Recent Bitcoin Rally Was a Bull Trap: Glassnode

Despite the recent price increases for both bitcoin and ether, perhaps fueled by the Fed and the US President, Glassnode believes there’re no clear signs of bear market trend reversals.

The analytics resource cited the low transaction fees and the lack of new active addresses.

Recent BTC Pumps Were Fake?

Following several consecutive weeks of price slumps, bitcoin finally regained some ground last week and charted a 6-week high above $24,500. This came shortly after the US Federal Reserve increased the interest rates by 75 basis points, and the nation’s president – Joe Biden – refused to admit the country had entered into a recession, despite the negative GDP quarters.

However, the asset failed to continue upwards and retraced to below $23,000 earlier today. In its latest report on the market state, Glassnode attributed the decline to the relatively low network usage.

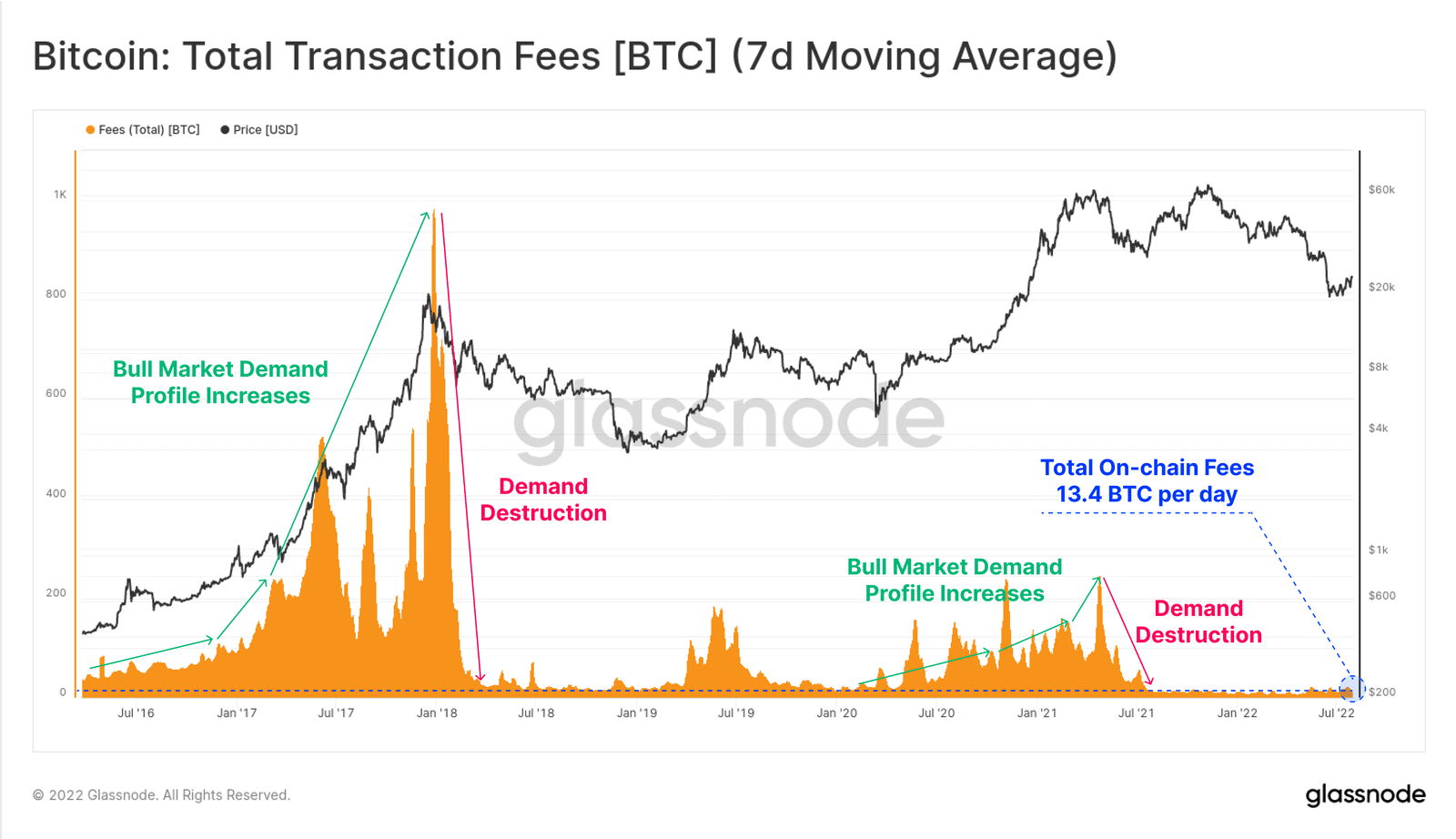

This is evident from the network fees, which tend to spike when there’re more users interacting on the largest blockchain (typically in bull markets) and fall back down in bear markets. Glassnode admitted that “we have not seen a notable uptick in fees yet.”

