Why the Biggest Emerging Markets Are Turning to Crypto

With the U.S. mired in political stasis while other regions build crypto frameworks, it’s worth looking at the evolution of, and outlook for, on-the-ground demand for crypto assets. This is getting more and more relevant as many large countries struggle with skyrocketing inflation, shaky currencies and autocratic control over financial access, and as populations become increasingly crypto-aware and a lack of trust in centralized institutions grows.

Last week, the government of Pakistan (the fifth largest country in the world in terms of population, with over 239 million inhabitants) was reported to have said that cryptocurrencies “will never be legalized” in Pakistan, in order to avoid FATF penalties.

Noelle Acheson is the former head of research at CoinDesk and Genesis Trading. This article is excerpted from her Crypto Is Macro Now newsletter, which focuses on the overlap between the shifting crypto and macro landscapes. These opinions are hers, and nothing she writes should be taken as investment advice.

This may sound on the surface like an overreaction to FATF’s crypto stance – last Thursday, the organization’s president published a letter titled “An end to the lawless crypto space” which urges crypto regulation rather than a total ban.

Then again, Pakistan has a somewhat tense relationship with the FATF, and just last October was taken off its “grey list” (which labels certain countries as having “deficiencies” in their AML controls, which in turn can lead to limited participation in global finance).

It’s also not hard to see the hand of the International Monetary Fund. Pakistan is currently in talks with the organization regarding a bailout package, although negotiations seem stalled and concern about the country’s political and economic issues is starting to affect neighboring nations. The IMF has not been shy about its unease with crypto markets, and a few months ago, reports surfaced that it had applied crypto-suppression conditions to negotiations with Argentina.

Yet crypto use in Pakistan is nevertheless active, as people are reportedly converting their salaries into stablecoins to prevent currency erosion. The rupee has dropped more than 20% against the U.S. dollar year-to-date, more than 30% over the past year. Meanwhile, BTC in rupee terms is up 103% so far in 2023 (vs 63% in U.S. dollar terms). It’s probably not a coincidence that a 2022 report from forensics company Chainalysis placed Pakistan 6th in terms of global crypto adoption.

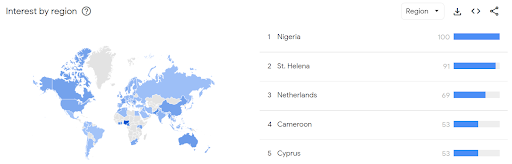

There’s also Nigeria (the sixth largest country in the world, with over 218 million people), which is likely to devalue its currency once the new president is sworn in, in a bid to alleviate trade imbalances and dollar shortages. The sub-Saharan nation ranked 11th in Chainalysis’ global crypto adoption ranking, and according to Google Trends, looking back over the past 90 days, Nigeria is the top-ranking country in terms of searches for the term “crypto” and second in terms of searches for the term “bitcoin.”

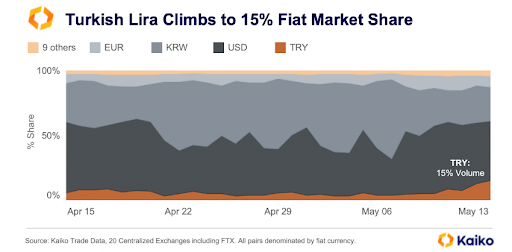

Turkey is the 18th largest country in the world in terms of population, with more than 85 million inhabitants. Last week its currency hit a new record low as markets brace for Erdogan’s likely re-election in the runoffs on May 28. A recent chart by crypto market data firm Kaiko shows the spike in crypto activity based in lira, now notably higher than euro-based activity. Turkey was 12th in Chainalysis’ 2022 crypto adoption ranking – currency woes and the pressing need to hedge and diversify are likely to push it up the list.

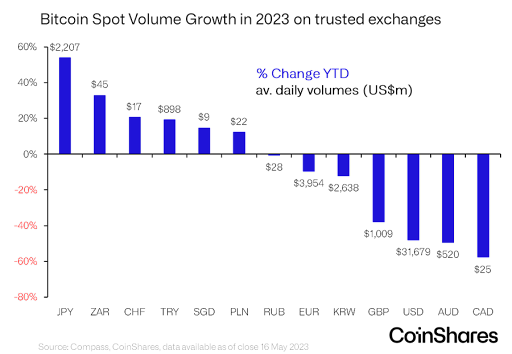

An unexpected entry into my “watch the adoption” list is Japan – the 11th largest country with over 124 million people, and the third richest in terms of nominal GDP. James Butterfill, head of research at CoinShares, shared a chart last week that plotted growth in spot volumes on crypto exchanges. The leader? Japan, with the second highest average daily volume (after the U.S.) and easily the highest percentage growth (approximately 55% year-to-date).

This could be largely for speculation, since Japan has low inflation and its currency is relatively stable. Or, it could be a sign of investors bracing for higher inflation and currency instability. Higher inflation would most likely trigger rate hikes, however, which should strengthen the yen, so it’s not clear what bitcoin would be a hedge for in Japan.

There are many other examples of citizens around the world turning to crypto to hedge against local currency volatility and debasement – Ukraine, Argentina and Lebanon are just a few that come to mind. Many struggle with the absence of reliable onramps and with the difficulty of custody. But few are even remotely concerned about the U.S. regulatory hostility.

All this serves as a reminder that the U.S. may have the largest financial market in the world, but crypto’s purpose goes well beyond the speculation that financial markets serve. What’s more, many developing economies are accustomed to regulators overstepping their bounds in terms of limiting financial freedom, and thus their citizens find the decentralized nature of many crypto assets easier to understand and appreciate than do individuals used to more open regimes.

Throw in the increasing probability of significant currency turmoil ahead in emerging countries’ economies, inflationary pressures and a strong dollar, and, in turn, the likelihood of political turmoil, and you can see how the “insurance” and “hedge” qualities of crypto assets such as BTC and stablecoins become even more compelling. Monetary liquidity headwinds may be significant, but they are not the whole crypto market story.