Phish Lot, Rural America And The Lightning Revolution

Bitcoin and Lightning are technologies that once again revolutionize human connections and the ability to share information.

This is an opinion editorial by Patrick McCaughey, a live music aficionado, Bitcoin advocate and pragmatist living in western Massachusetts.

Humans are innately social creatures. We enjoy meals together, we exchange ideas with one another, and when the time is right, we set our soul free and surrender to the flow of living in the moment with like-minded beings. We are, after all, just swimming in this real thing we call life. As technology progresses with exponential rapidity, the methods we use to communicate and share information are going through a dramatic shift. Our trip may be short but we have come a long way in just a few decades of technological innovations. These innovations are paving the way for a new frontier of connecting with our fellow humans: new ways of exchanging ideas, storing information and transmitting value are shattering the legacy systems that have for far too long been the status quo. If we can imagine it, we can build it — and if we can build it right we have the ability to conjure up a world that values truth, fairness and a chance at an equitable future for all. This bullish sentiment relies on a rather large assumption, however: That we will maintain constant access to wireless communication via a robust and decentralized network.

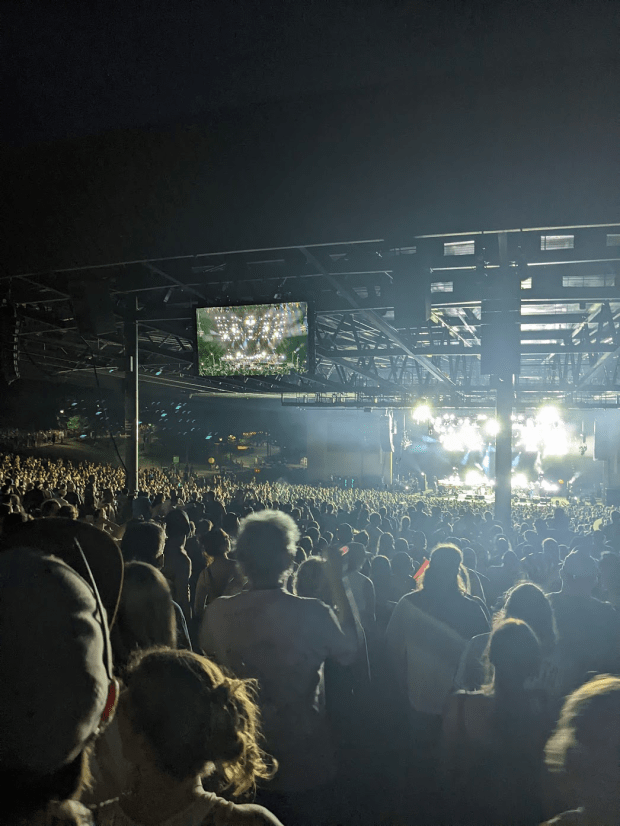

On Friday, July 23, I attended my 64th Phish concert. The venue was a first for me: Bethel Woods Center for the Arts in Bethel, NY. Bethel is most widely known for being the location of the iconic Woodstock Festival in 1969, the largest music festival in modern history which drew some estimated 400,000+ attendees (unless you ask Trey Anastasio). The area is drenched in cultural history, and the surrounding landscape is as picturesque and breathtaking as you could imagine. Despite over 50 years having passed since this legendary event, the little patch of rural America it took place in felt as though it was untouched by the passing of time. For better or worse, this largely agrarian community of the Catskills has yet to catch up with the speed of connectivity that city dwellers have become accustomed to.

While unexpected, I didn’t really think this would pose too much of an issue. After all, there were no mobile communication devices in 1969 and they seemed to do just fine. But then I began thinking about the logistics of the night ahead of us, and how our society is ever closer to being reliant on uninterrupted Internet access in order to participate. Lyft, Uber, Instagram, Twitter, SMS messages — all of these services would soon be more or less unusable. While we easily booked our Lyft from the hotel’s WiFi, once it came time to fetch a ride back, we had no hopes of booking a return trip using any of the modern apps we take for granted, let alone the ability to call a cab.

