First Mover Americas: Bitcoin Pushes Above $29K After Fed Rate Hike

:format(jpg)/www.coindesk.com/resizer/Wsw21Z13uYNeMwlEy09fcHX_LHw=/arc-photo-coindesk/arc2-prod/public/Z2G3HHMTVJGWRAQIH4UHCT3FEY.jpg)

Jamie Crawley is a CoinDesk news reporter based in London.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

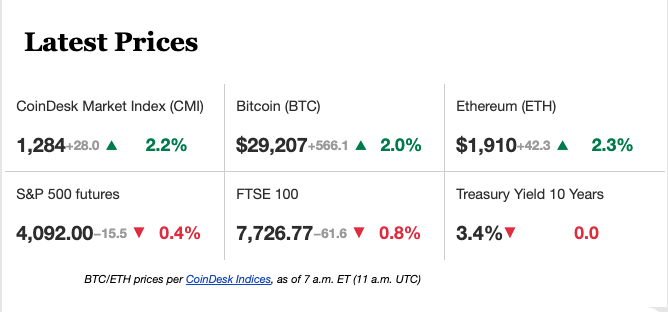

Latest prices 5/4/2023

Bitcoin has pushed above $29,000 following the U.S. Federal Reserve’s 25 basis point interest rate hike on Thursday, with some analysts speculating on a strong break to the upside after over a month of trade in a narrow wedge. The move over $29,000 came a few hours after the Fed hike as a report indicated another U.S. bank failure could soon be at hand. Crypto services provider Matrixport has said that if Thursday’s rate rise proves to be the last of this cycle, bitcoin could rally 20% to $36,000. Despite trading volumes declining slightly, the “path higher sees only limited resistance,” Matrixport said in a research note on Thursday. The end of the recent earning season will see stock buybacks restart, which will “continue to be a tailwind for stocks and risk assets,” the note added.

The U.S. Securities and Exchange Commission (SEC) decided not to include a definition of digital assets in its latest hedge fund ruling, in what could have been a sign of positive intent toward clearer regulation of the crypto sector. The SEC had included the definition of assets that “use distributed ledger or blockchain technology,” in its 2022 proposal to overhaul mandatory disclosures for hedge funds, but has now pulled that wording. The agency said it is “continuing to consider this term and [is] not adopting ‘digital assets’ as part of this rule at this time.” Anne-Marie Kelley, a former SEC official and now a partner at Mercury Strategies, suggested the commission may have deleted it as “any recognition of digital assets’ uniqueness weakens their litigation stance that digital assets are securities.”

The WallStreetBets token (WSB), which is linked to the WallStreetBets subreddit, dropped 90% in the last 24 hours following a big run higher that had seen its market cap jump to $50 million in under three days. The plunge came after one of the insiders connected to the project, @zjzWSB, dumped a large amount of tokens in return for 334 ETH ($635,000). Blockchain sleuth @ZachXBT flagged the transactions on Twitter, which seemed to trigger the mass selling, bringing about the 90% crash. Users had previously received an airdrop of nearly seven ether worth of WSB tokens for simply pasting their crypto wallet addresses on Twitter. This helped the tokens go viral on Crypto Twitter, forming part of the ongoing memecoin frenzy, which has also spawned the likes of PEPE.

