Senators Lummis and Gillibrand to Unveil Updated Bill Classifying Crypto Assets as Commodities

On July 12, an amended crypto bill by Senators Cynthia Lummis and Kirsten Gillibrand will be submitted.

The revamped “Responsible Financial Innovation Act” aims to classify most crypto assets as commodities, similar to gold.

This would bring them under the umbrella of the Commodities Futures Trading Commission (CFTC) rather than the Securities and Exchange Commission, which is “stifling innovation in financial technologies,” according to the Senators.

Crypto Bill Redux

The SEC wants to apply 90-year-old legislation to regulate and treat crypto companies the same as banks and stock exchanges.

“The domestic industries really are trying to comply, for the most part, and they’re just getting the cold shoulder,” said Lummis who added, “That’s not how we regulate in this country,” according to Wired.

The newly proposed legislation aims to protect investors and prevent the major collapses that crippled the industry in 2022. However, it does not advocate enforcement action, lawsuits, or the demand for exchange asset freezes to hurt investors (which is what the SEC has been doing).

The report, citing a person with knowledge of the act, explained that the new bill, if passed, would require crypto exchanges to store customer funds in third-party trusts. It would also prevent internal trading by exchanges using their own funds or tokens.

Furthermore, the CFTC would also have the power to supervise exchange affiliates for potential misdemeanors.

The act also prohibits “rehypothecation,” which is a practice of financing digital assets already locked up in other loans.

The legislation has already been passed to the CFTC and SEC for their purview, but Lummis is concerned that it will get stonewalled.

“After all of our efforts to reach out to them and work with them, I do not want them to come in at the last minute to put their kibosh on this.”

America is already way behind the rest of the world with regard to crypto regulations. As a result, an exodus of talent, innovation, and capital is already underway.

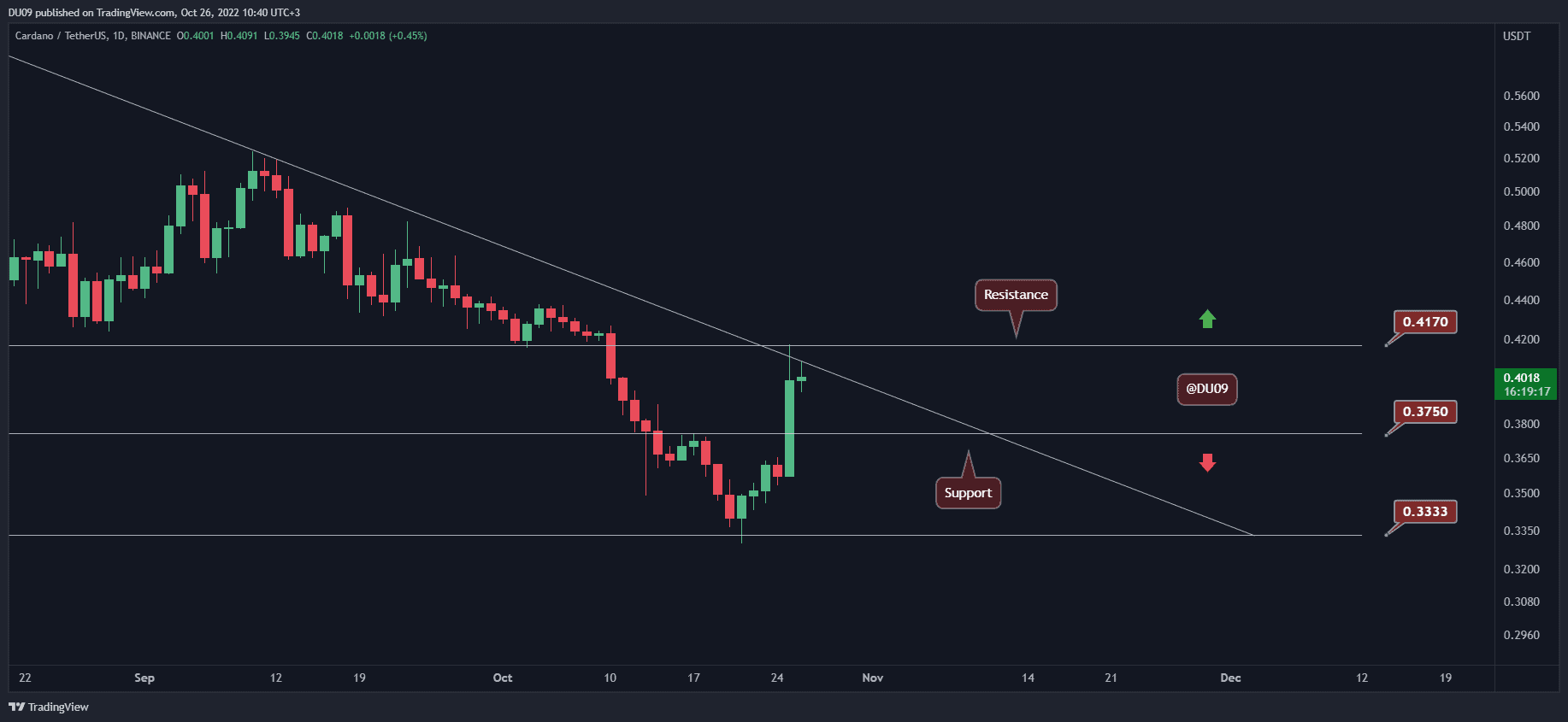

Crypto Market Outlook

While crypto markets would be buoyed by progressive legislations in the U.S., sentiment and volumes are currently flat.

Total capitalization remains flat on the day at $1.23 trillion, with very little movement from the high-cap coins over the past 24 hours.

The post Senators Lummis and Gillibrand to Unveil Updated Bill Classifying Crypto Assets as Commodities appeared first on CryptoPotato.