It Will Take a While Before a Bitcoin ETF Approval: Yoni Assia, CEO of eToro Says

One of the hottest topics in the cryptocurrency community is the potential approval of a Bitcoin exchange-traded fund (ETF) and whether or not it will have a catalyzing impact on the crypto markets.

2018 hasn’t seen anything positive in this regard. In fact, the year saw multiple Bitcoin ETF applications rejected one after another, including the one by famous Facebook twins Cameron and Tyler Winklevoss. The SEC slam the door shut on their ETF proposal in July 2018.

Shortly after that, in August, the US Securities and Exchange Commission rejected nine more Bitcoin ETF applications.

VanEck and SolidX file the one ETF application that everyone has his eyes set on at the moment and it’s backed by CBOE Global Markets. After having postponed its decision on the application a few times, the final deadline for the SEC to rule on that is set for February 2019.

Signs of Despair?

The continuous clampdown on behalf of the Commission has raised serious concerns over whether or not a Bitcoin ETF will ever get approved.

According to the CEO of the leading social trading platform eToro, Yoni Assia, a cryptocurrency ETF won’t see the green light, at least nor in the near future.

This was said during his speech at the Israel Bitcoin Summit. Assia shared his views on the current state of the cryptocurrency market, blockchain technology, and the possibilities of an ETF being approved.

He thinks that it’s “going to be a while” before an ETF is approved:

“The ones that said in January 2018 that ‘crypto is a bubble and people are going to lose their money’ are now the smart guys in the room because they were ‘right. Those do not encourage any approval of an ETF application, So I think it’s going to be a while before we see an ETF but you never know.”

Interestingly enough, Assia considers that at least one country will bankrupt completely, leaving the people to flock to Bitcoin.

“It is inevitable that in the next five years we’re going to see at least one country where people flock to Bitcoin,” said Assia. “All the banks in such country will go bankrupt, and the government will have zero chance of reviving the banking system because there is no need for local currency or local bank.”

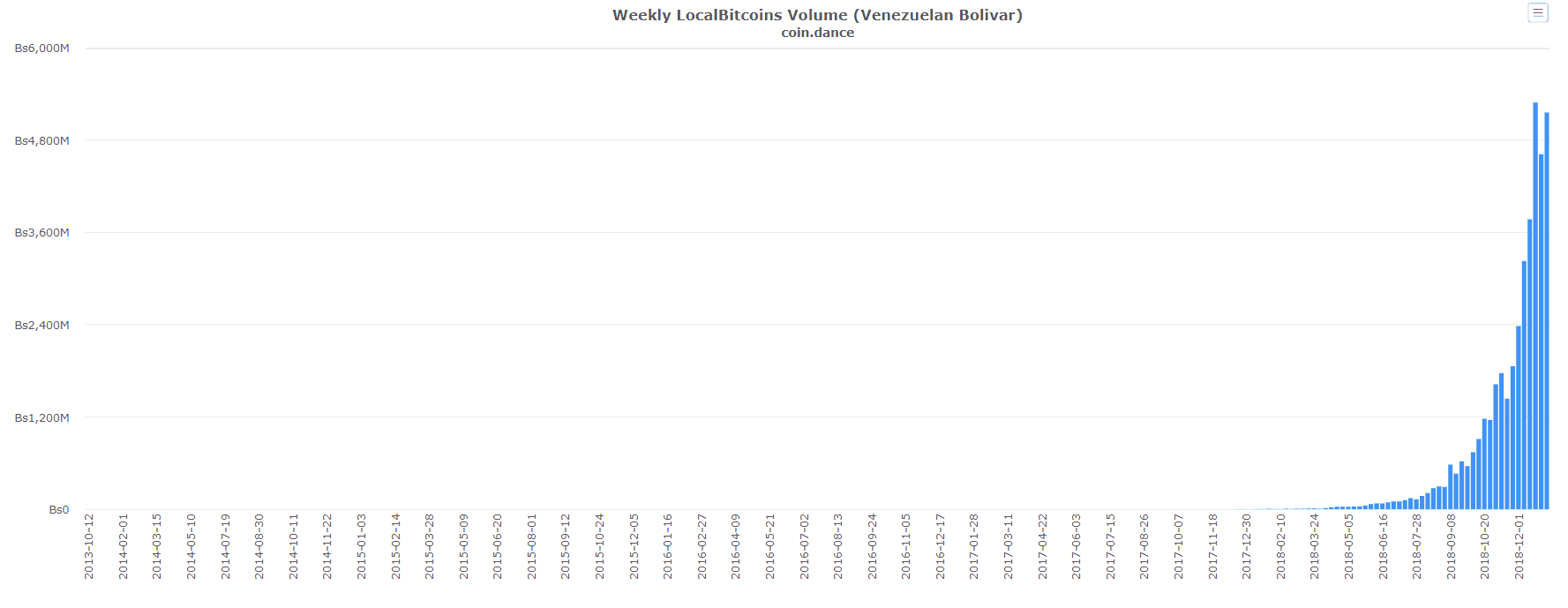

There seems to be plenty of merit in the words of eToro’s CEO. Venezuela, for example, has been torn by hyperinflation. The financial state of the country is so unstable that the IMF projects the inflation to reach the vast 1.37 million percent rate of the inflation.

And, as it turns out, in times of financial crisis, people are turning to Bitcoin. New data reveals OTC trading activity in Venezuela and shows the unprecedented growth in the past two quarters of 2018.

The light at the end of the tunnel?

It’s important to note that not all experts share the same views as Assia. SEC Commissioner Hester Peirce confirmed that a Bitcoin ETF is “definitely” possible in a podcast dubbed “What Bitcoin Did.”

Peirce won the hearts of the cryptocurrency community after she formally dissented against the decision of the US SEC to deny Cameron and Tyler Winklevoss application.

What is more, the Commissioner expressed her definitive disagreement with the decision of the SEC, arguing that it threatens investor protection and innovation.

The post It Will Take a While Before a Bitcoin ETF Approval: Yoni Assia, CEO of eToro Says appeared first on CryptoPotato.