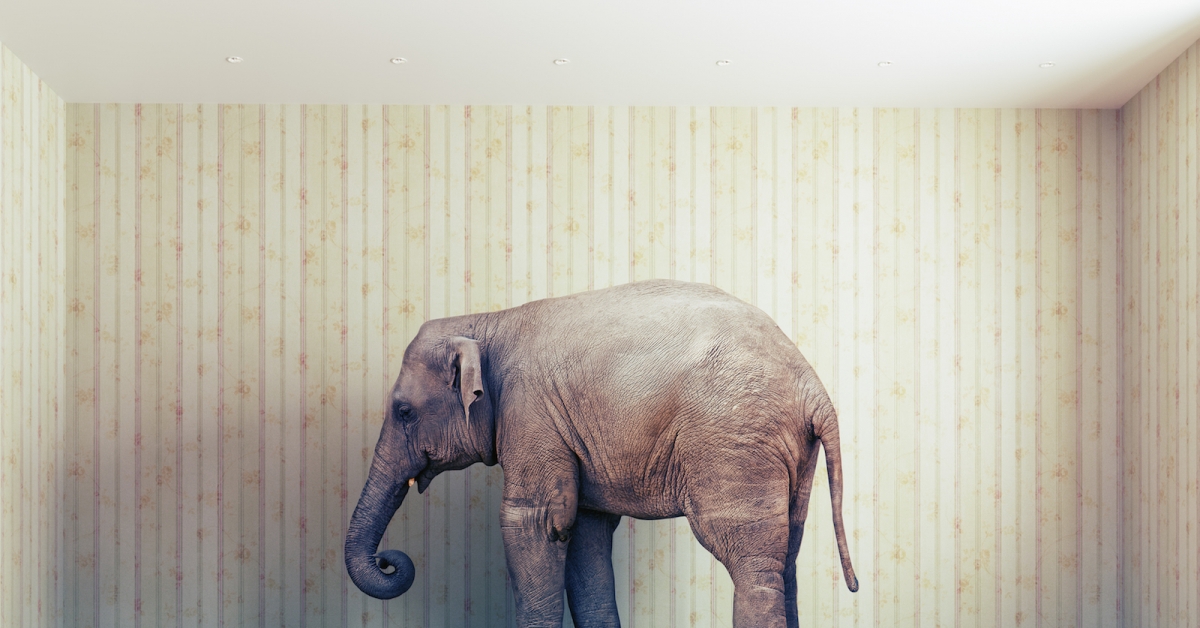

SPiCE, Unable to Get Liquidity in the US, Takes Tokenized Blockchain VC Fund to Asia

Venture chief Tal Elyashiv thinks his tokenized VC fund can find a foothold on Asian exchanges. (SPiCE)

SPiCE Venture Capital has listed its tokenized blockchain fund (SPiCE VC) on Malaysia’s Fusang Exchange as the firm’s director Tal Elyashiv turns to Asia in his hunt for token liquidity.

- Elyashiv told CoinDesk that Fusang will introduce SPiCE VC to global investors, family offices and institutions in Asia that the $15 million tokenized fund simply could not reach with its two existing investment platforms: SharesPost and OpenFinance Network.

- Those two U.S. alternative investments portals, which both restrict SPiCE VC trades to the country’s elite accredited investor class, “have not lived up to the promise of a marketplace that is active,” said Elyashiv.

- He blamed low token liquidity on those exchanges’ noncustodial format and what he called their “very complicated user interfaces.” Fusang, he said, has advantages on both fronts: “They run a full book.”

- Despite Elyashiv’s criticism of SharesPost and OpenFinance, SPiCE VC will continue to be listed on them.

- The new listing is SPiCE VC’s latest attempt to pump liquidity into an asset class that seldom trades hands.

- “Liquidity is the number one issue for [investors] in the VC industry,” Elyashiv said. “And we wanted to find a solution for that.”

- SPiCE’s portfolio companies include Securitize, Bakkt and INX Exchange, which this week is proceeding with its long-awaited tokenized public offering.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.