Phish Lot: The Last Remaining Unfettered Free Market

Upon exiting the show we were immediately greeted with scents and subtle sounds, like colors in the landscape, and textures of the town. Hot butter was sizzling on a grill, a crisp ‘77 “Eyes of the World” was roaring from a vendor’s speaker, and the whirring hiss of nitrous oxide seemed to envelop our every moment. “One for $10, three for $20, ice cold!” announced the vagabond gas salesman. Some attendees lined up and happily gave his asking price, while others tried to negotiate, “How about four for $20? No? Okay, five for $25?” This is a common phenomenon in the world of Phish, a scene that is more akin to the Wild West than it is to a traditional shopping experience today.

This is price discovery at its finest. On Phish Lot, there are market dynamics unfolding before our eyes that are rooted in pragmatism and first principles. Free markets may not be the be-all end-all way to approach everything, but they sure are efficient. No calls, puts or leverage about it, this was a raw unadulterated spot market, and we were here for it. After running into a few friends, saying our goodbyes, and indulging in a balloon or six, we decided to make our pilgrimage to the exit in hopes of catching a ride back to our hotel. After what felt like an eternity, the local taxi company (shoutout to Catskill Mountain Transportation!) showed up and began shuttling everyone to various hotels and campgrounds well into the night, and we eventually made it back to our hotel so we could rest up and do it all over again the following day.

The network issues I experienced that night illustrated a very important point: we will not see a hyperbitcoinized world until Internet outages are a thing of the past. If the very thing we require to utilize Bitcoin as a network (consistent Internet access) is highly centralized, it doesn’t mean that Bitcoin has failed us, it just means we need to dig deeper into how to outfit ourselves with resilient techniques for securing high-range wireless communication. The only way Bitcoin stands a chance at becoming the global reserve currency is if uninterrupted network access is as ubiquitous as life itself. Otherwise, we’re just brain dead and made of money: No future at all.

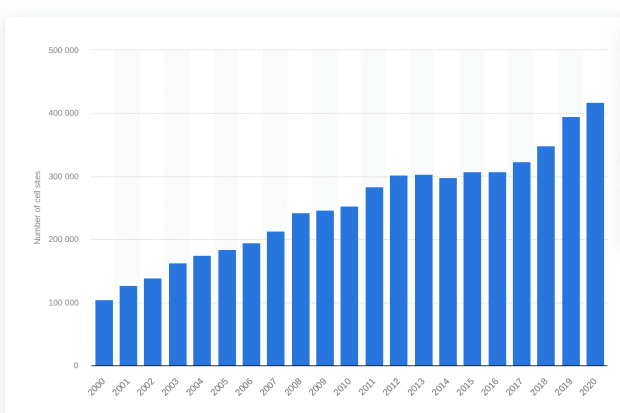

Take Back The Internet With Mesh Networks

Mesh networks are actually a pretty old school technology. They have long been used by the military to provide constant communications in locations unequipped with wired or satellite service. Even though the technology to construct such a network is rather simple, we haven’t really had the need for them due to the speed at which wireless cell towers have been constructed. In the year 2000, there were 104,288 towers operating in the United States. By 2020, that number increased to 417,215.

One of the largest of these tower operators is American Tower, proclaiming on their website, “Our global portfolio includes approximately 222,000 communications sites, including more than 43,000 properties in the United States and Canada and approximately 179,000 properties internationally.” While we are in many ways fortunate to have this infrastructure enabling modernity and a technologically proficient society, it is a far cry from the decentralized, peer-to-peer permissionless world we aspire to live in.

In the 2018 blog post entitled Understanding Mesh Networking Part 1, Ram Ramanathan, Chief Scientist at GoTenna describes mesh networks as follows:

“A wireless mesh network is a network of devices (often called nodes) that communicate with each other using peer-to-peer wireless links typically over multiple hops — that is, by bouncing a message from one device, through another and landing at a third (or fourth, etc.). This kind of network also operates in an infrastructure-less and decentralized manner, meaning it doesn’t require great resources at the back end to be usable, and no one node is prioritized over another.”

