Grayscale’s Solana Trust Trades at 869% Premium as Institutions Flock to SOL

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Grayscale’s Solana Trust (GSOL) is trading at a premium of 869% to its underlying assets amid a surge in institutional interest in the cryptocurrency industry, CoinGlass data shows.

The trust’s shares are priced at $202 following a 653% rise since the start of September, while the SOL token trebled to $58 from $19. CoinGlass shows it holds 115,900 tokens ($6.78 million) on behalf of its clients.

The widening premium comes after the underlying asset, SOL, surged 20% on Friday. Positive sentiment continues to build after FTX founder Sam Bankman-Fried was found guilty on seven counts of fraud earlier this month. The token was dubbed one of the “Sam Coins” before the exchange’s collapse because it had invested millions into the ecosystem and built Serum, a decentralized exchange, on the Solana network.

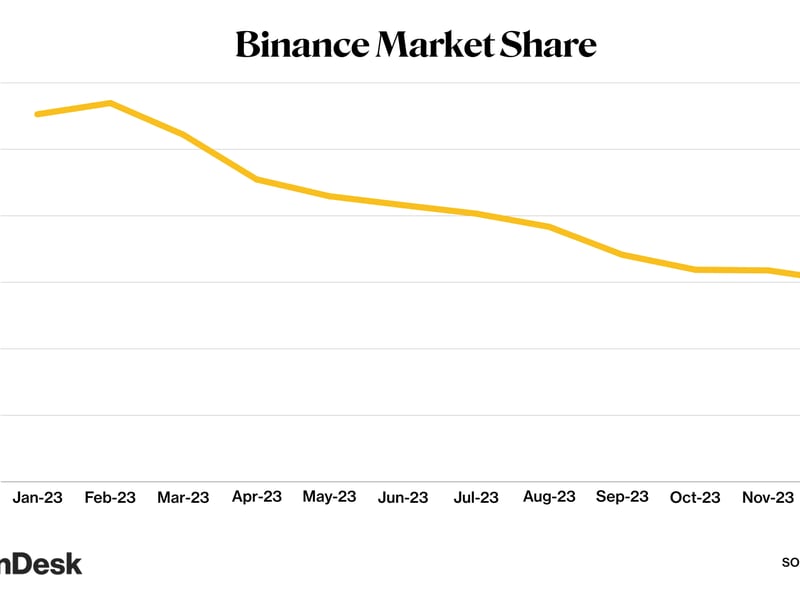

Institutional interest in crypto has experienced an uptick over the past few months, with CME, the venue that is preferred by institutions, overtaking Binance in terms of derivatives market share. The increase can be attributed to optimism around the potential approval of a spot bitcoin ETF, something that the SEC has consistently denied over the past few years. Grayscale is the only institutional on-ramp for Solana because only bitcoin (BTC) and ether (ETH) are listed on CME.

Grayscale Investments and CoinDesk are both owned by Digital Currency Group.

SOL lost 80% of its value in a two-month period following FTX’s implosion last November; It has since risen by more than 590% from a low of $8, according to TradingView.

Edited by Sheldon Reback.