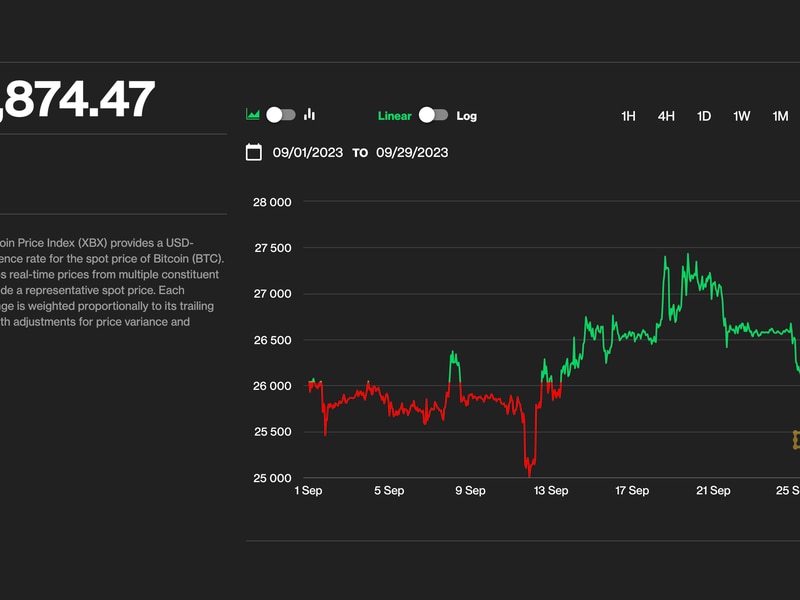

Investors Buying Bitcoin Amid Price Slump to Near $10K, Data Shows

Prices have shed over $2,000 since Aug. 17 (CoinDesk BPI)

Despite significant losses for bitcoin since mid-August, the “buy the dip” mentality in the crypto markets is still strong, blockchain data suggests.

- While the cryptocurrency has declined from $12,400 to $10,000 in the past three weeks, the number of “accumulation addresses” has increased by 2% to 513,000, according to data source Glassnode.

- “Lots of new daily buyers are coming in to absorb supply,” Su Zhu, CEO of Singapore-based Three Arrows Capital, told CoinDesk in a Telegram chat.

- Accumulation addresses are those that have at least two incoming non-dust transfers (representing minuscule amounts of bitcoin) and have never spent funds.

- The metric excludes addresses belonging to miners and exchanges, and addresses active more than seven years ago to exclude lost coins.

- The divergence between prices and accumulation addresses suggests that investors view the recent price drop as a typical bull market pullback and expect prices to rise once more.

- “Markets typically retrace one third or more in a bull market after local euphoria,” Zhu tweeted on Friday, suggesting prices could drop to as low as $8,800 and still be a “healthy target.”

- Bitcoin fell by over 10% on Thursday, confirming a head-and-shoulders breakdown – a bearish reversal pattern – and a violation of the six-month-long bull market trendline.

- Usually, such patterns invite more substantial chart-driven selling, yielding deeper price declines.

- So far, bitcoin has managed to defend the $10,000 support – possibly a sign of an underlying bullish tone in the market.

- “I am flabbergasted by the strength shown at $10,000, and it probably means $100,000 is more likely than $5,000 at this stage,” Zhu said in another tweet.

- At press time, bitcoin is changing hands near $10,117, representing a 1.59% decline on the day.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.