Weekly DEX Volume on BNB Chain Hits Highest in a Year

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

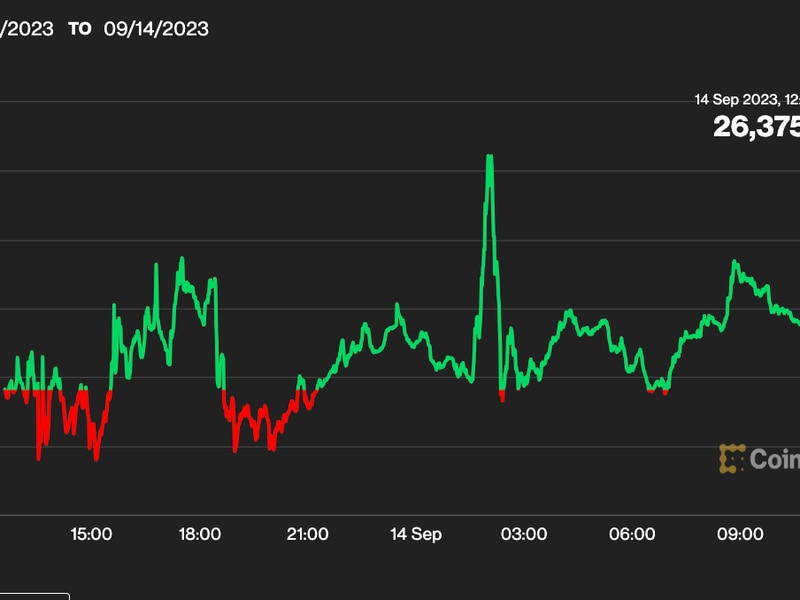

Weekly decentralized exchange (DEX) trading volume on Binance’s BNB Chain has reached its highest level in a year, according to data from DefiLlama.

The week commencing May 7 saw DEX volume on BNB reach $5.11 billion, a level not seen since early May 2022, though volume did rise to just above $5 billion in the week following crypto exchange FTX’s November collapse.

This comes as DEXs witness an uptick in popularity, perhaps as a result of U.S. regulators clamping down on centralized exchanges. In April, DEX Uniswap topped centralized exchange Coinbase in trading volume for the fourth consecutive month.

There are a few reasons behind the yearly high. Lower fees on the BNB Chain might mean users are more likely to trade there, said Katie Talati, head of research at Arca, trying to explain the surge in volume. Another reason, she suggested, could be due to Binance’s popularity in the world of centralized exchanges. “It makes sense that users get routed to BNB Chain after using Binance,” she said.

“The opportunity to list on Binance and marketing support from the Binance ecosystem explains this,” said Charles Storry, head of growth at crypto index platform Phuture, echoing Talati’s comments. “Projects that gain traction get a Binance listing, an unspoken benefit but often happens,” he added. “We’re seeing a ton of projects look to leverage the Binance relationship.”

There’s also Uniswap – the largest decentralized exchange by volume – which in March, expanded to the BNB Chain.

“Uniswap being deployed onto BNB Chain a few months ago alongside Binance being the largest crypto exchange has brought more trading volume to the chain,” said Talati.

BNB Chain was launched by crypto exchange Binance (previously Binance Smart Chain) and is now a community-driven decentralized ecosystem, according to Binance’s website.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.