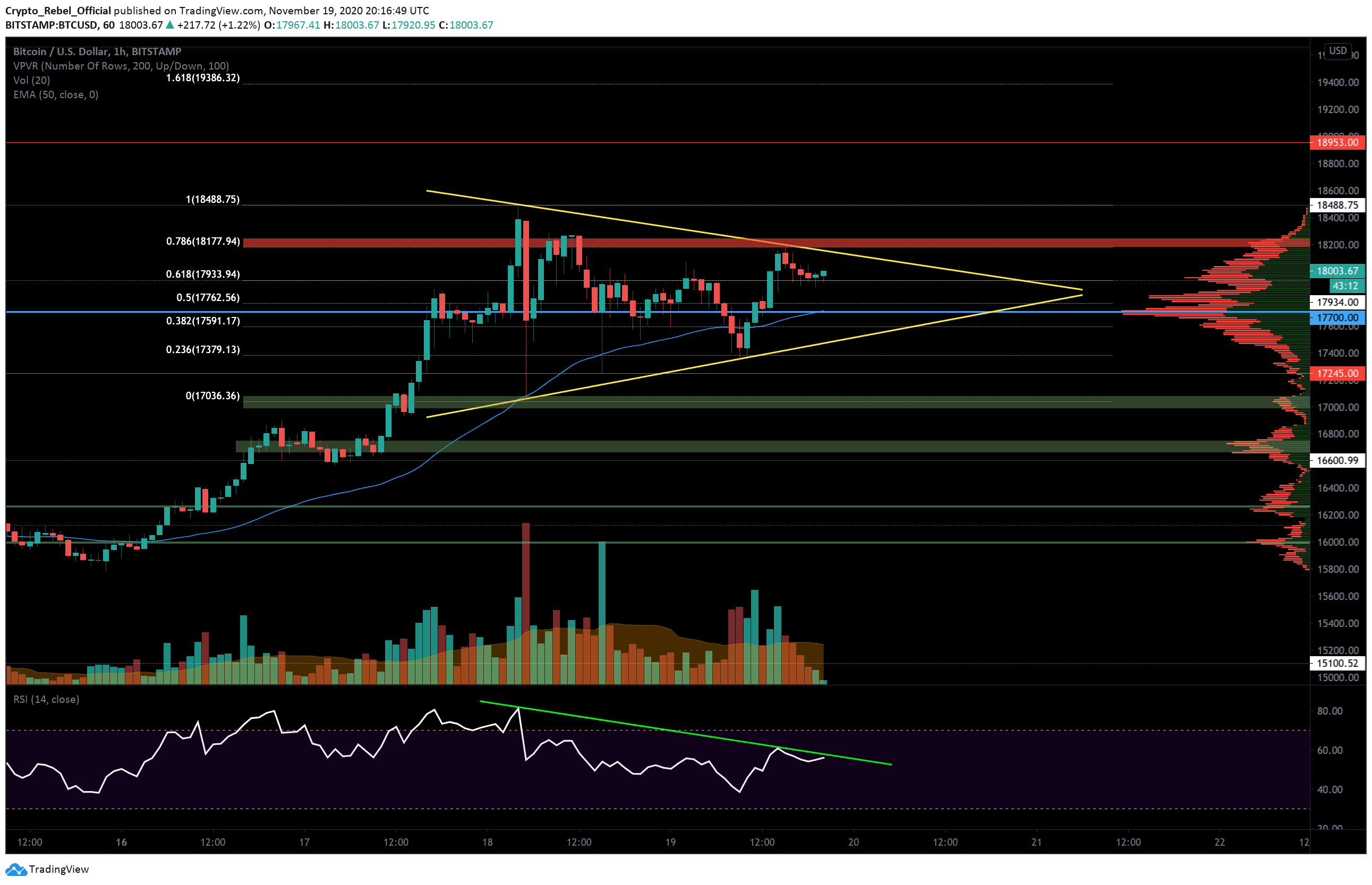

Bitcoin price is tracking inside a pennant pattern right now as candle wicks pinch between two trend lines (yellow). This is a classic bullish continuation pattern and usually results in a strong breakout once the asset reaches maximum consolidation.

According to new figures from Skew, the statistical likelihood of Bitcoin’s price ending the year higher than $20,000 – it’s current all-time high – now stands above 25%.

Despite this optimism, however, short-term volatility has slackened right off during this period of consolidation. The global crypto market capital has been holding steady around $500 billion for the last 3 days. Will we see another surging rally start soon?

Price Levels to Watch in the Short-term.

On the 1-hour BTC/USD chart, we can see that the leading cryptocurrency is currently resting along with the key 0.618 Fibonacci support at $17,933 after an unsuccessful attempt to break the first major short-term resistance at $18,200 (red bar).

If bullish traders can overcome this area, then we should expect to see the next set of resistances at the following levels above:

(1) $18,488 – the current high (1.0 Fibonacci level on the chart).

(2) $18,953 – key daily resistance from December 2017 (red line).

(3) $19,386 – 1.618 Fibonacci level.

(4) $19,660 – the official Bitcoin all-time high according to Bitstamp BTC/USD chart.

It’s worth noting that BTC is now only a 9.05% rally shy of returning to its all-time high price – well within reach considering the asset has risen 16% in the last 3 days.

If confidence departs from the market and bears take back control of BTC, then there are a range of short-term supports that will likely get reactions:

(1) $17,933 – 0.618 Fibonacci level and a strong intraweek S/R level.

(2) $17,700 – Point of Control (blue line) that also overlaps with the hourly 50-EMA line.

(3) $17,480 – Approximate area of pennant pattern support (yellow line).

(4) $17,000 – Psychological level and order block support zone (green bar).

There is also a second major support bar around $16,700 (lowest green bar) that could also help prop up prices in the event of a strong bearish breakout from the pennant pattern. According to the VPVR indicator, the $15,400 level will most likely be the bottom if a heavy correction occurs.

Total market capital: $511 billion

Bitcoin market capital: $333 billion

Bitcoin dominance: 65.2%

*Data by Coingecko.

Bitstamp BTC/USD 1-Hour Chart