PEPE Meme Coin Craze Spreads Wealth to Ethereum Validators Running Blockchain

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.

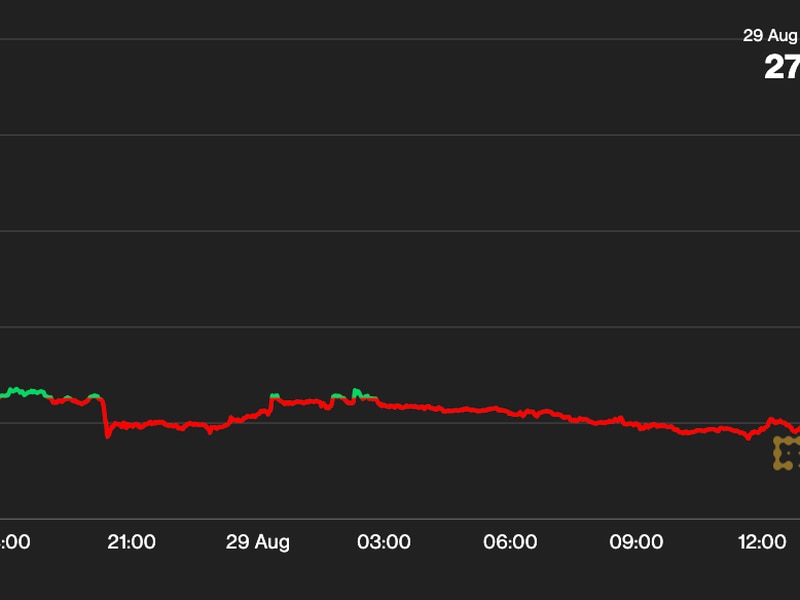

This past weekend’s craze around the meme coin PEPE drove a dramatic increase in the profitability for validators running the Ethereum network – at the heart of the action.

