ETHW Fiasco: 90% Price Drop, Replay Attacks, Justin Sun’s Poloniex Supports Rival Chain

Despite being touted by some as the natural continuation of Ethereum, which stayed on proof-of-work, EthereumPoW has had a rocky start.

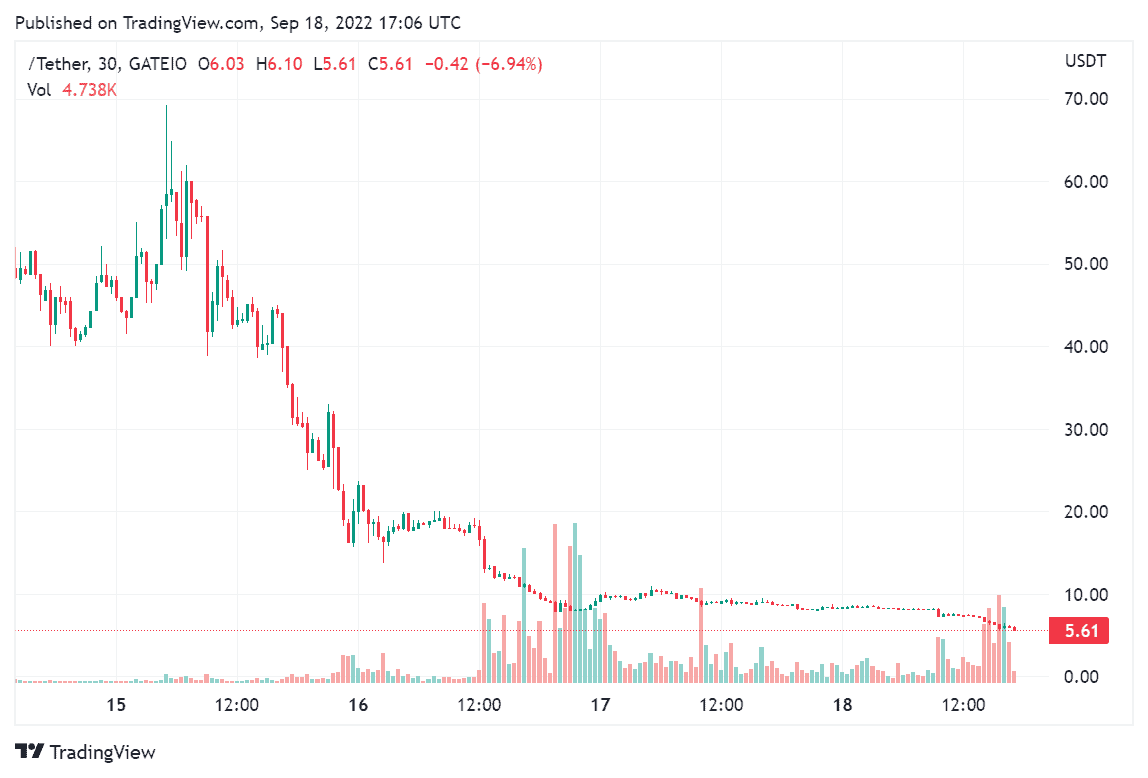

The first few days after the hard fork, it saw multiple technical bugs, while the native cryptocurrency plummeted by 90% in days.

- As the Ethereum Merge was coming close, Chandler Guo – a popular Chinese miner – proposed a hard fork that will see the creation of EthereumPoW – a duplicate version of the blockchain to continue to be based on proof of stake.

- The fork was supposed to take place a day after the Merge, and ETH holders would have been entitled to get an airdrop of the same amount of the new token – ETHW.

- However, multiple users on Twitter started complaining when EthereumPoW was scheduled to go live that they were unable to open the web page. As of writing these lines, CryptoPotato also couldn’t open it.

- There were also reports about replay attacks against EthereumPoW, but security companies like CertiK and PeckShield said they are related to incorrect ChainID, and the “vulnerability does not lie with EthereumPoW.”

- Nevertheless, the hard fork received a lot of support from community members, including famous ones such as Justin Sun. He promised that the crypto exchange he has invested in – Poloniex – will list ETHW.

- However, citing “market situation, consensus of users and the community,” the exchange had a change of heart and decided to go with a rival fork chain – EthereumFair (ETF). Later on, Poloniex even said users had already received the ETF airdrop.

- The network issues, competitive blockchains, and the lack of promised support have all harmed the ETHW price performance. The asset, still available for trading on a few exchanges, had skyrocketed to $60 a few days ago but has plummeted by 90% since then to below $6 as of now.

The post ETHW Fiasco: 90% Price Drop, Replay Attacks, Justin Sun’s Poloniex Supports Rival Chain appeared first on CryptoPotato.