Ethereum Fees Spike as Bots Spend Millions to Frontrun Punters of PEPE, CHAD

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Shovel makers benefit the most in a gold rush, and crypto trends are no different.

Sandwich bots are frontrunning punters of newly-issued tokens such as pepe (PEPE) and chad (CHAD) – memecoins with no intrinsic value that caught wind of Crypto Twitter degens almost overnight as the tokens zooted over 10,000%.

A sandwich attack, traps a user’s transaction between two transactions, which is then further manipulated to gain profits. This is done by frontrunning the victim’s trade by buying the same asset, and then selling tokens to the victim in the same trade for a slightly higher price.

Sandwich attackers aren’t typically a form of exploit but are looked upon in crypto circles as a type of predatory behavior, which skims value from users, leads to a spike in gas fees and doesn’t benefit either the network or the user.

The victim might not notice it, but for sandwich bots, the gains can run into millions of dollars as they target thousands of wallets and skim a few dollars each time.

A wallet named “Jaredfromsubway.eth,” a likely nod to the popular sandwich chain, has spent over $2 million in the past week on Ethereum network fees trying to sandwich traders punting on predominantly low-cap tokens.

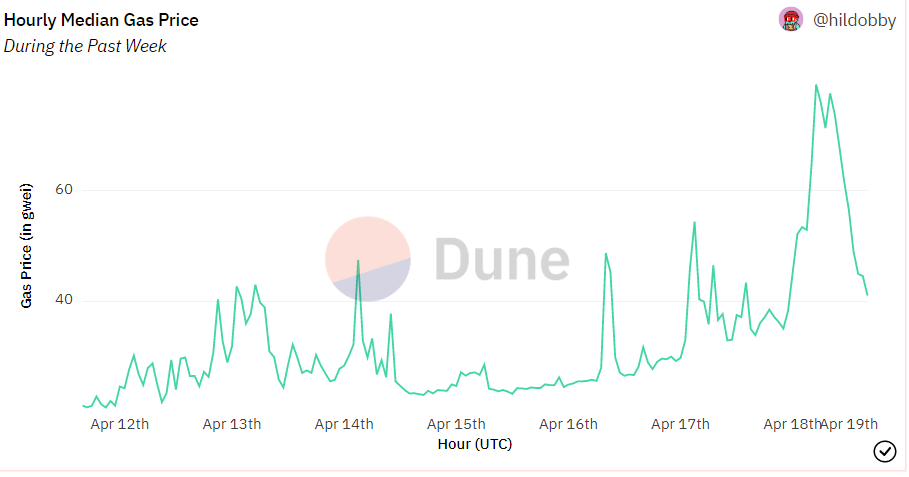

That has driven up fees of the entire network, data from Dune Analytics shows. Each transaction on the Ethereum network costs over $10 as of Asian morning hours on Wednesday – ten times more than last week’s $1 level.

Gas fees have spiked. (Dune)

The actions of Jaredfromsubway.eth mean they spent 7% of all fees on Ethereum in the past 24 hours, the data shows, becoming the top spender on the network.

That is ahead of fees spent by Arbitrum, a layer 2 blockchain that batches transactions on the Ethereum network, and Uniswap, the most-used decentralized exchange.

It is unclear how much Jaredfromsubway.eth made from their frontrunning actions, but given they spent a significant amount – and continue to do so – the gains likely exceed costs by a significant amount.

Meanwhile, the pepe frenzy is on in full force. Pepe tokens nearly doubled in the past 24 hours as Crypto Twitter traders moved over their doge-themed token obsession to bet on the internet meme instead, as CoinDesk reported.

Scores of pepe wannabes have popped up as well, as have chad, wojak, and babypepe – each a nod to internet memes.

Most of these are unlikely to last beyond a few weeks. But unlike then, entities like Jaredlikesubway.eth is eating the gains while fresh.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.