IMF: Limited Impact From Crypto Crash But Global Recession Likely

In its World Economic Outlook update for July, the International Monetary Fund said that 2022 has been “gloomy and more uncertain.”

The report, published on July 26, noted that a “dramatic sell-off” of crypto assets led to large losses in crypto investment vehicles and hedge funds. However, “spillovers to the broader financial system have been limited so far.”

The report was referring to the collapse of the Terra ecosystem in May and the resultant runs on crypto lending and brokerage platforms Celsius, Voyager Digital, Three Arrows Capital, and BlockFi, among others.

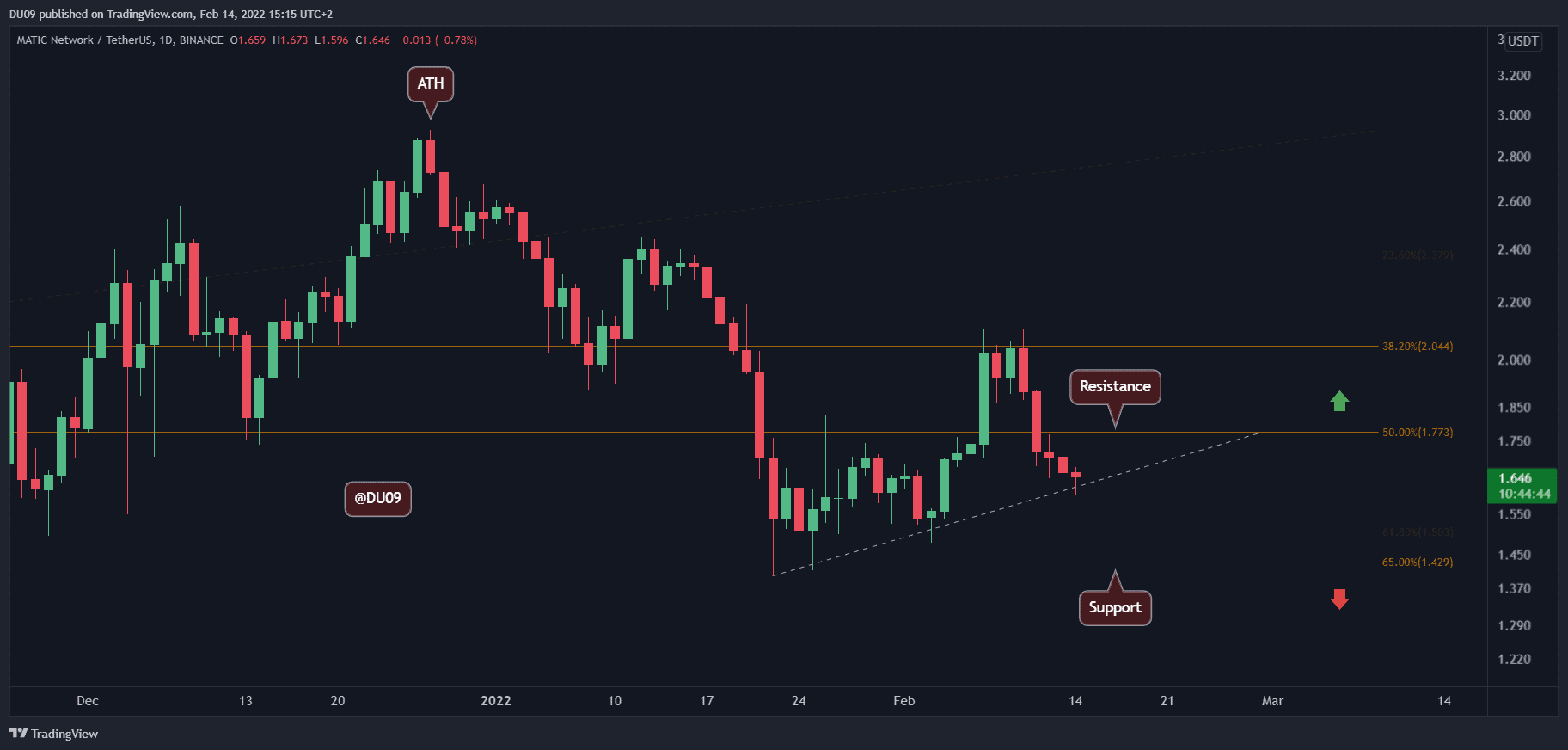

Crypto markets have declined around 70% from their peak capitalization of $3 trillion in November 2021 to current levels of about $1 trillion. Last week’s brief rally appears to have dissipated as around $80 billion has left the space since the weekend.

Gloomy Global Outlook

The IMF’s gloomy outlook suggests there could be more pain for digital asset markets. “Several shocks have hit a world economy already weakened by the pandemic,” it stated.

Russia’s war in Ukraine and resultant supply chain issues have compounded a pandemic-battered global economy that has not had a chance to recover. This is terrible news for high-risk asset classes such as cryptocurrencies.

It said the baseline forecast is for growth to slow from 6.1% last year to 3.2% in 2022. Some countries will see growth decline in 2022, sending them spiraling into recession. Reduced household purchasing power due to inflation and tighter monetary policies have exacerbated the problems.

The report predicted that these issues are likely to continue into 2023. “The risk of recession is particularly prominent in 2023 when in several economies growth is expected to bottom out.”

U.S. Recession Fears

This week, the U.S. Bureau of Economic Analysis (BEA) will release its advance estimate of second-quarter GDP (gross domestic product). Current Atlanta Fed predictions estimate a figure of -1.6%, which is the same decline as the previous quarter.

The technical definition of a recession is two consecutive quarters of negative GDP growth. However, U.S. politicians are already trying to wriggle out of using this term by changing the parameters of that definition and downplaying recession risks.

A recession would put more pressure on digital asset markets and other high-risk investments.