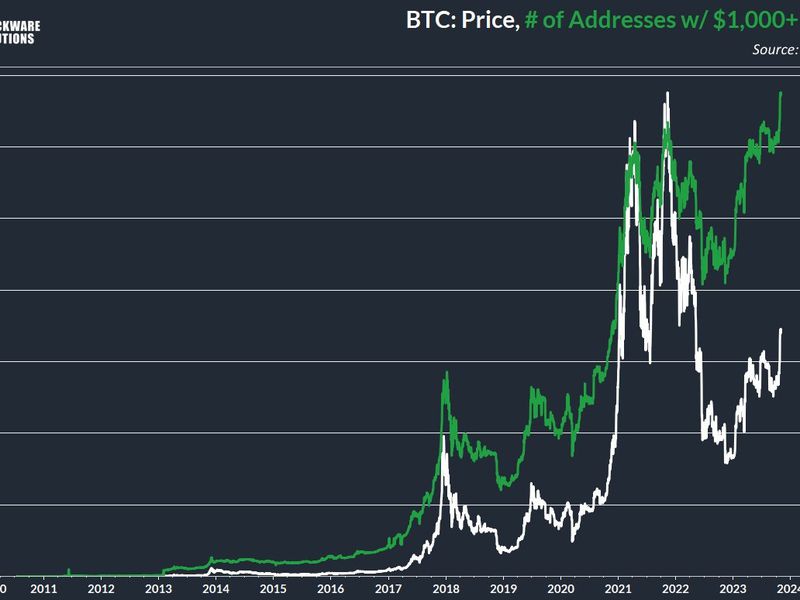

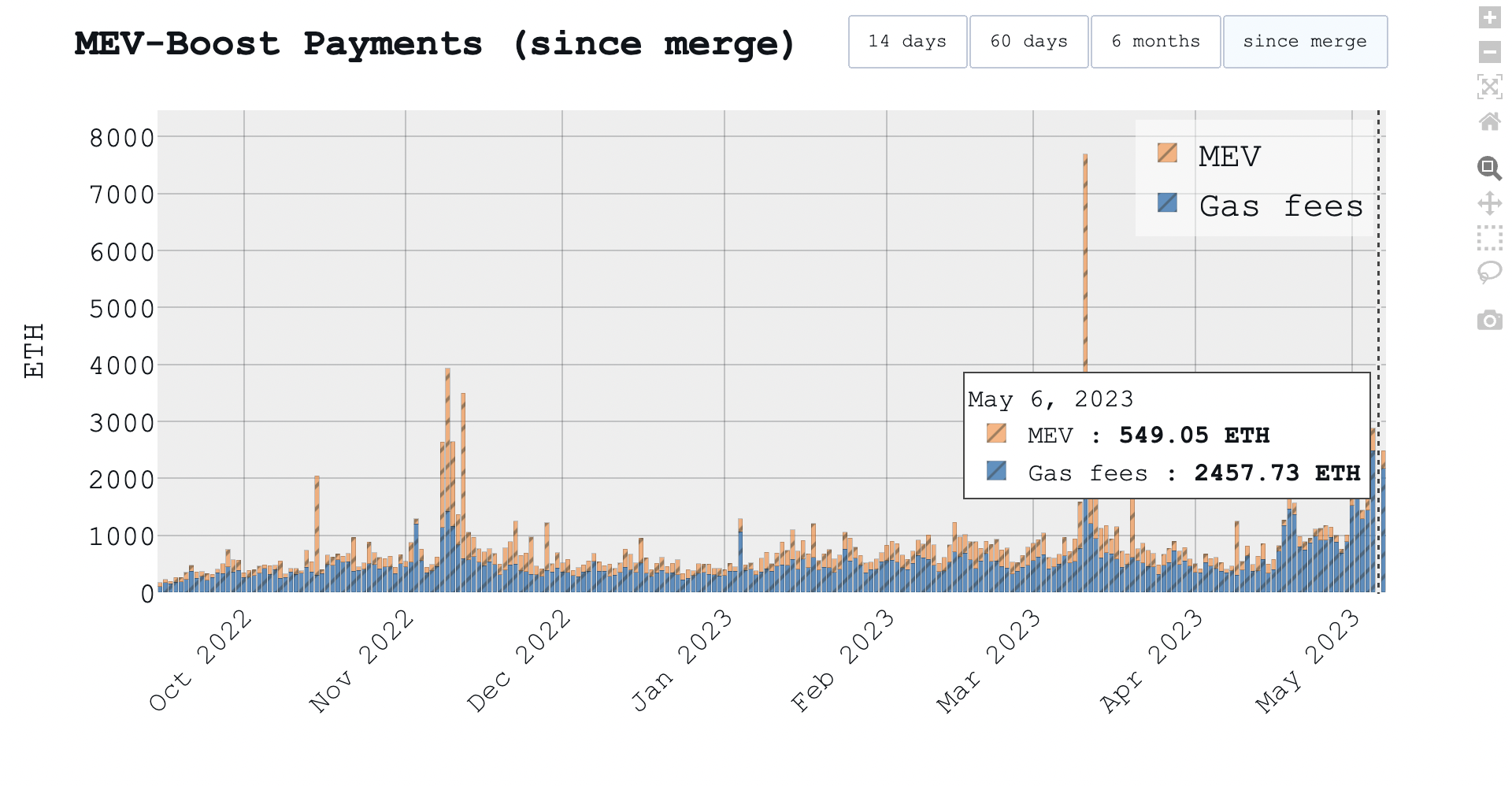

Ethereum validators, who are responsible for running the blockchain following its transition last year to a proof-of-stake network, saw profits from MEV-Boost payments spike over the weekend, according to the dashboard mevboost.pics. The total revenue including transaction fees nearly matched what validators made during the trading frenzy that accompanied the collapse of Sam Bankman-Fried’s FTX crypto exchange.

On May 6, the total reward in MEV revenue was at 549.05 ETH and 2,457.73 ETH in gas fees, for a total of 3,006.78 ETH (worth $5.6 million at current prices). On Nov. 9, at the height of the FTX collapse, MEV revenue was at 2,505.69 ETH while gas fees were at 1,423.99 ETH, for a total revenue of 3,929.68 ETH ($6.1 million).

MEV, or maximal extractable value, is a feature of crypto trading, with some parallels to arbitrage in traditional markets. It represents the amount of additional income that validators can earn by rearranging or optimizing the order of transactions within a block, an ostensibly legal activity that’s sometimes likened to front-running.

The main tool that Ethereum validators use to overcome some controversial MEV practices is MEV-Boost, a software created by Flashbots, that allows validators to request blocks from a network of builders. Validators connect to MEV-Boost through relays to earn MEV.

As part of their MEV rewards, validators are allotted a share from the transaction fees from the block they propose as well as the MEV within a block.

When the meme coin craze began with PEPE, transaction fees skyrocketed and validators made a significant amount of money thanks to those fees.

Normally, during these kinds of periods, the MEV itself constitutes a very large part of the income that validators make, however, when gas fees spike, validators can make more money off of that too.

MEV-Boost Payments during PEPE coin craze (mevboost.pics)

Since 85% of Ethereum validators are connected to MEV-Boost, most of the data reflecting MEV activity is captured through that.

“In the end, block proposers (validators) make a lot of money if people pay high fees for their transactions,” said Toni Wahrstätter, an Ethereum researcher who tracks MEV-Boost activity with his dashboard.

The only time that MEV rewards and gas fees were both higher than the PEPE craze was during the SVB bank run and depeg of stablecoin USDC.

Since the weekend, transaction fee rewards have declined, following the pattern of PEPE’s drop in price and Binance listing it on the centralized exchange.

Edited by Bradley Keoun.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.