Spain’s Banco de Sabadell Stock Crashing, 99% Down From ATH: Another Red Mark for the Global Economy?

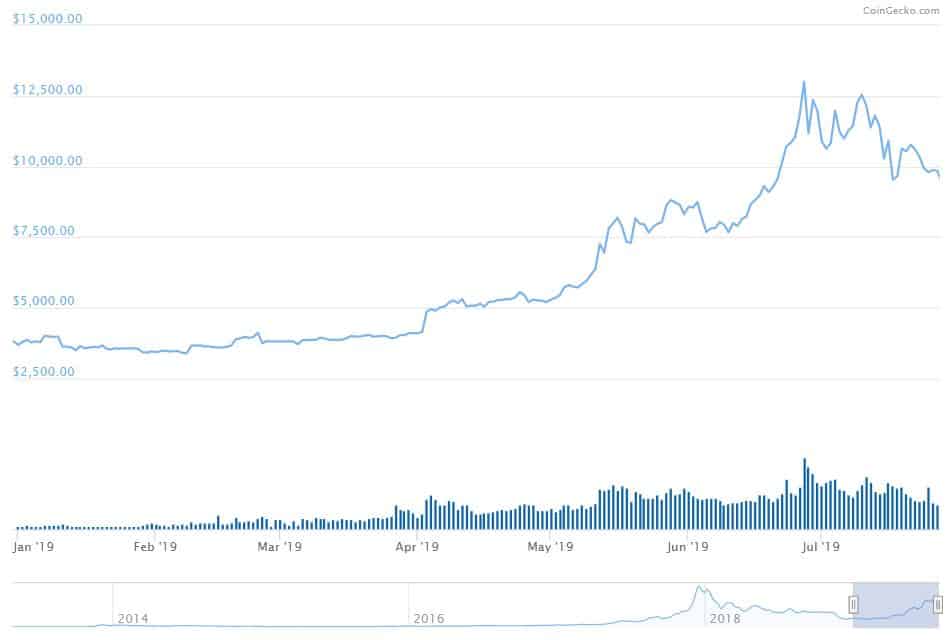

Despite Bitcoin’s latest price decline, the world’s leading cryptocurrency is outperforming a broad range of banking institutions. This makes the “long Bitcoin, short the bankers” narrative even more relevant. In fact, longing Bitcoin in 2019 while simultaneously shorting the stocks of certain banks might have been one of the best possible moves.

Banks Are Having Hard Times

“Long bitcoin, short the bankers” is perhaps one of the most popular catchphrases among the cryptocurrency community, commonly used by Anthony “Pomp” Pompliano of Morgan Creek Capital.

Crunching the numbers, however, it’s apparent that it might be a lot more than just a catchphrase.

As noted by popular investment strategist and economic historian Raoul Pal, the share price of banks in Spain keep on plummeting.

My weekly public notice. Spanish banks keep plummeting… Banco Sabadell, new all time low at 80c and down 99% from peak. pic.twitter.com/QJDoqVOaD9

— Raoul Pal (@RaoulGMI) July 29, 2019

According to a recent report, the bank sold around $9 billion worth of bad loans to outside companies. The same source states that the number of bad loans in Europe is tumbling but also says that they will never be fully gone. Even though the news is seemingly good, Banco de Sabadell is seeing its stock price plummet and is already a shadow of its former self, being 99% down from its ATH.

But it’s not just Spanish banks that are having hard times. The stock price of the international investment bank Deutsche Bank, which is based in Frankfurt, has also been on a steady decline.

Year-to-date, the value of DB’s stock has decreased by about 5 percent. However, when we look at the bigger picture, these numbers are a lot more alarming. In one year, shares of Deutsche Bank have shed around 40 percent of their value. In the last five years, the bank’s stock price has seen a 77% decrease. Since its all-time high price back in April 2007, DB is down upwards of 94 percent.

As you can see, it’s not just cryptocurrencies that go through market cycles.

Bitcoin Prevails

While it’s still down about 52 percent from its all-time high value, Bitcoin has had a very profitable 2019. Since January 31, the cryptocurrency’s price has risen approximately 190% despite having fallen around $4,000 in the last couple of weeks.

In other words, if one had longed Bitcoin at the beginning of the year, while also shorting the stock price of the aforementioned banks, he or she would have made a solid profit.

The post Spain’s Banco de Sabadell Stock Crashing, 99% Down From ATH: Another Red Mark for the Global Economy? appeared first on CryptoPotato.