Semler Scientific Buys Additional $50 Million Worth of Bitcoin

Bitcoin Magazine

Semler Scientific Buys Additional $50 Million Worth of Bitcoin

Medical equipment provider Semler Scientific has acquired 455 Bitcoin for $50 million, marking it one of the largest purchases as more publicly traded companies continue to adopt Bitcoin treasury strategies.

According to a Form 8-K filed with the SEC on May 23, the company purchased the Bitcoin between May 13 and May 22 at an average price of $109,801 per coin, including fees. The acquisition brings Semler’s total Bitcoin holdings to 4,264 BTC, acquired at an aggregate cost of $390 million.

The purchase was funded through Semler’s at-the-market (ATM) equity offering program, which has raised approximately $114.8 million since its launch in April 2025. The company has issued 3,003,488 shares under the $500 million program to date.

“$SMLR acquires 455 Bitcoins for $50 million and has generated BTC Yield of 25.8% YTD. Now holding 4,264 $BTC. Flywheel in motion. ,” said Eric Semler, Chairman of Semler Scientific. The company’s Bitcoin holdings are now valued at approximately $474.4 million based on current market prices.

Semler reported its Bitcoin Yield – a key performance indicator measuring the year-to-date percentage change in total Bitcoin holdings relative to diluted shares outstanding – has reached 25.8% in 2025. The metric has become a standard measure among public companies holding Bitcoin on their balance sheets.

The company maintains a Bitcoin Dashboard on its website to provide transparent information about its holdings, including market data, performance metrics, and acquisition details, as part of its Regulation FD compliance strategy.

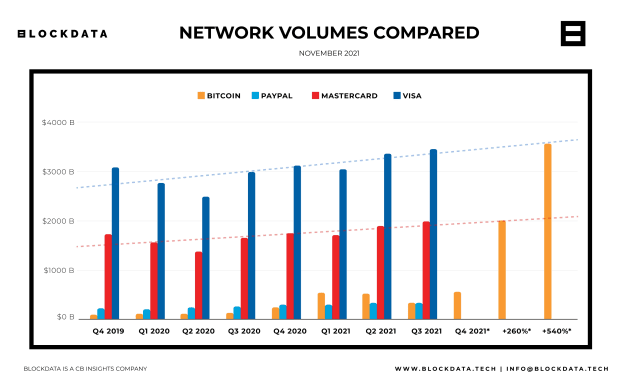

Semler’s move comes amid accelerating corporate Bitcoin adoption in 2025, with over 40 public companies announcing Bitcoin treasury programs this year alone. The market has shown increased sensitivity to corporate treasury activities as institutional adoption continues to grow.

The company’s latest Bitcoin purchase reinforces the growing trend of public companies using equity offerings to fund Bitcoin acquisitions, a strategy pioneered by larger players like Strategy, which recently added 7,390 BTC to its holdings through a similar funding mechanism.

This post Semler Scientific Buys Additional $50 Million Worth of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.