Ripple Price Analysis: XRP Plans Next Move Following Consolidation At $0.30?

- XRP saw a small 2% price rise today as it reached $0.295.

- The coin dropped by a total of 3.4% over the past week after it reached the $0.313 level.

- Against Bitcoin, XRP found support today at 2435 SAT (200-days EMA and .382 Fib Retracement).

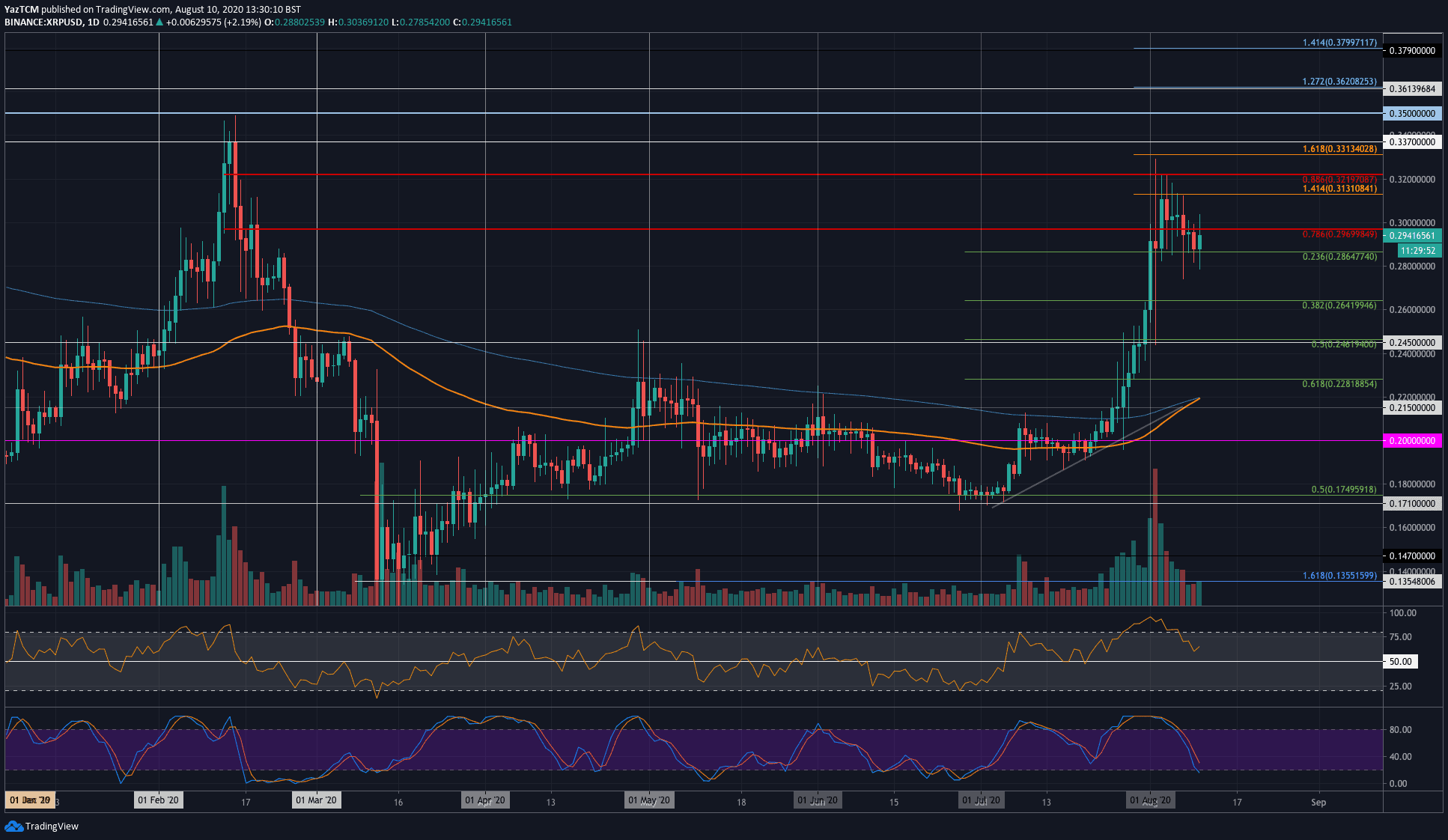

XRP/USD: XRP Bulls Find Support At .236 Fib Retracement

Key Support Levels: $0.286, $0.264, $0.245.

Key Resistance Levels: $0.3, $0.313, $0.321.

At the start of August, XRP surged into the resistance at $0.321 provided by the bearish .886 Fib Retracement. More specifically, it was unable to break above $0.313 (1.414 Fib Extension), which caused it to roll over and head lower this week.

Over the weekend, XRP found strong support at $0.286 (.236 Fib Retracement) and managed to rebound from there to reach $0.295 today. The coin is now facing resistance at $0.30 again and must overcome this level to re-test the August highs. A break beneath $0.28 could result in XRP headed back toward $0.245.

It is also important to note that the 100-days EMA is primed for a golden crossover signal above the 200-days EMA, which is a very strong long-term bullish sign if it is produced.

XRP-USD Short Term Price Prediction

Looking ahead, once the buyers break back above $0.3, resistance is expected at $0.313 (1.414 Fib Extension) and $0.321 (bearish .886 Fib Retracement). This is followed by added resistance at $0.331 (1.618 Fib Extension), $0.337, and $0.35.

On the other side, support is first located at $0.286 (.236 Fib Retracement). Beneath this, support lies at $0.264 (.382 Fib Retracement), and $0.245.