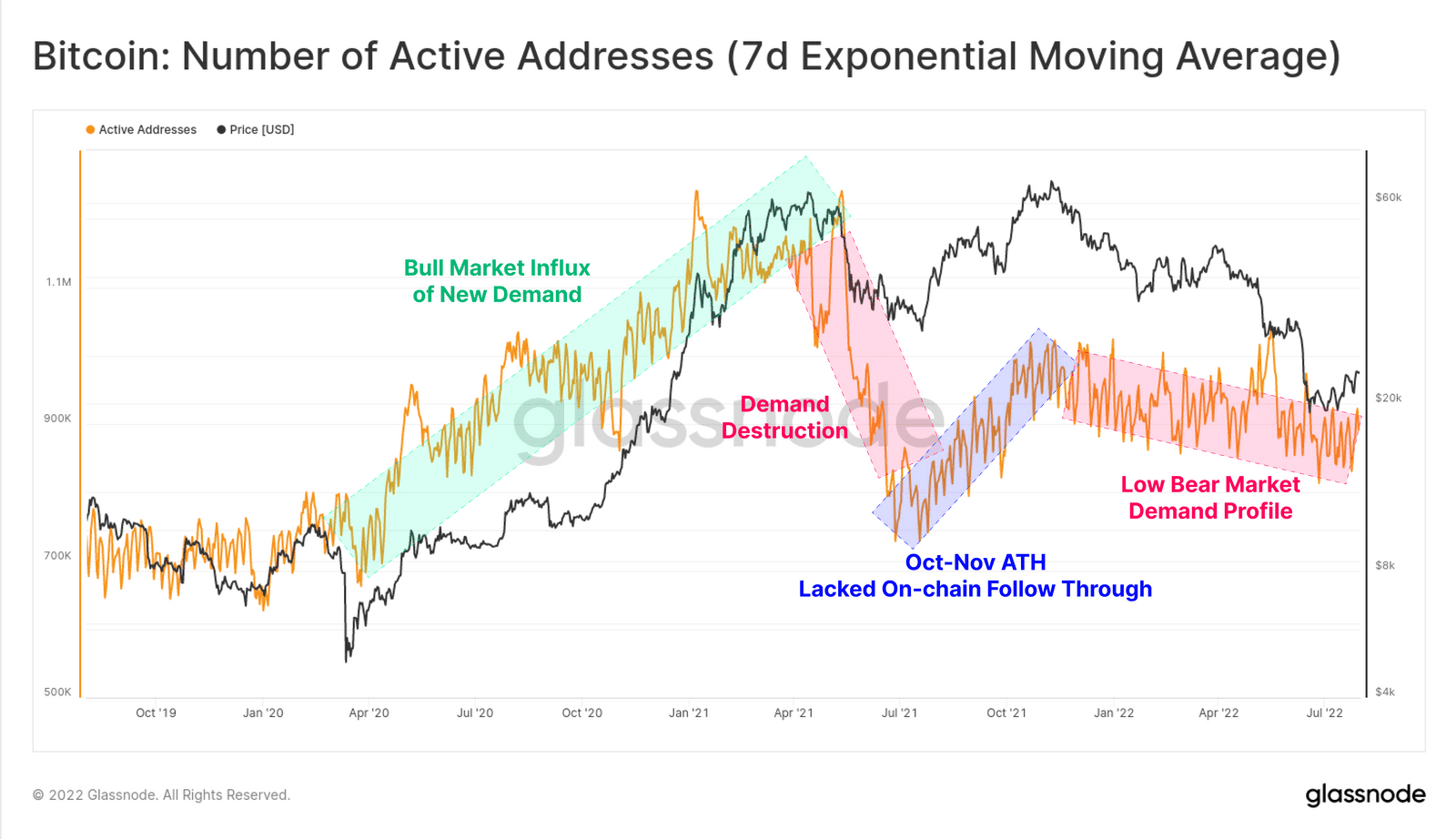

Moreover, the company reaffirmed its stance after exploring the current network activity, which shows “little influx of new demand” except for a few brief spikes during major capitulation events.

Ethereum Fees Suggest the Same

If one can make conclusions based on the network congestion and fees in regards to the underlying asset’s short-term price performance, the Ethereum situation seems quite similar.

As CryptoPotato reported yesterday, the gas fees paid on the second-largest blockchain have dropped to multi-month lows, with the average price being under $5.

This causes issues for the native cryptocurrency. This is because the EIP-1559, implemented with the London hard fork last year, cannot burn enough ETH due to a lack of network usage. As such, the cryptocurrency has become highly inflationary once again.

Nevertheless, the ETH community hopes this will change soon as the Merge is supposed to take place in the next few months.