Looking at Some Unanswered Signature and Silvergate Bank Questions

I think it’s safe to assume people want certainty. Companies want to know they’ll be able to tap banking services. For that to happen, banks need to be comfortable serving crypto companies. And for that to happen, they probably need to know what factors led to Signature becoming a failed bank – was it, as so much of the industry keeps saying, the mere fact it served crypto clients? Or was it because the bank itself had some deeper issues?

Related Posts

Bitcoin Recovers from $11.3K Despite Losses in European Stocks

Aug 13, 2020 at 13:31 UTCUpdated Aug 13, 2020 at 13:32 UTCBitcoin prices (CoinDesk BPI)Bitcoin Recovers from $11.3K Despite Losses in European StocksBitcoin has shrugged off a drop to $11,300 for the third day running. The cryptocurrency dipped to $11,287 at 09:10 UTC Thursday, only to chart a quick recovery to levels around $11,500, according…

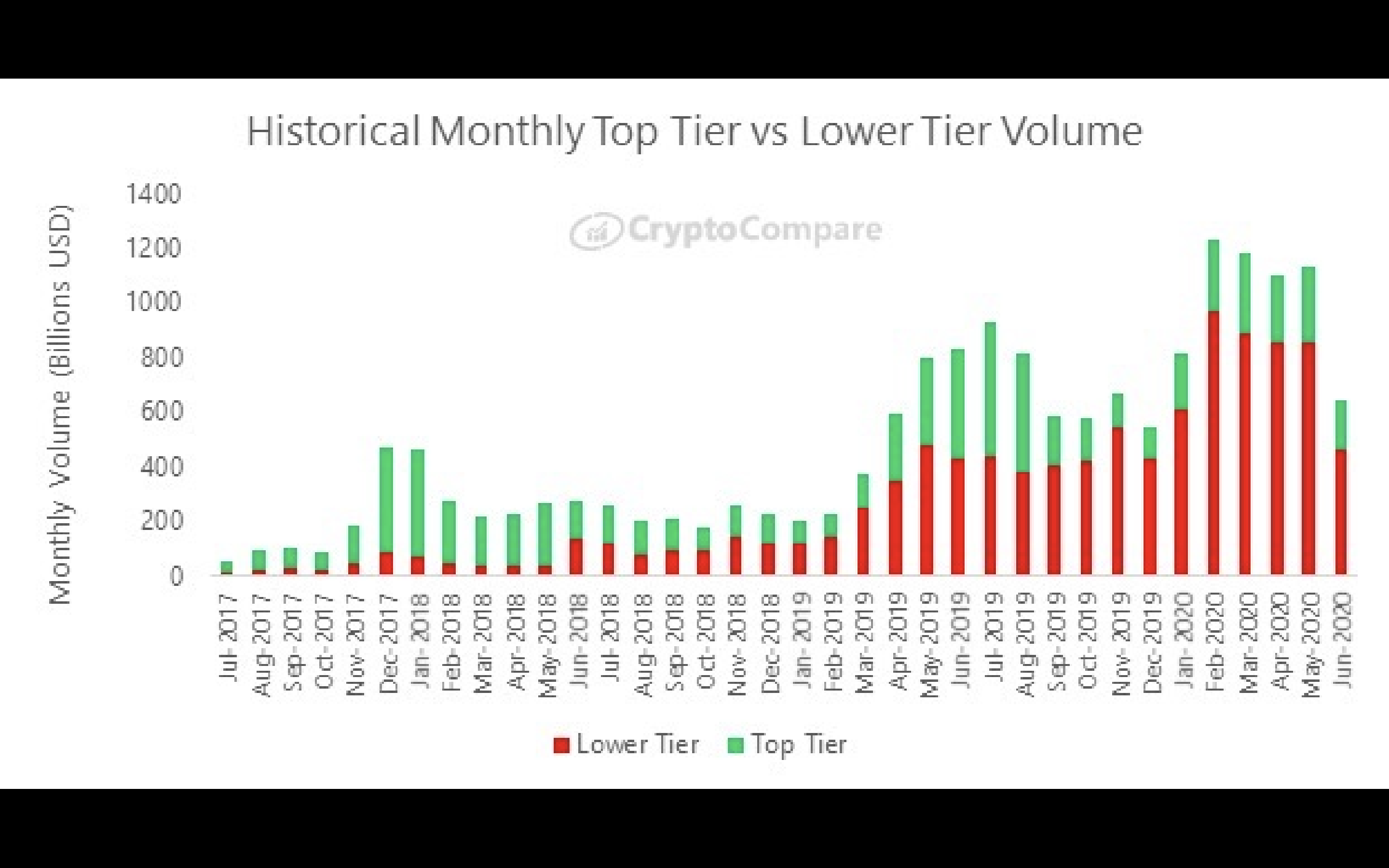

Crypto Exchanges See Big Drop in Volumes as Bitcoin Volatility Approaches 2020 Low