The RSI has been falling from overbought conditions but remains above 50 to indicate the bulls control the market momentum. Additionally, the Stochastic RSI is almost at oversold conditions, and a bullish crossover signal would help send the market above $0.3.

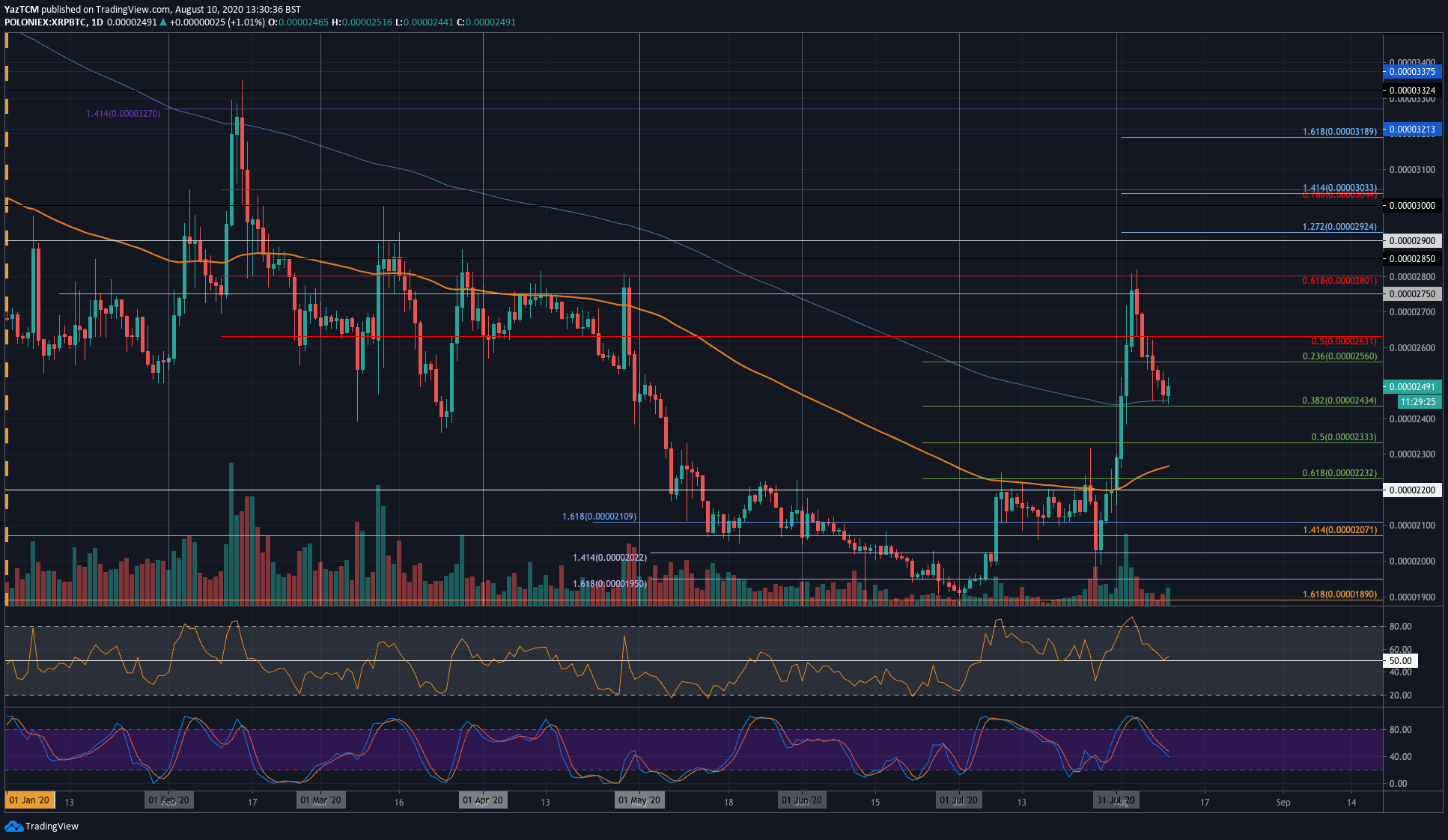

XRP/BTC: Bulls Defend 200-days EMA Support

Key Support Levels: 2333 SAT, 23000 SAT, 2250 SAT.

Key Resistance Levels: 2630 SAT, 2700 SAT, 2800 SAT.

Against Bitcoin, XRP has been falling over the past week as it dropped from the 2800 SAT resistance (bearish .618 Fib Retracement) to reach 2335 SAT (200-days EMA). The support here is further bolstered by a .382 Fibonacci Retracement level.

Despite the recent price decline, XRP is still in a very strong position against Bitcoin. If the buyers can continue to defend the 200-days EMA, then it can be expected to rebound back toward 2800 SAT.

XRP-BTC Short Term Price Prediction

Moving forward, if the bulls cause a rebound from 2435 SAT, resistance is first located at 2630 SAT (Bearish .5 Fib Retracement). This is followed by resistance at 2700 SAT, 2800 SAT (Bearish .618 Fib Retracement), 2900 SAT, and 3000 SAT (bearish .786 Fib Retracement).

On the other side, if the sellers break beneath the 200-days EMA, support lies at 2333 SAT (.618 Fib Retracement), 2300 SAT, and 2250 SAT (100-days EMA).

The RSI recently bounced from the 50 line, which is a strong sign that the sellers are unable to take control of the market momentum from the bulls. If it can remain above the 50 line, XRP can be expected to push higher from the 200-days EMA.

The post Ripple Price Analysis: XRP Plans Next Move Following Consolidation At $0.30? appeared first on CryptoPotato.