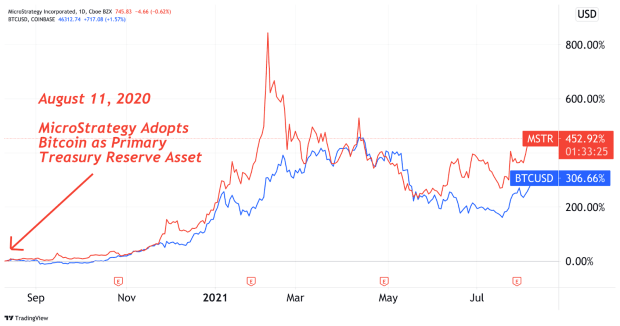

MicroStrategy Stock Has Gained 452% In First Year On Corporate Bitcoin Standard

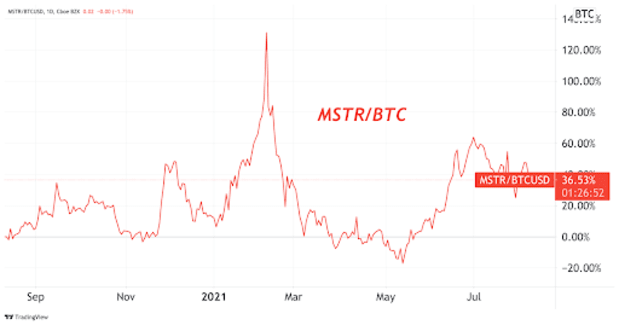

One year since adopting a corporate Bitcoin standard, MicroStrategy’s stock has exploded as the bitcoin price has risen 306%.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

“This is not a speculation, nor a hedge. It is a deliberate corporate strategy to adopt the Bitcoin Standard.”

These were the words of CEO Michael Saylor following the announcement of MicroStrategy’s move to adopt a corporate bitcoin standard. First announced one year ago yesterday, on August 11, 2020, the move was the first of its kind and was a significant step in the history of bitcoin.

Looking back after one year, MicroStrategy stock has gained 452.92%, while the price of bitcoin has increased by 306.66%. One of the reasons for the outperformance in MSTR shares is the speculative attacks executed, by leveraging up the company balance sheet to acquire more bitcoin.

In The Daily Dive #005, “Writing The Corporate Bitcoin Accumulation Playbook”, we covered the various ways that MicroStrategy has used its access to public capital markets to acquire more bitcoin:

- 08/11/20 – MicroStrategy Adopts Bitcoin As Primary Treasury Reserve Asset

- 08/11/20 – MicroStrategy Announces Commencement Of Modified Dutch Auction Tender Offer To Purchase Up To $250 Million Of Its Class A Common Stock

- 12/07/20 – MicroStrategy Announces Proposed Private Offering Of $400 Million Of Convertible Senior Notes

- 12/11/20 – MicroStrategy Completes $650 Million Offering Of 0.750% Convertible Senior Notes Due 2025

- 12/21/20 – MicroStrategy Announces Over $1B In Total Bitcoin Purchases in 2020

- 02/16/21 – MicroStrategy Announces Proposed Private Offering Of $600 Million Of Convertible Senior Notes

- 02/20/21 – MicroStrategy Completes $1.05 Billion Offering Of Convertible Senior Notes Due 2027 At 0% Coupon And 50% Conversion Premium With Bitcoin Use Of Proceeds

- 02/24/21 – MicroStrategy Acquires Additional 19,452 Bitcoins For $1.026 Billion

- 06/07/21 – MicroStrategy Announces Proposed Private Offering Of $400 Million Of Senior Secured Notes

- 06/14/21 – MicroStrategy Completes $500 Million Offering Of 6.125% Senior Secured Notes Due 2028 With Bitcoin Use Of Proceeds

- 06/14/21 – MicroStrategy Launches “At the Market” Securities Offering For Flexibility To Sell Up To $1 Billion Of Its Class A Common Stock Over Time

Saylor and MicroStrategy took a lot of heat in particular for the latest $500 million junk bond debt raise and subsequent bitcoin purchase, when the odds remain incredibly in favor of Saylor and MicroStrategy.