Sound familiar? If so, it’s because mesh networks function using the same basic principles as the Lightning Network. While I like Ramanathan’s succinct definition of a mesh network and believe GoTenna has made a lot of progress in this field, being beholden to a counterparty who can/will leak your private data is antithetical to the entire point of this technology. It cannot be overstated that companies like GoTenna are not our friends. Regardless of whether the rumors are true that In-Q-Tel (the CIA’s venture capital division) played a role in funding GoTenna, it is a closed platform that discourages innovation, development, and interoperability. Furthermore, they are clearly more focused on maintaining government contracts than helping the average citizen.

Rather than rehashing what has already been written about numerous times in this space, I will refer you to one of my favorite articles on the topic which came out earlier this summer: “Making Bitcoin Unstoppable Part One: Mesh Networks” by L0la L33tz. L33tz offers a broad overview of the historical relevance of mesh networks being used for Bitcoin transactions (both using Lightning and transacting on-chain via the Blockstream Satellite), as well as technical processes to set these up using readily available, non-dedicated, off-the-shelf hardware. Personally, I wouldn’t be surprised to see mesh networks begin to proliferate over the coming decade due to numerous factors such as a reduction in hardware costs (lead by AI and robotics), citizens becoming increasingly wary of their governments’ ability to act on the behalf of the people, and the drive to bring last-mile internet connectivity to everyone on the planet.

Lighting On Lot

Phish has long been associated with the counterculture movement. On tour there is a burgeoning microeconomy that has been growing alongside the band since the early days of their history. Food, beverages, art, clothing, pins, hoola hoops and intoxicants of all shapes and colors are available for purchase before and after the shows from a multitude of unofficial vendors. For decades, cash was the only accepted method of payment by these nomadic sellers, but as the world has shifted towards digital transactions, it is becoming more and more common for folks to accept Venmo and Cash App for their goods. While this is definitely convenient for both parties in any given transaction, it does not come without its drawbacks.

Aside from the obvious KYC component of these applications, chargebacks can still occur. If a buyer pays a Venmo/Cash App request using a credit card linked to their accounts, a chargeback can revoke funds a seller has received well after the sale has taken place. For merchandisers that rely on funds coming in to purchase supplies for the next show, this can lead to problems when getting ready for their next event. If grilled cheese and hot dog peddlers do not have liquid funds to stock their coolers with ingredients or refill their tanks with propane, these vibrant gray markets may not be able to sustain themselves as we propel ourselves into a future where the digital and physical worlds seamlessly merge.

As CBDCs loom closer to becoming a reality, it is up to us as a collective to prioritize a censorship resistant, immutable and open monetary network that is accessible to everyone. Otherwise, we risk not being able to opt out of a dystopian nightmare where authorities have the ability to surveil and halt our transactions at will. To be clear, I am in no way, shape or form condoning illicit activity, money laundering or anything of the like. I am simply proposing that as we move away from a cash economy, we maintain the properties of cash as we know it which allow for private, fungible and unsurveiled transactions.

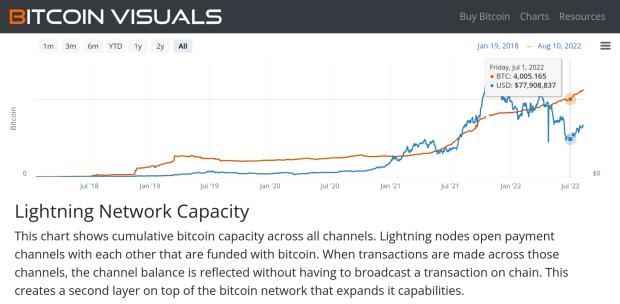

The adoption rate of the Lightning Network is currently growing at an astonishing speed. On July 1 2022, the Lightning Network capacity broke 4,000 BTC, equating to over $77 million worth of value across all channels. Two years prior, that number was under 1000 coins, representing less than $10 million in value. As the saying goes; slowly, then suddenly, then all at once. While the technology is still very much nascent, there are clear benefits to transacting over the Lightning Network. Even bankers are keen on this fact. Earlier this summer, researchers at the Federal Reserve Bank of Cleveland wrote a paper titled, “The Lightning Network: Turning Bitcoin Into Money.” The piece highlights these benefits, citing instant settlement, low fees and reduction of congestion on the Bitcoin timechain, all of which are a boon for Lightning adoption.

