Two Reasons Bitcoin’s Bear Market is Far From Over: Analysis

The cryptocurrency market is in a state of ongoing range-bound trading, and this is especially true for Bitcoin’s price.

BTC seems to have been confined within a range between $18,000 and $24,000 for the past few months, with neither bulls nor bears being able to take control. This has resulted in a prolonged chop – one of the most definitive signs of a bear market, especially when the price is trending downward.

Analysts from the popular cryptocurrency research platform CryptoQuant now give a few more reasons why the Bitcoin bear market is far from over.

Significant Lack of Demand

One sign that the Bitcoin price doesn’t seem to have many catalysts for an increase is the significant lack of demand, according to one CryptoQuant analyst.

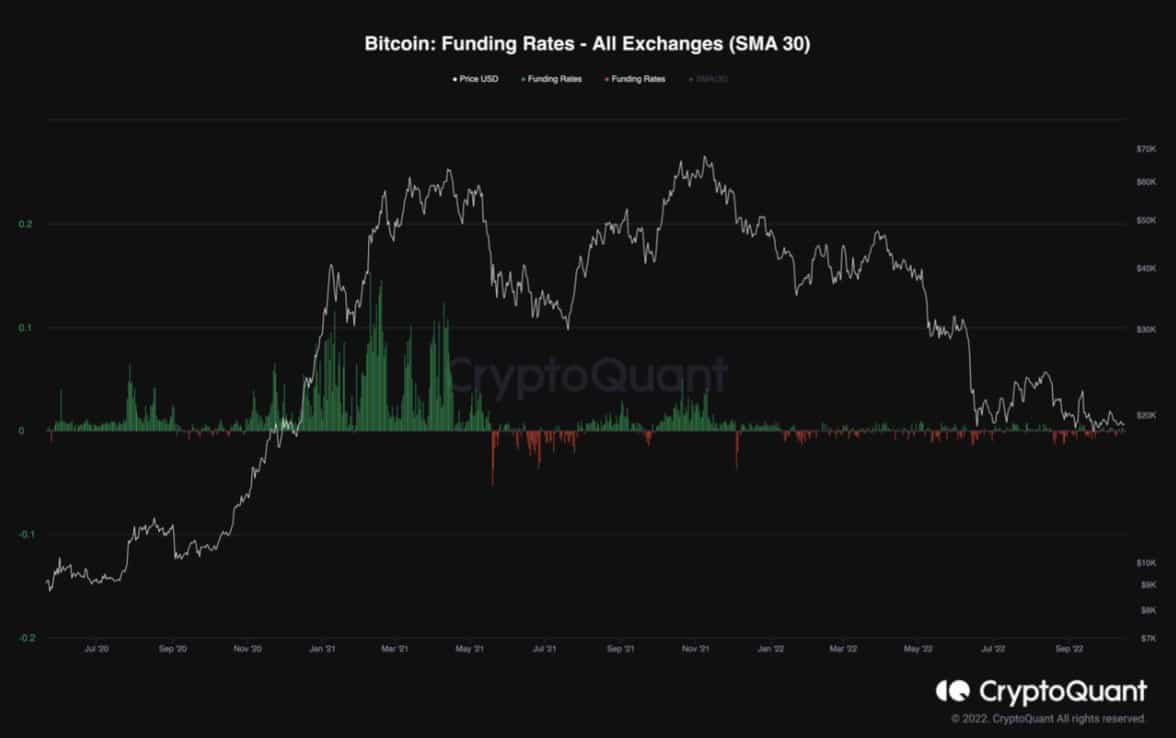

He points out that the funding rates in the futures market have turned negative when the BTC price dropped from the $22K level and while it is consolidating around the $19K mark.

However, the metric’s values are significantly lower compared to the 2019-2021 period, indicating a massive lack of demand and activity in the futures market, which usually results in a period of consolidation and range phase.

The analyst also concluded that this particular metric should be watched closely, especially in the short term, because extreme negative values tend to “increase the probability of a short-squeeze and could cause a reversal in the cryptocurrency’s price.”

Sentiment in a Bearish Trend for Bitcoin

According to another analyst, the short-term sentiment from on-chain participants remains in a bearish trend. This is evident because Spent Output Profit Ratio (SOPR) for the short term remains below a value of one.

Resistance level was just reached for the most recent daily close. This is bearish for the week ahead.

Additionally, the analyst notes that all participants who bought after the high in December 2020 are now at a loss. This makes it tougher for long-term holder SOPR to “turn back to a positive trend anytime soon.”

This makes the short-term SOPR more information compared to the aSOPR/SOPR, at least in the current market conditions, because the latter combines both long-term and short-term data.

Conclusion

Bitcoin bear markets are marked by periods of slow bleeding where the prices depreciate while the volatility thins out.

However, the above can also provide opportunities for those who are looking to invest in BTC. According to the Singaporean financial services firm DBS Bank, Bitcoin remains an unprecedented opportunity.

Commenting on the matter was Daryl Ho, investment strategist and senior vice president at DBS, who said:

Most of the methods by which you trade assets require a central clearing party to verify the trade. So, it is still an opportunity that fiat money cannot buy because fiat monetary systems are still governed by central banks.

[…] I think bitcoin is still unique whether the price changes or not. If we just look purely on a price basis, you will see a lot of volatility and that doesn’t inform you a lot about what benefits it actually brings.

The post Two Reasons Bitcoin’s Bear Market is Far From Over: Analysis appeared first on CryptoPotato.