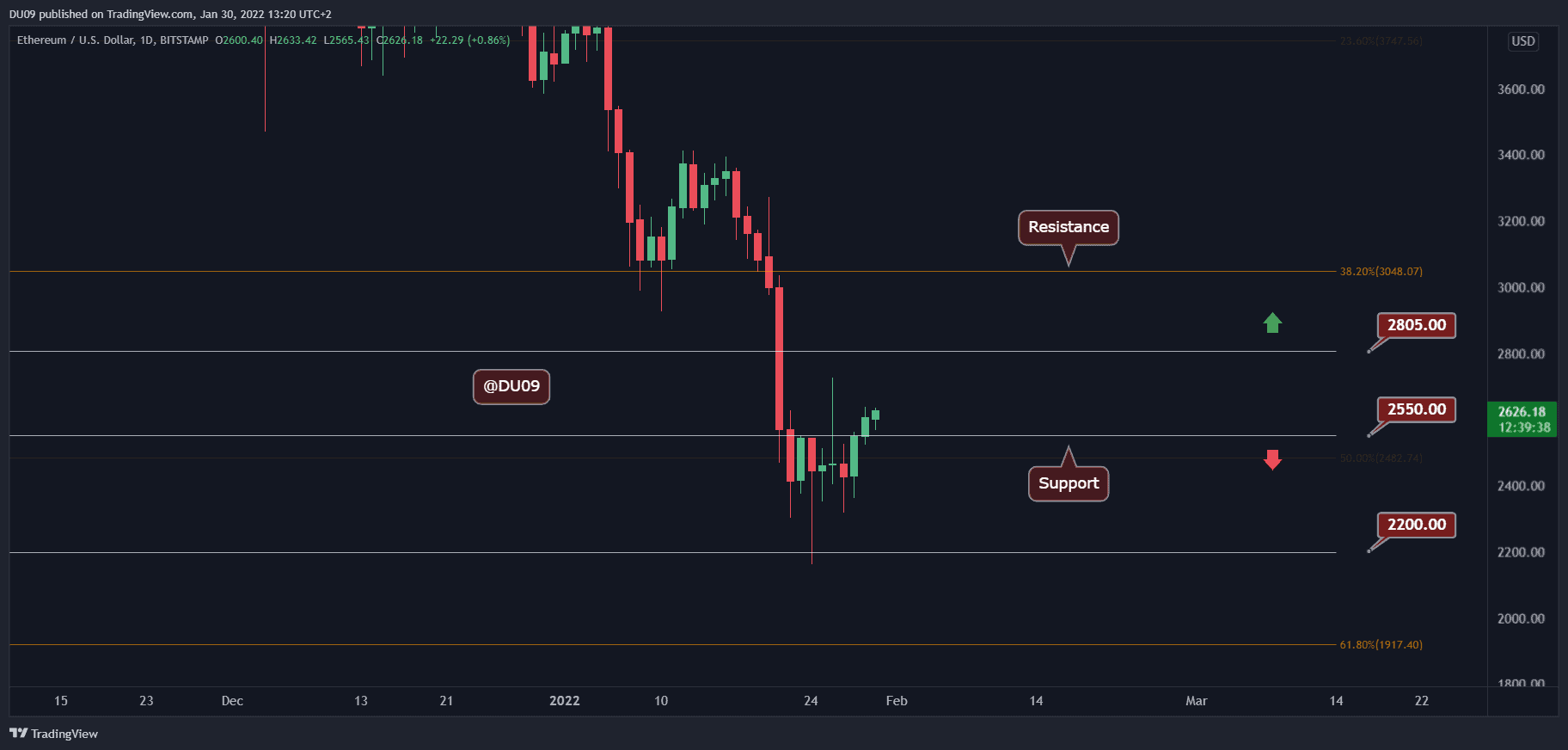

Ethereum Price Analysis: ETH Seen 20% Weekly Recovery, Is $3K Retest Next?

Ethereum managed to break above $2,600 after buyers took control of the short-term price action. Since recording a 6-month low on Monday ($2160), ETH recovered over 20%.

Key Support levels: $2,550, $2,200

Key Resistance levels: $2,805, $3,000

ETH had seen a positive weekend so far, managing to break and daily close above the critical resistance at $2,550 which has now turned into support. The immediate resistance is now found at $2,805 and if ETH maintains the bullish momentum, then the price might target the $3K milestone, which is a key psychological level.