Today, many people need Bitcoin. It is an economic lifeboat for people that are under the oppression of authoritarian regimes living with double-digit inflation. There are countless stories of humans utilizing Bitcoin as a freedom tool in countries like Nigeria, Sudan and Ethiopia. People that are following a jam band around selling beers and grilled cheese sandwiches in the country that holds the global reserve currency status don’t need Bitcoin in the same way people do in say, Turkey, where the local currency has been melting away. The Phish scene definitely doesn’t need Bitcoin and the Lightning Network to thrive. Arguably — today anyway — it doesn’t need Bitcoin at all. However, there are few communities that have the tenacity, willingness and know-how to adopt this burgeoning technology in an effective and meaningful way that will permeate our culture.

From Digital Music To Digital Money

Phish fans are long known for being early adopters of budding tech. As the tape trading community pioneered by the Grateful Dead spilled over into the Phish scene, the quirky ‘90s geeks who obsessed over the band’s live recordings were arguably a major catalyst for the digital transformation of music that we take for granted today. As the audio industry made leaps and bounds in media formats, tapes led to CDs and eventually affordable CD-Rs/CD-RWs and these tapers were on the forefront of this audio revolution. Initially these live music aficionados simply used the internet as a means to find and connect with one another, but the actual media itself was still physical until the late ‘90s. In 1997, if you had interest in obtaining a copy of a particular recording but had no shows to trade in return, you would need to find someone who was advertising the show in their collection via a forum, send a message, and engage in what was known as “B&P” (blanks and postage). A taper or collector would simply provide the show free of charge as long as the inquirer sent blank CDs and return postage.

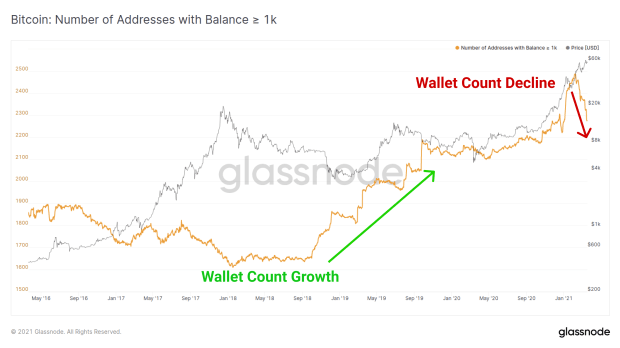

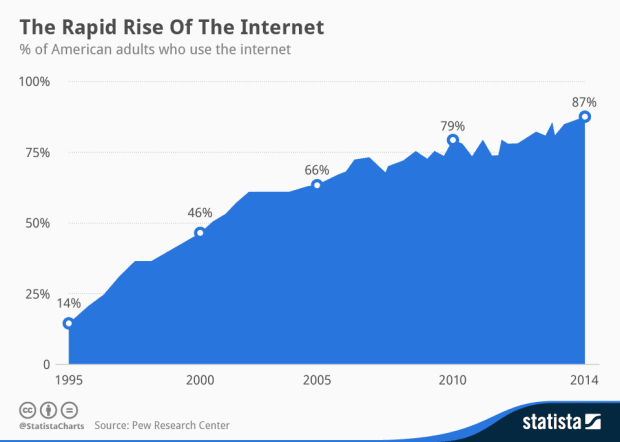

While this worked well enough, there was a drive within this community of tenacious tapers and traders to bring their recordings to the digital space. While this was discussed as early as 1996, the combination of slow internet speeds and large file sizes made this process nothing more than a pipe dream at the time. However, the exponential growth of internet adoption was a key element in cracking this metaphorical nut. According to Statisa, the percentage of Americans who used the Internet increased from 14% in 1995 to a whopping 46% just 5 years later as we approached the year 2000. As illustrated by the chart above, this was the largest increase of internet users in a five year time span in the history of its existence. As internet access grew and File Transfer Protocol (FTP) servers spread like wildfire, tapers were eventually able to take full advantage of their passion and craft in 1998 with the birth of etree, a decentralized digital file sharing community that allowed users to share lossless audio files over the internet for the first time in history. While this process was a bit clunky at first, it led to the infamous but short-lived Napster, with the modern day equivalent being Spotify and Apple Music, which many of us have at our fingertips. Now, a quarter of a century later, it is estimated that physical albums account for less than 10% of all music consumption in the United States.

