U.S. Treasury Warns That DeFi Used by North Korea, Scammers to Launder Dirty Money

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

:format(jpg)/www.coindesk.com/resizer/Lky4i31E0VGlf1KEVfI5nxsXZS8=/arc-photo-coindesk/arc2-prod/public/PRTUSW5G55EPJKV5XA3VM4F6HE.jpg)

Sandali Handagama is a CoinDesk reporter with a focus on crypto regulation and policy. She does not own any crypto.

:format(jpg)/www.coindesk.com/resizer/x37dWM_1ORxU2nCUG8EyVsmvF4Y=/arc-photo-coindesk/arc2-prod/public/3CZRUU6QWVDQ5PSXCNWHUB6CY4.png)

Jesse Hamilton is CoinDesk’s deputy managing editor for global policy and regulation. He doesn’t hold any crypto.

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

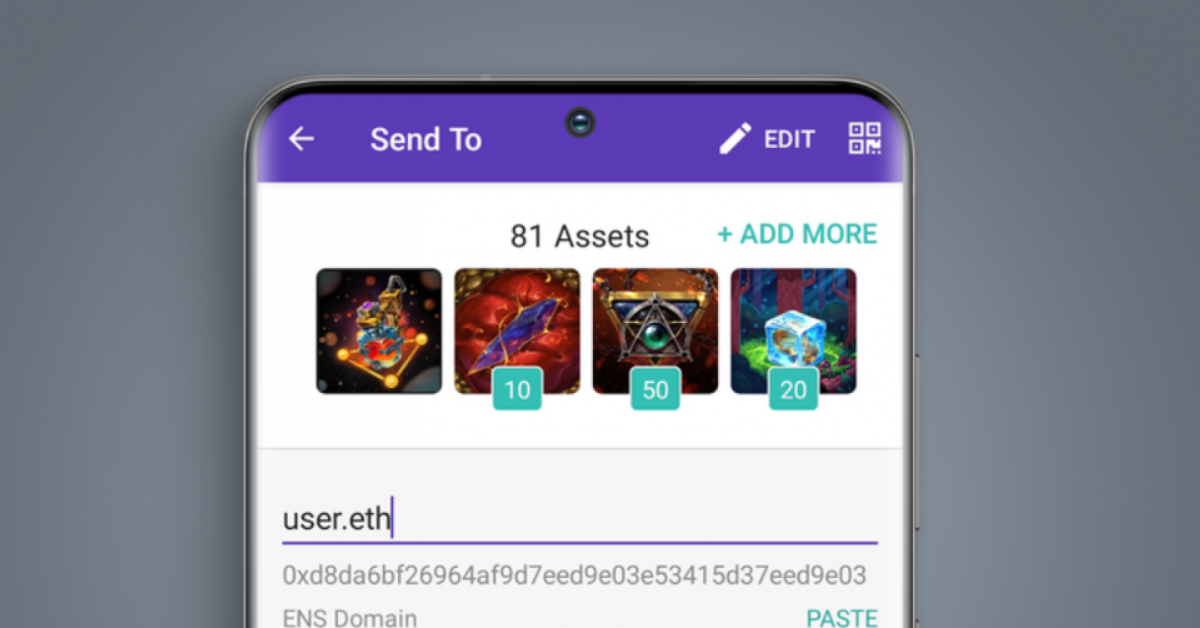

Decentralized finance (DeFi) services that aren’t compliant with anti-money laundering and terrorist financing rules pose “the most significant current illicit finance risk” in that corner of the crypto sector, according to the U.S. Department of the Treasury’s first analysis of hazards from the technology.

In an expected risk assessment published Thursday, the Treasury said thieves, scammers, ransomware cyber criminals and actors for the Democratic People’s Republic of Korea (DPRK) are using DeFi to launder proceeds from crime.

On the basis of its findings, the Treasury recommends an assessment of “possible enhancements” to U.S. anti-money laundering (AML) requirements and the rules for countering the financing of terrorism (CFT) as they should be applied to DeFi services. It also calls for input from the private sector to inform the next steps.

“The private sector should use the findings of this assessment to inform their own risk mitigation strategies,” said Brian Nelson, Treasury’s undersecretary for terrorism and financial intelligence, in a statement.

The 40-page report warns that “DeFi services at present often do not implement AML/CFT controls or other processes to identify customers, allowing layering of proceeds to take place instantaneously and pseudonymously.”

The report references several instances where DeFi projects “have affirmatively touted a lack of AML/CFT controls as one of the primary goals of decentralization.” A footnote in the document cites ShapeShift’s 2021 transformation to a decentralized exchange “for the purpose of ceasing to collect customer information for AML/CFT compliance.”

“When these entities fail to register with the appropriate regulator, fail to establish and maintain sufficient AML/CFT controls, or do not comply with sanctions obligations, criminals are more likely to exploit their services successfully, including to circumvent U.S. and UN sanctions,” the report said.

Although the goal of the assessment is to “identify the scope of an issue,” the report recommends the U.S. government strengthen its AML/CFT regulatory supervision and consider providing additional guidance for the private sector on compliance checks for DeFi services.

The assessment furthers the work outlined in President Joe Biden’s executive order on crypto from last year, and is the first of its kind in the world, a separate press statement issued by the Treasury said. Other jurisdictions including the European Union have also started looking at tackling money laundering risks associated with DeFi.

Edited by Jesse Hamilton.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Lky4i31E0VGlf1KEVfI5nxsXZS8=/arc-photo-coindesk/arc2-prod/public/PRTUSW5G55EPJKV5XA3VM4F6HE.jpg)

Sandali Handagama is a CoinDesk reporter with a focus on crypto regulation and policy. She does not own any crypto.

:format(jpg)/www.coindesk.com/resizer/x37dWM_1ORxU2nCUG8EyVsmvF4Y=/arc-photo-coindesk/arc2-prod/public/3CZRUU6QWVDQ5PSXCNWHUB6CY4.png)

Jesse Hamilton is CoinDesk’s deputy managing editor for global policy and regulation. He doesn’t hold any crypto.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Lky4i31E0VGlf1KEVfI5nxsXZS8=/arc-photo-coindesk/arc2-prod/public/PRTUSW5G55EPJKV5XA3VM4F6HE.jpg)

Sandali Handagama is a CoinDesk reporter with a focus on crypto regulation and policy. She does not own any crypto.

:format(jpg)/www.coindesk.com/resizer/x37dWM_1ORxU2nCUG8EyVsmvF4Y=/arc-photo-coindesk/arc2-prod/public/3CZRUU6QWVDQ5PSXCNWHUB6CY4.png)

Jesse Hamilton is CoinDesk’s deputy managing editor for global policy and regulation. He doesn’t hold any crypto.