Exchange volumes are at a rock bottom as traders turn away from sluggish bitcoin markets. Trading volumes on "top tier" spot exchanges fell by 36% in June, according to a report from London-based data provider CryptoCompare.Similarly, crypto derivatives exchanges experienced a 35.7% drop in volume to $393 billion – the lowest monthly volumes since the…

JPMorgan Expanding Blockchain Project With 220 Banks to Include Payments

news Investment banking giant JPMorgan Chase is planning to expand an existing blockchain project to include settlement features as it seeks to fend off competition from payments upstarts such as TransferWise and Ripple. The blockchain-based Interbank Information Network (IIN), set up in partnership with Australia’s ANZ bank and the Royal Bank of Canada back in 2017,…

Bitcoin Miner Marathon Buys $100M BTC, Will Once Again Adopt ‘Full HODL’ Strategy

Marathon Digital (MARA), one of the largest bitcoin (BTC) miners, bought $100 million worth of BTC in the open market and said it will readopt its strategy to hold all mined bitcoin on its balance sheet. The miner said in a statement on Thursday that it now holds over 20,000 bitcoin, worth nearly $1.3 billion

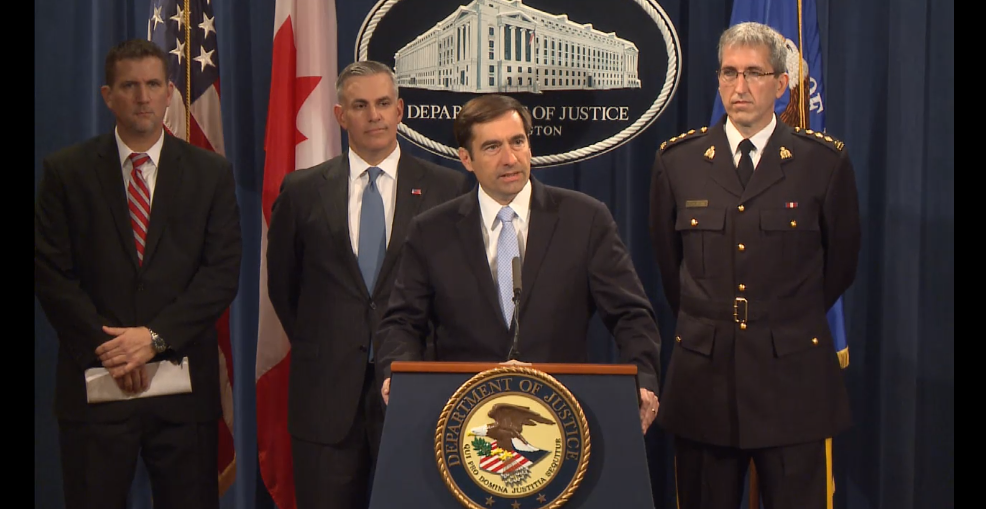

Another US Indictment Links Bitcoin to Covert Russian Intelligence Activity

A newly-published indictment by the U.S. Department of Justice charges seven alleged Russian intelligence agents with using cryptocurrencies as part of a broad "influence and disinformation" scheme. The government alleges that Aleksei Sergeyevich Morenets, Evgenii Mikhaylovich Serebriakov, Ivan Sergeyevich Yermakov, Artem Andreveyich Malyshev, Dmitriy Sergeyevich Badin, Oleg Mikhaylovich Sotnikov and Alexey Valerevich Minin are members of…

Dutch Central Bank to Crypto Firms: Register in 2 Weeks or Shut Down

May 5, 2020 at 18:01 UTCUpdated May 5, 2020 at 18:43 UTC(Credit: TonyV3112 / Shutterstock)Dutch crypto companies must register with the Netherlands’ central bank by May 18 or cease operations immediately, the monetary authority said Monday.De Nederlandsche Bank (DNB) is moving to quickly enforce enhanced Dutch anti-money laundering (AML) laws, which passed the Dutch Parliament…

Chinese Authorities Have Seized a Massive $4 Billion in Crypto From PlusToken Scam

Nov 27, 2020 at 10:35 a.m. UTCUpdated Nov 27, 2020 at 10:58 a.m. UTCChinese policeman(Chalermpon Poungpeth/Shutterstock)Chinese Authorities Have Seized a Massive $4 Billion in Crypto From PlusToken ScamA police crackdown on the PlusToken Ponzi scheme in China has resulted in cryptocurrencies worth billions of dollars being seized.In a Nov. 19 court ruling reported by The…

Jack Dorsey’s Block Bitkey Bitcoin Wallet Comes to Market in More Than 95 Countries

Jack Dorsey's fintech company Block (SQ) has unveiled its self-custody bitcoin wallet Bitkey for pre-order in more than 95 countries.Bitkey consists of a mobile app, hardware device and a set of recovery tools, Block announced on Thursday.Bitkey includes a mobile app, hardware device, and a set of recovery tools, according to the company. (Block/Business Wire)The