Orange Prices Are Up Since 2020 by About as Much as Bitcoin

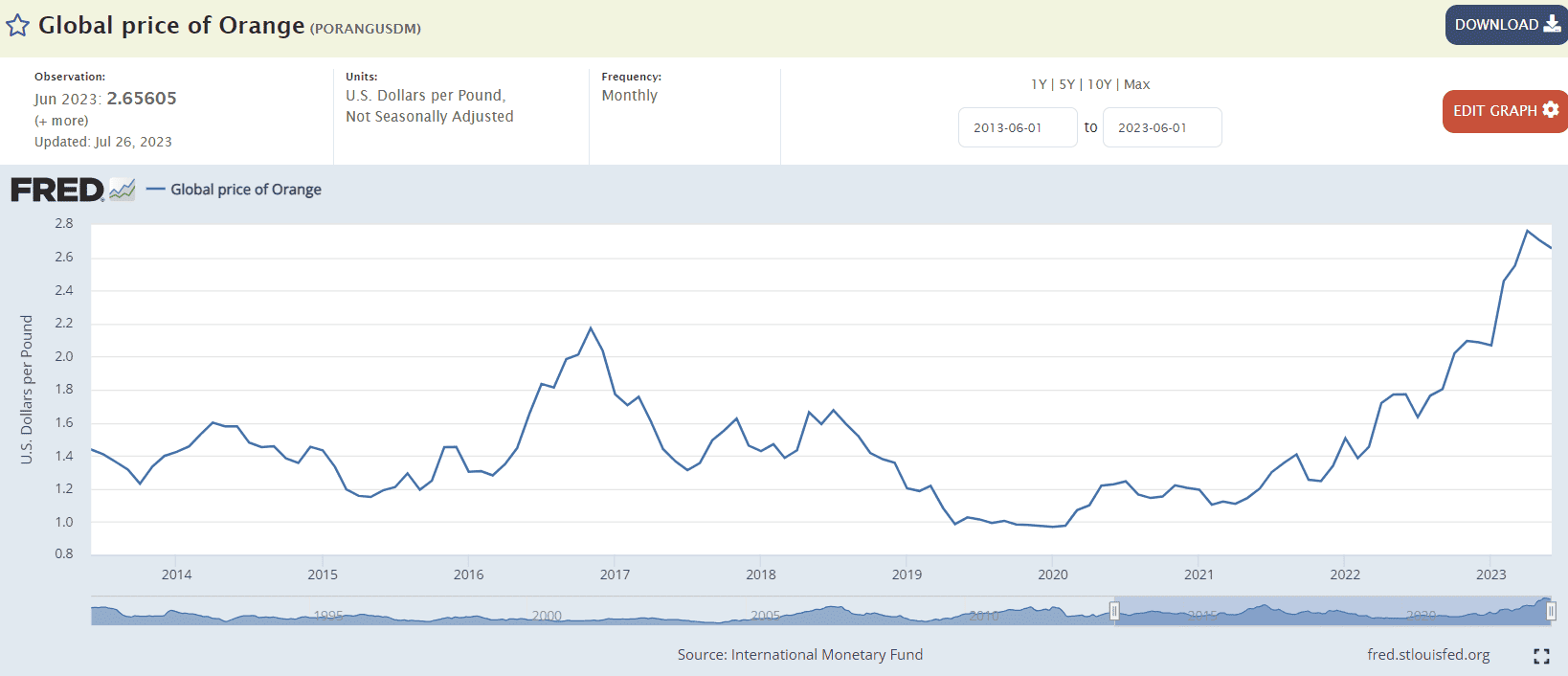

Orange prices have been on the rise since 2020, but this August, the commodities futures markets expect them to surge.

At the same time, orange juice futures are hitting record highs:

“In recent weeks, prices in the OJ futures market have topped $3 per pound. Around this time last year, prices were hovering at around $1.81 per pound.

The price increase has been fueled primarily by short citrus supply around the globe.”

Imagine how pricey oranges could get if the supply was limited to 21 million.

