MicroStrategy Acquired an Additional 155 Bitcoin Since End of Q3

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Alongside its third-quarter earnings report, software developer MicroStrategy (MSTR) disclosed the purchase of another 155 bitcoins (BTC) during October, bringing the total acquired since the beginning of Q3 to 6,607.

As of the end of October, the Tysons, Virginia-headquartered firm co-founded by Michael Saylor was the owner of 158,400 bitcoins acquired at a total cost of $4.69 billion, or $29,586 per bitcoin.

The company booked an impairment loss on its digital asset holdings of $33.6 million during Q3. Cumulative impairment losses have now risen to $2.23 billion reflecting an average carrying amount per bitcoin of roughly $15,491. That, of course, isn’t terribly reflective of the market value as of Sept. 30 of the company’s bitcoin, which was $27,030, nor the current price just under $35,000.

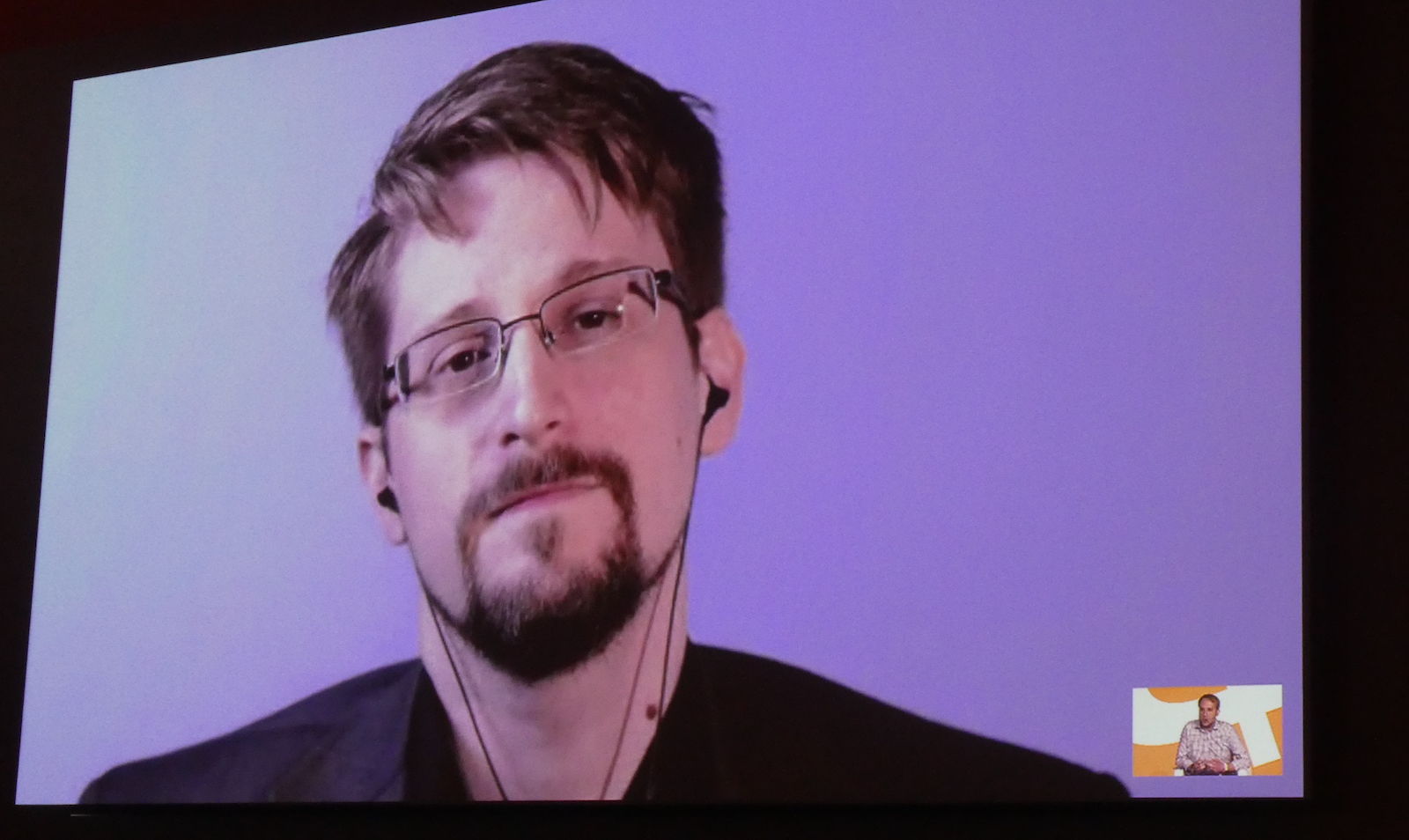

Speaking on the earnings call, Saylor said on an earnings call that he thought increasing regulatory clarity in the crypto industry is creating “more comfort for institutional investors to be able to participate.”

“I think we’ll see positive regulatory initiatives that will create more clarity and consistency during the coming 12 months,” he added.

MSTR shares are higher by 2.3% mid-morning on Thursday to $436.37.

Edited by Stephen Alpher.