How The Bitcoin Halving Will Affect Mining And New Crypto Startups Are Raising Millions

Bitcoin has been the talk of the crypto market in recent weeks, with many investors looking forward to the upcoming halving event, set to occur in April 2024.

While this halving event will pose challenges for established firms, some projects are raising millions to launch new models that could revolutionize the mining sector.

This article explores the evolution of Bitcoin mining and how both the upcoming halving and new crypto startups could shape its future.

The Evolution of Bitcoin Mining – A Brief Summary

Bitcoin mining is the process by which new Bitcoins are created, and transactions are verified on the blockchain.

Computers around the world “mine” for Bitcoins by solving complex mathematical problems that validate blocks of transactions.

For their efforts, these “miners” receive BTC payouts.

Bitcoin mining initially began in 2009 after the launch of the Bitcoin network by Satoshi Nakamoto.

In the early days, mining could be done using regular home computers due to the low network difficulty and hashrate required.

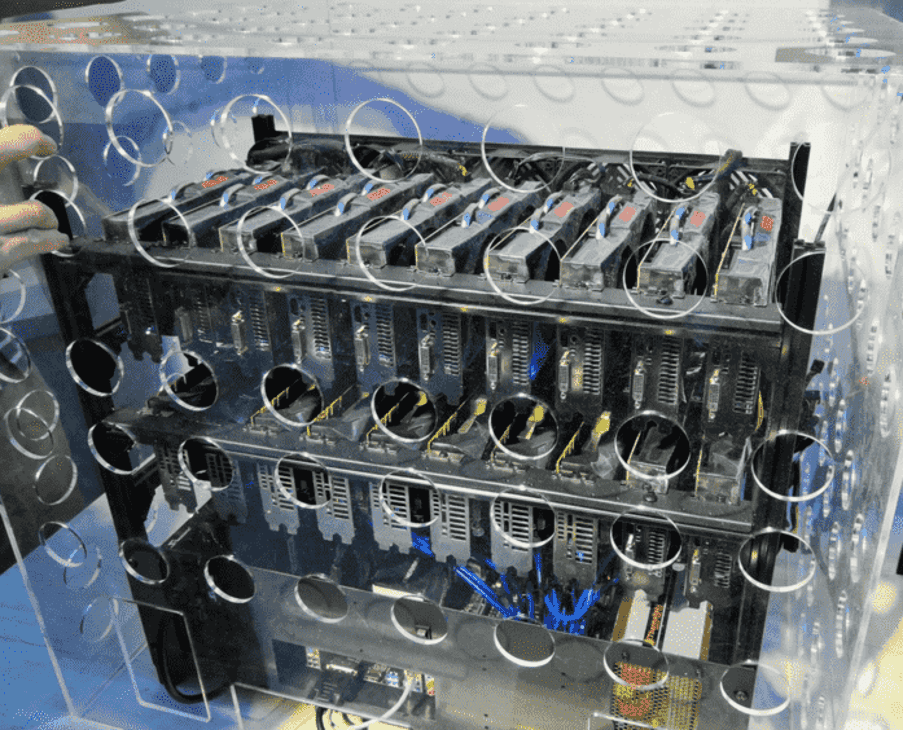

As interest in Bitcoin mining grew, people started building dedicated mining rigs with graphics cards that could hash faster.

By 2013, Bitcoin mining had shifted to using ASIC miners – specialized hardware designed specifically for mining BTC.

This made mining with home computers unprofitable, meaning the process was essentially inaccessible to those without the required resources.

Over the years, mining difficulty – an indicator of the required hashing power to mine a block – has risen exponentially.

As per the latest data from YCharts, the average mining difficulty now sits at 62.46 – a whopping 1,124% higher than it was in December 2018.

In turn, the hardware and energy required for profitable mining have also increased massively.

How Bitcoin Halving Events Impact the Mining Landscape

As highlighted above, Bitcoin mining has evolved dramatically since the early days when individuals would mine BTC on their home computers.

Importantly, periodic Bitcoin halving events have been key milestones during this evolution.

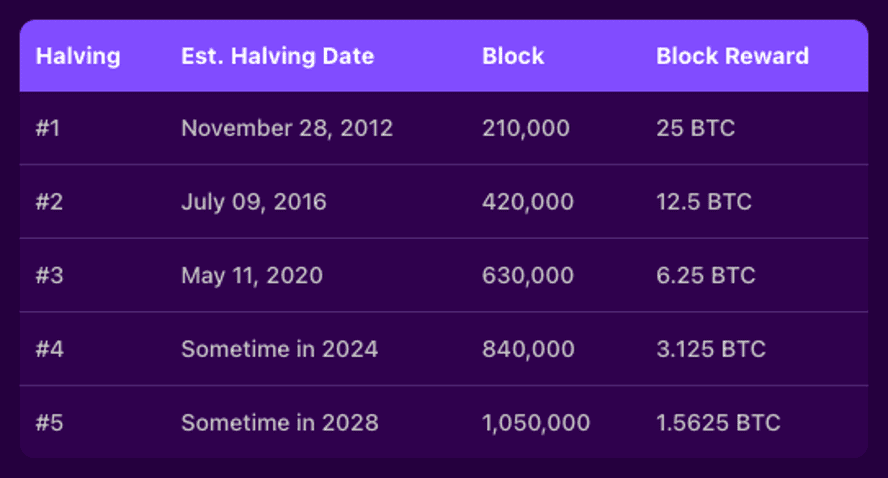

Bitcoin halvings occur every four years and result in the reward that miners receive for mining new blocks being cut in half.

