Major Crypto Firms Need Extra Rules, Global Cooperation, Says ECB’s McCaul

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

:format(jpg)/www.coindesk.com/resizer/VDk3MowyGg2DUxeRJFgGIHdZ6SE=/arc-photo-coindesk/arc2-prod/public/ZHFQDVVL5ZHVNGH7MTIESP35ZU.jpg)

Jack Schickler is a CoinDesk reporter focused on crypto regulations, based in Brussels, Belgium. He doesn’t own any crypto.

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

Major global crypto companies like FTX and Binance need tougher rules and more international regulatory cooperation, European Central Bank (ECB) Supervisory Board member Elizabeth McCaul said in a blog post on Wednesday.

McCaul, a member of the ECB arm responsible for overseeing banks, said recent attempts to regulate such as the European Union’s Markets in Crypto Assets regulation (MiCA) wouldn’t fully address the problem of complex international structures, or “ecosystem” companies that claim to have no headquarters.

“How can we supervise firms that have no physical borders?,” McCaul said. “We need to put more thought into imagining what international coordination will look like and how it can be effective in regulating the crypto world.”

McCaul cited precedents from banking, where consolidated groups are governed by “colleges” of international supervisors, and securities – where regulators defer to foreign jurisdictions that are deemed equivalent – but said that crypto companies would need to become more legally accountable.

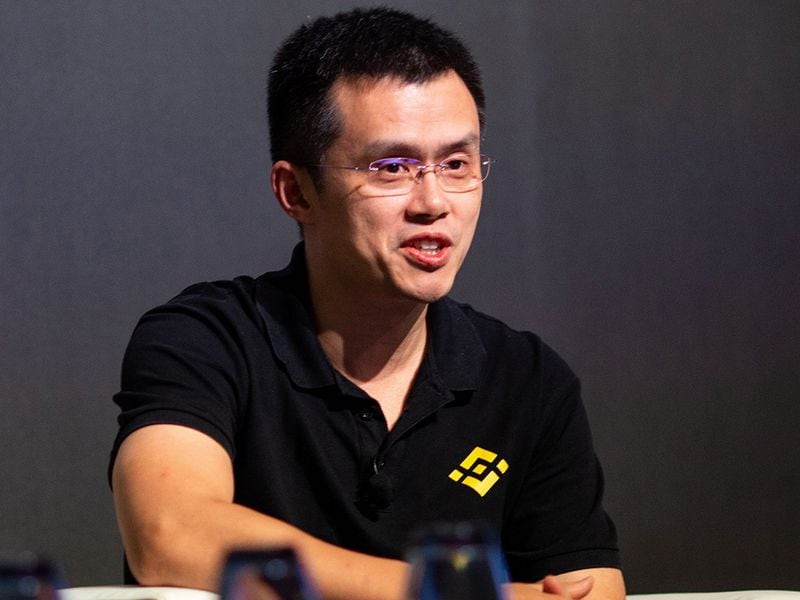

“No jurisdiction should allow entities to run their business without disclosing their legal status and who is responsible for the business,” she said. “Even firms that claim to have no headquarters, such as Binance, need to be ‘supervisable’.”

While smaller entities could remain under MiCA, which is set to be finalized by the European Parliament within weeks, McCaul said major crypto providers would need a separate regime comprising stricter requirements and enhanced supervision. The threshold for deeming an operator as “significant” also needs to shift, given that neither FTX nor Binance met the current criteria, she added.

Fabio Panetta, who sits on the ECB’s Executive Board has previously described crypto as a “Ponzi scheme” fueled by greed. ECB President Christine Lagarde has also called for further laws in areas like crypto staking and lending that MiCA doesn’t cover.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/VDk3MowyGg2DUxeRJFgGIHdZ6SE=/arc-photo-coindesk/arc2-prod/public/ZHFQDVVL5ZHVNGH7MTIESP35ZU.jpg)

Jack Schickler is a CoinDesk reporter focused on crypto regulations, based in Brussels, Belgium. He doesn’t own any crypto.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/VDk3MowyGg2DUxeRJFgGIHdZ6SE=/arc-photo-coindesk/arc2-prod/public/ZHFQDVVL5ZHVNGH7MTIESP35ZU.jpg)

Jack Schickler is a CoinDesk reporter focused on crypto regulations, based in Brussels, Belgium. He doesn’t own any crypto.