First Mover Americas: eToro Delists 4 SEC Targeted Tokens for U.S. Customers

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Social investing platform eToro will delist a selection of crypto tokens for its U.S. customers in a month’s time in response to recent legal action by the U.S. Securities and Exchange Commission (SEC). From July 12, U.S. customers will no longer be able to open new positions in the tokens of Algorand (ALGO), Decentraland (MANA), Dash (DASH) and Polygon (MATIC), eToro announced on Monday. However, customers will still be able to hold and sell existing positions in these tokens. The crypto platform cited “recent developments” as the reason for the move, referring to the SEC’s legal action against crypto exchanges Coinbase and Binance, in which the regulator claimed certain cryptocurrencies were securities.

Market makers and traders are fleeing Binance.US en masse following last week’s SEC lawsuit against it alleging multiple securities violations. Liquidity, which is measured by aggregated market depth for 17 tokens on Binance.US, has dropped 76% since, according to a report by Kaiko. The day before the June 5 lawsuit, market depth was at $34 million, whereas on Monday, it had plunged to $7 million, said the report. The exchange also saw its U.S. market share drop to 4.8% from 20% in April. Binance global also witnessed a drop in market depth, dipping 7% since the start of June, said Kaiko.

Members of the U.K. digital asset space seem to largely support a proposal by the country’s financial watchdog to move companies away from promoting crypto as an inflation hedge. The popular argument that limited-supply cryptocurrencies like bitcoin (BTC) can hold firm against rising price levels may be theoretically sound, but due to a lack of data combined with the volatility of crypto assets, it can also mislead investors, industry observers told CoinDesk. Issued last Thursday, the FCA’s tough rules to govern crypto promotional material in the U.K. include a ban on free non-fungible tokens (NFT) giveaways and airdrops. In guidance accompanying the rules, the regulator issued guidance for stablecoin issuers, saying firms should be able to “demonstrate claims of stability or links to a fiat currency.”

-

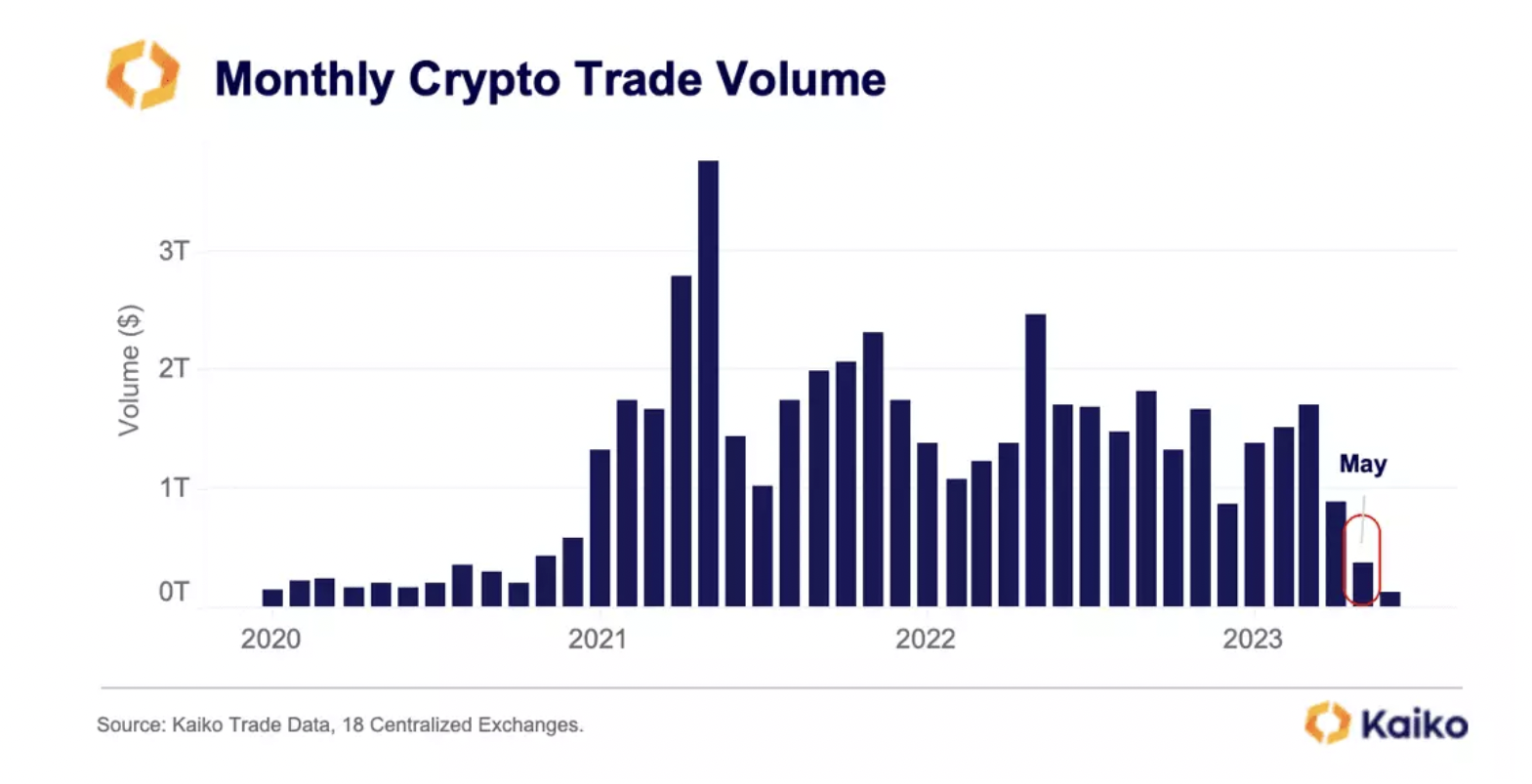

The chart shows monthly trading volume in crypto market since early 2020.

-

Activity cooled in May with total volume across 18 centralized exchanges falling to lowest since 2020.

-

“The summer months tend to have lower activity and volatility, and unless there is another large market event, we can expect similar trends,” Paris-based crypto data provider Kaiko noted.

Edited by Stephen Alpher.