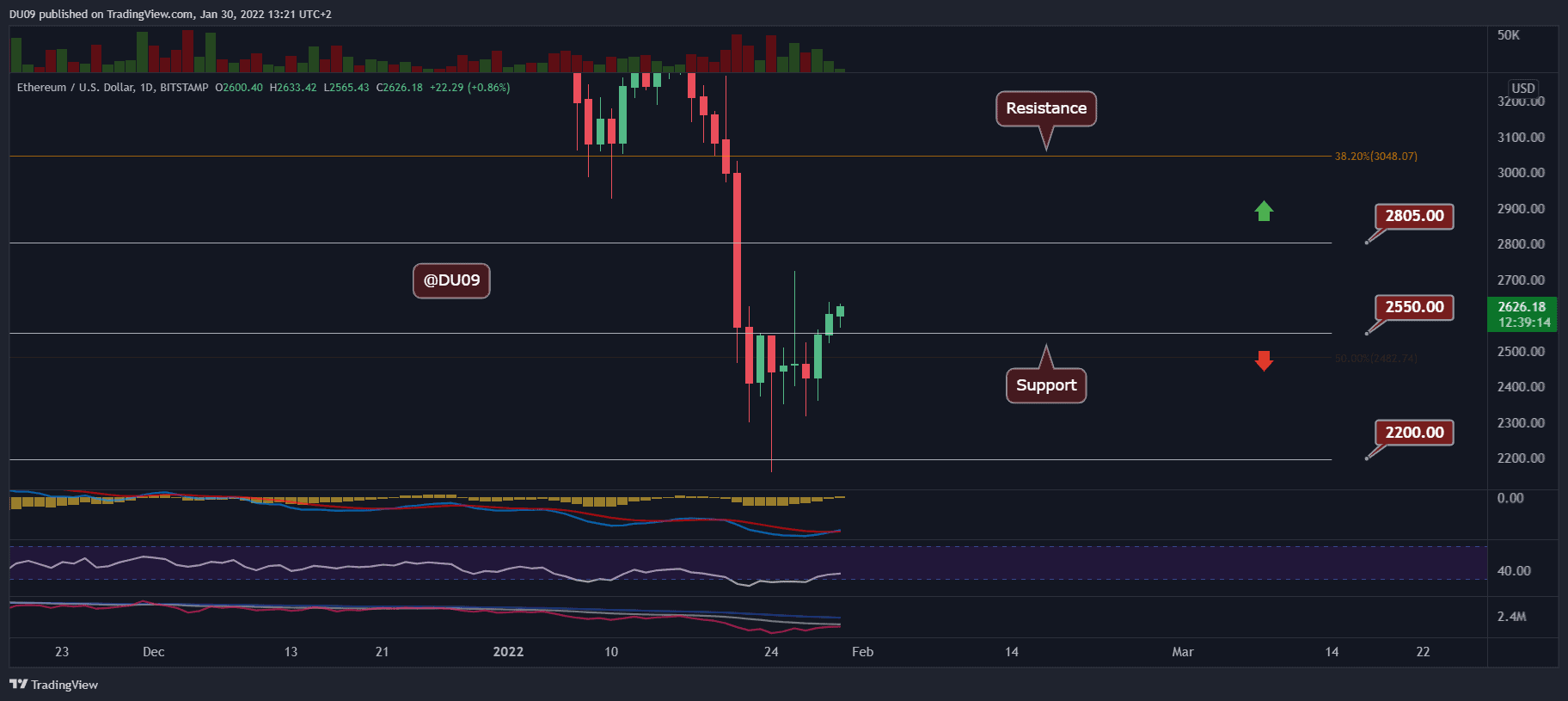

Technical Indicators

Trading Volume: Decent volume during this most recent rally. However, the weekend volume remains low, and best to wait for Monday to confirm the current price action’s momentum.

RSI: The RSI has surged above the oversold area and is moving higher. The most important thing is for the RSI to make a higher high and break away from the downtrend that has lasted since November.

MACD: Good news for buyers as the daily MACD did a bullish crossover today. This can indicate the start of a significant rally that can push ETH back towards $3,000.

Bias

The current bias for ETH is short-term bullish, as shown by the indicators.

Short-Term Price Prediction for ETH

ETH is giving some clear bullish signals and appears ready to move even higher. If ETH can break the resistance at $2,805 and then challenge the key psychological level at $3,000. The momentum over the weekend is not the strongest, thus best to wait for the Monday’s price action to confirm the current bias.