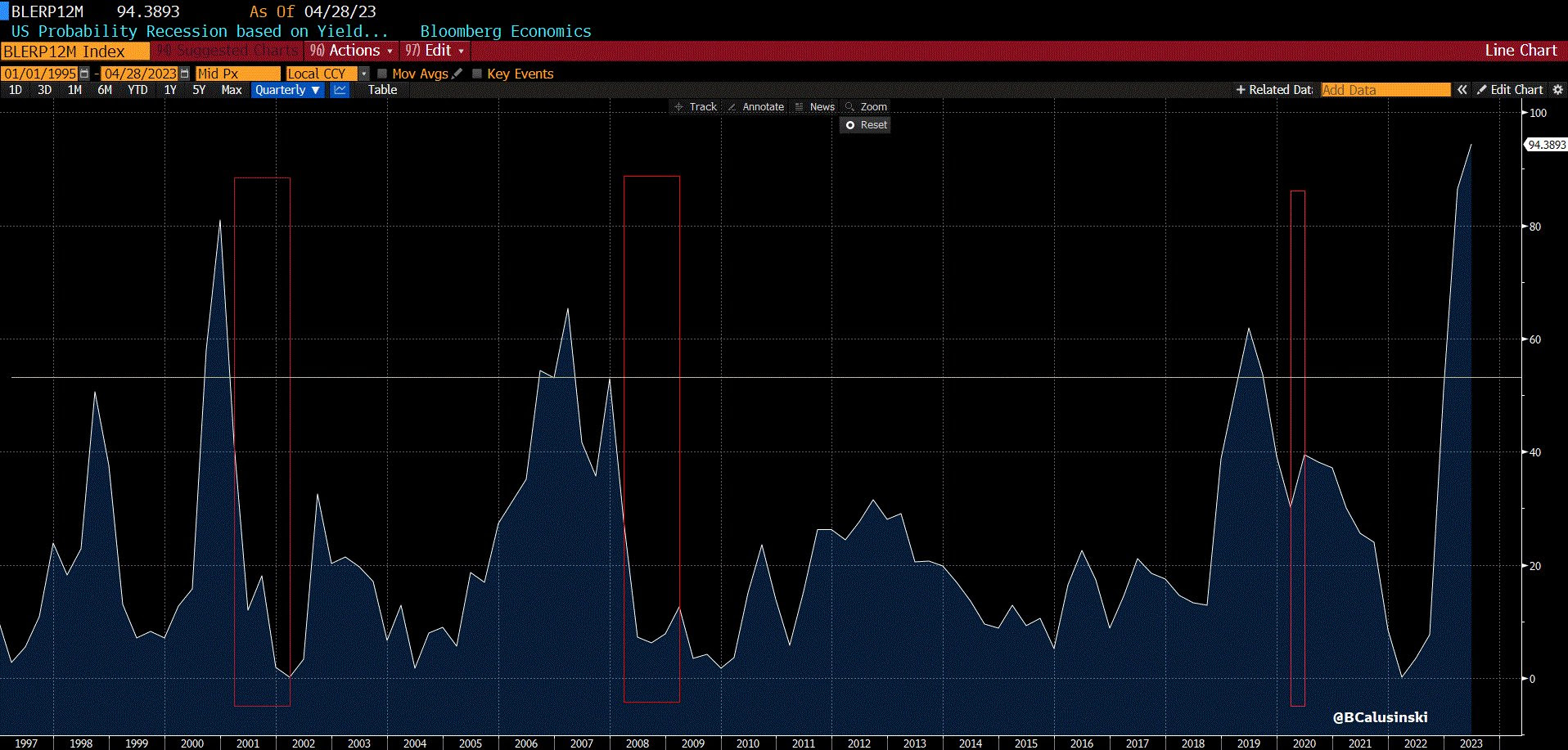

Source: Bloomberg, Cheddar Flow’s Ben Calusinski

-

The chart shows U.S. recession probability based on the Federal Reserve chairman Jerome Powell’s preferred indicator, the so-called near-term forward spread – which tracks the difference between expected yields on three-month Treasury bills in 18 months and the current three-month yield.

-

The probability has surged to 94%, the highest ever, surpassing the peaks seen ahead of the coronavirus-induced crash, the sub-prime crisis and the dot-com bubble.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Wsw21Z13uYNeMwlEy09fcHX_LHw=/arc-photo-coindesk/arc2-prod/public/Z2G3HHMTVJGWRAQIH4UHCT3FEY.jpg)

Jamie Crawley is a CoinDesk news reporter based in London.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Wsw21Z13uYNeMwlEy09fcHX_LHw=/arc-photo-coindesk/arc2-prod/public/Z2G3HHMTVJGWRAQIH4UHCT3FEY.jpg)

Jamie Crawley is a CoinDesk news reporter based in London.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.