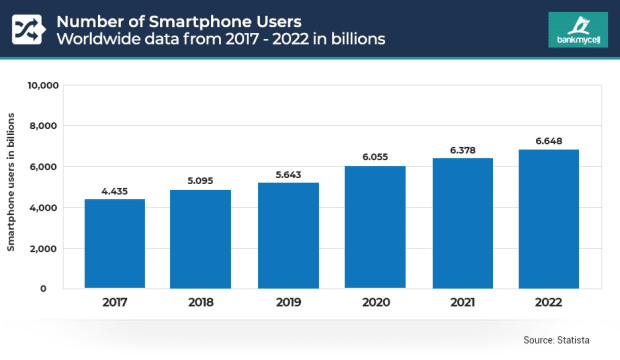

Just like with the digital audio revolution, a new monetary paradigm is not something that will occur overnight. New technology is funny; One day a device shows up and a few people start using it, then all of a sudden it becomes ingrained in everyday life. Being an early adopter of tech myself, I remember the exact day the first iPhone came out: June 29 2007. I was at a backyard party in Oakland and someone had just gotten back from the Apple store with one of these shiny new 21st century marvels, eager to show off their fancy new gadget. All the guests stood in awe as we gazed upon a new age of information access. Over the next couple of years it seemed rare to meet someone with one of these new miniature supercomputers, with many still favoring the Blackberry or even flip phones. Then, in what felt like an all of a sudden transformation, the smartphone became ingrained in daily life. In 2022, the number of smartphone users in the world is 6.648 Billion, which is over 83% of the earth’s population. This number is quite staggering when considering that the first iPhone hit the stage in Cupertino just 15 years ago.

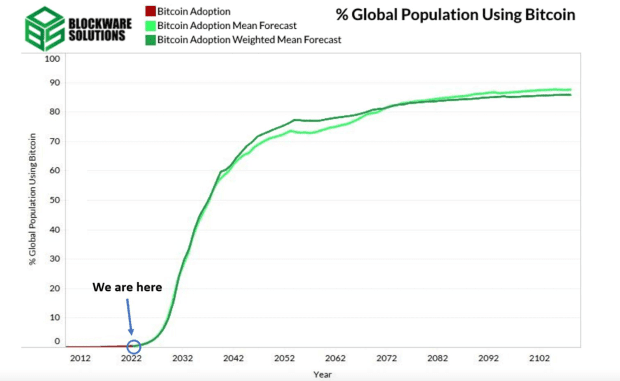

Whether it comes to spending or saving, Bitcoin is objectively superior to government issued dollars. For audiophiles, Bitcoin is the FLAC to the .mp3 that is fiat currency. Just like lossless audio cannot be degraded, Bitcoin cannot be debased, and its discovery has allowed us as humans to contain, express and transfer value in such a way that is truly remarkable for our species. If we care about the time and energy we expend as individuals and as a group, we should all demand the ability to transact using a currency that is not subject to corruption, one that plays no favorites, and treats every participant in the network as an equal. Blockware estimates that by 2030, we will see 10% of the global population using Bitcoin. Whether or not this prediction comes true is obviously yet to be seen, but if it does, it might not be a bad idea to get ready for the transition before it happens. The dollar is dying and the oligarchy is doing everything they can to maintain their power to control the money. But this doesn’t mean we are destined for a de facto doom and gloom dystopian future.

There are things we can do right now to better prepare ourselves for the world we want to live in. Are you interested in how Bitcoin Core works? Run a full node. Do you have some sats and want to provide liquidity on Lightning? Open Lightning Channels. Do you care about our ability to wirelessly communicate in a decentralized and immutable manner? Operate a mesh network. Do you value discrete transactions? Learn how to use Bitcoin privately. Are you a developer? Develop on Lightning. Do you run a small business? Accept Bitcoin. By taking these small but powerful actions we can shape our reality in such a way that decreases economic friction, ensures self-sovereignty and sends a powerful message to future generations: Keep what’s important and know who’s your friend.

This is a guest post by Patrick McCaughey. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.