Major Options Exchange to Launch Ripple (XRP) Pairs in January: Details

TL;DR

- Deribit plans to launch linear options for XRP, SOL, and MATIC in January, targeting European markets and doubling down on derivatives trading.

- Despite its price fluctuations, XRP remains a popular choice for payments, with institutions like HSBC allowing its use.

- Following its legal victories against the US SEC, XRP might be on the verge of a bull run, as indicated by ChatGPT.

Embracing XRP and Other Coins

The leading cryptocurrency exchange – Deribit – announced its intentions to launch linear options for Ripple (XRP), Solana (SOL), and Polygon (MATIC). The company used X (Twitter) to disclose its plans as it also vowed to apply for a brokerage license in the European Union (EU).

In a recent interview, Deribit’s CCO Luuk Strijers said the upcoming offering will see the light of day in January, describing the European region as “the best environment to launch new products.”

Crypto derivative trading volumes have slid significantly from their peak levels, hampered by the declining prices of most digital currencies and the uncertainty reigning in the sector. According to Richard Galvin – Co-Founder of Digital Asset Capital Management – adding more options involving alternative coins (and not only ETH) could benefit cryptocurrency exchanges.

Earlier this year, Deribit rolled out a zero-fee spot trading platform focusing on derivatives. Strijers shed more light on that development and its purposes:

“That’s why we do it for free, not because we don’t like the potential revenues, but because we aim to generate revenue primarily through derivatives trading.”

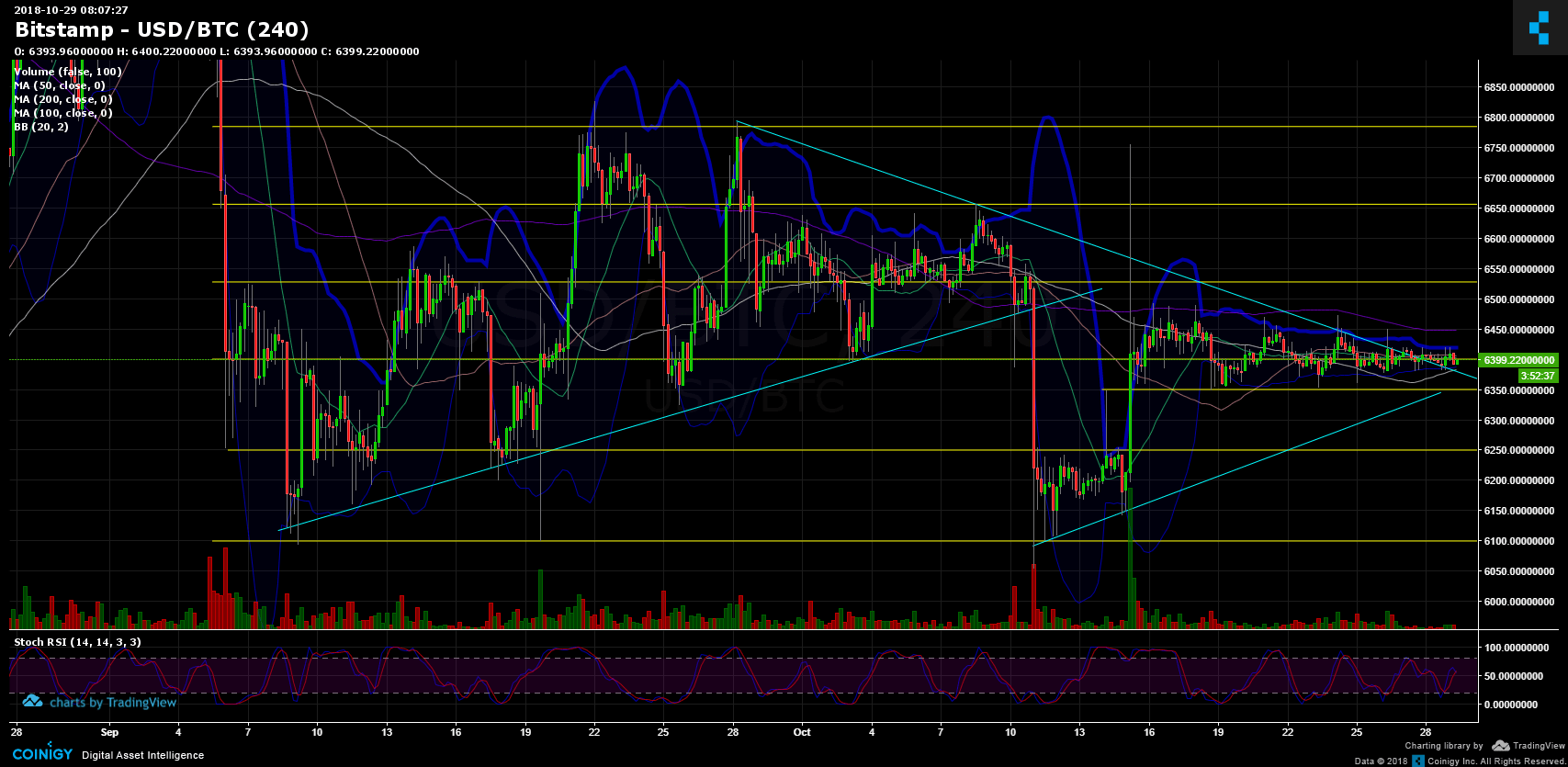

XRP Remains Popular Despite its Consolidation

The native token of Ripple might not be in its best shape (considering the price decline after the spike in July), but it maintains its popularity. In fact, some prominent companies and financial giants such as HSBC allowed eligible clients to pay their mortgage bills and loans in various cryptocurrencies, including XRP.

The asset was also the top trending token in the entire realm at one point last week after Ripple secured a second victory in a row against its big enemy – the US SEC.

According to ChatGPT, a decisive win at the trial next year and other factors could push XRP toward a new bull run. Those curious to find out how high the asset could go in case of such a rally can watch our video below:

The post Major Options Exchange to Launch Ripple (XRP) Pairs in January: Details appeared first on CryptoPotato.