The next halving, expected in April 2024, will slash the mining reward from 6.25 BTC per block to 3.125 BTC per block.

Naturally, such a massive reduction in mining revenue will be challenging for miners – even public mining firms like Marathon Digital and Riot Blockchain.

Some mining firms may even be forced to shut down unless the Bitcoin price rises enough to offset the reduced block rewards.

However, the halving will also impact Bitcoin’s supply; with fewer new coins being generated, it could increase demand and, potentially, the price over time.

For this reason, many investors anticipate the halving as a potentially bullish event for Bitcoin, which has historically been the trend following previous halvings.

Innovative Startups like Bitcoin Minetrix Seek to Shake Up Mining Sector

While the upcoming halving poses challenges for established Bitcoin mining firms, it also presents opportunities for new entrants aiming to shake up the sector.

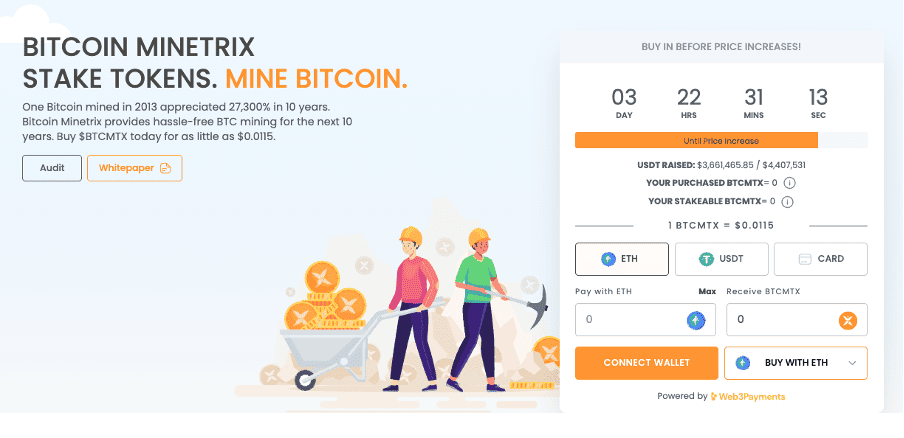

Several crypto startups have recently raised millions in funding to develop innovative mining solutions, with Bitcoin Minetrix (BTCMTX) being one of the most talked-about.

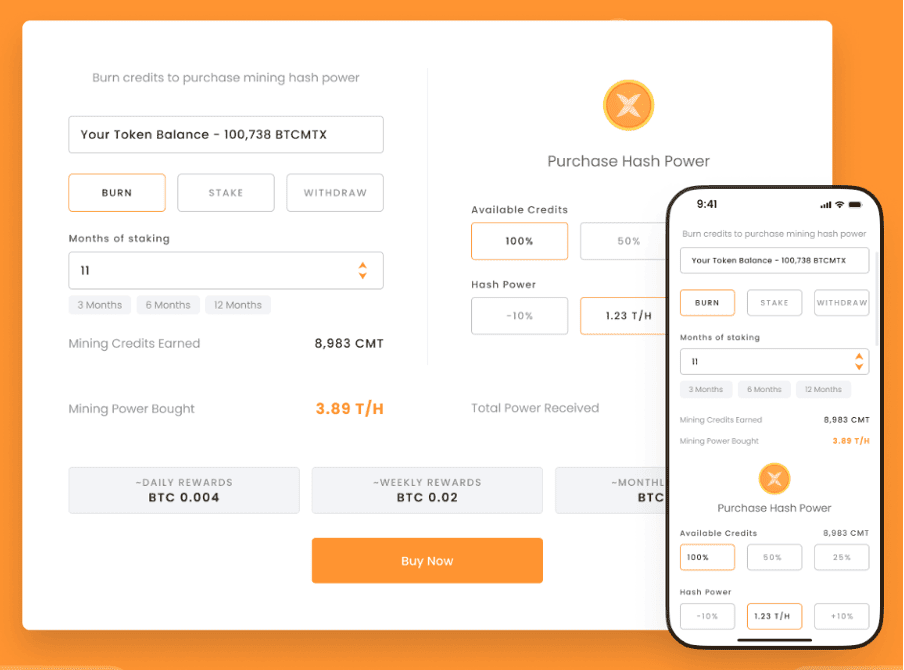

Bitcoin Minetrix is building a tokenized cloud mining platform that enables users to earn mining rewards by staking the native BTCMTX token.

The project aims to open Bitcoin mining to a broader audience through its decentralized, transparent model.

Bitcoin Minetrix’s presale event, which commenced in late September, has raised over $3.6 million so far, demonstrating strong interest from traders and investors.

The capital raised will help Bitcoin Minetrix launch its platform, build a mobile app, and scale operations.

According to Bitcoin Minetrix’s whitepaper, the development team also has ambitious plans for the future, including securing exchange listings for BTCMTX and forging partnerships with cloud mining firms.

While the halving may consolidate mining power with major firms, new entrants like Bitcoin Minetrix show that innovation is still possible in the sector.

The next generation of Bitcoin mining could look very different thanks to the approach of groundbreaking startups like this.

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post How The Bitcoin Halving Will Affect Mining And New Crypto Startups Are Raising Millions appeared first on CryptoPotato.