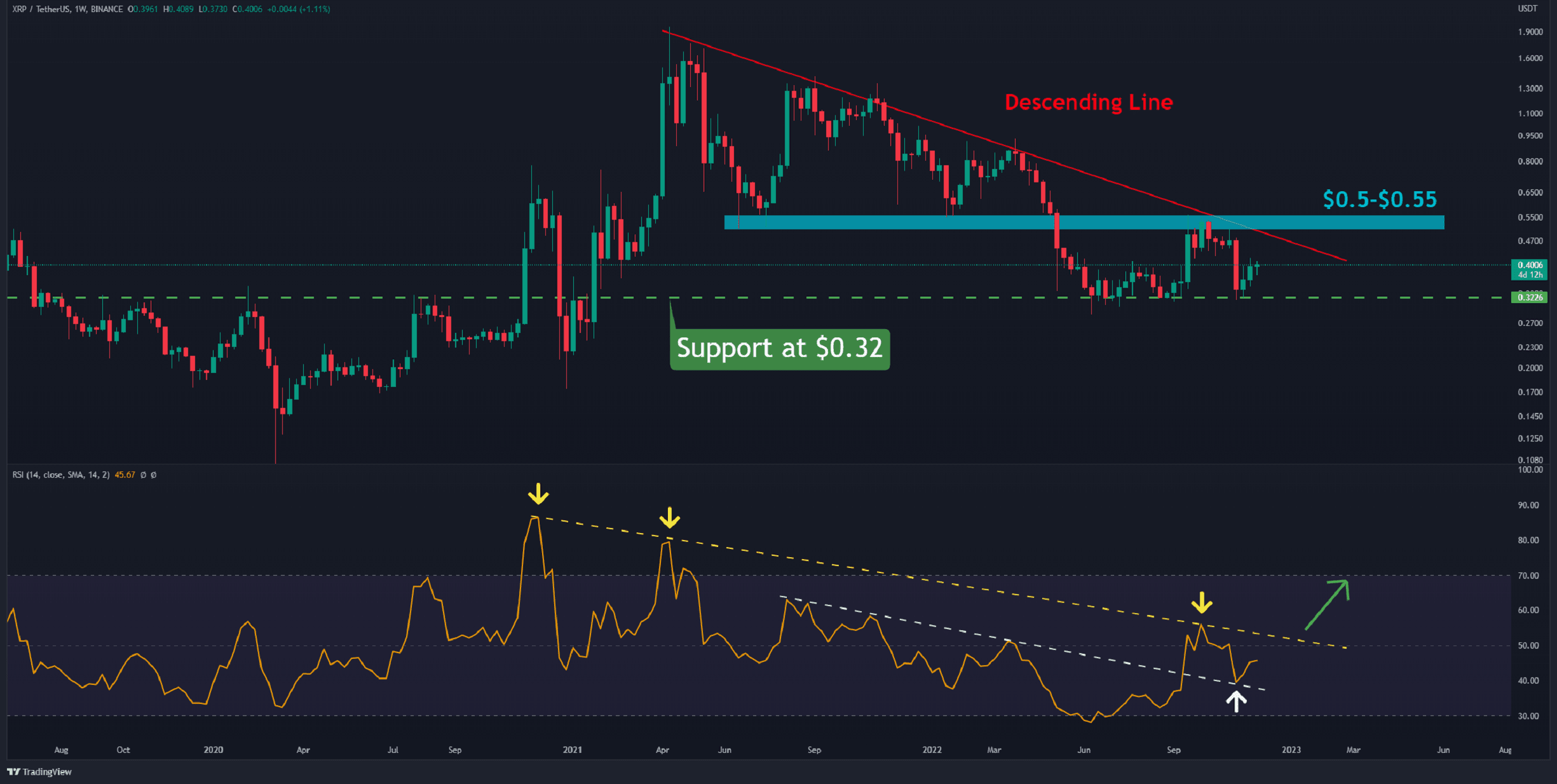

Oranges and Bitcoin Prices on a 3-Year Peel

Whether bitcoin’s price surges in August is an open question for the market. However, IMF data from the Fed shows orange prices have been spiraling out of control since January 2020, like BTCUSD.

The correlation between BTCUSD and orange prices and orange juice futures is theoretically what bitcoin’s advocates expected if their cryptocurrency project succeeded. Now their theory is empirically validated.

The orange comparison is so legally spot on after the SEC vs. Ripple battle, one might suspect Satoshi Nakamoto (who designed bitcoin’s logo) had read up on U.S. securities law before launching their project. It’s another sign of the BTC project’s consummate professionality from beginning to end.

Aren’t You Glad for an Inflation Shelter?

Global orange prices are up by over 180% since Jan 2020. Meanwhile, BTC went on a peel some 230% from January 2020’s $9,000 levels. That’s because the dollar’s inflation is BTC’s price rally, the same as it is for the prices of consumer goods. When the Fed drops rates, dollars buy less, but BTC buys more.

A dollar earned in Jan 2020 can’t buy half the oranges it used to. But one saved on bitcoin’s blockchain has more than kept up with inflation. It can buy even more oranges today than it could when it was earned. That’s why bitcoin’s die-hard advocates say it’s an inflation shelter for your earnings.

The post Orange Prices Are Up Since 2020 by About as Much as Bitcoin appeared first on CryptoPotato.