Ethereum: Basic Principles and Trading

Featured – Unlike Bitcoin, which is intended to serve as a digital currency, Ethereum is a decentralized platform which runs smart contracts. A smart contract is an application which runs exactly as it is programmed without the possibility of downtime, censorship, fraud, or interference of a third-party.

The platform was launched in 2015 and, as of yet, it’s the largest open-ended decentralized platform which allows the creation of Decentralized Applications (dApps) and the abovementioned smart contracts.

The idea for the platform was initially conceived by Vitalik Buterin who has since become one of the most prominent influencers in the field of cryptocurrencies. However, the project as it is today was co-founded by Anthony Di Lorio, Charles Hoskinson, Mihai Alisie, and Vitalik Buterin. Buterin also announced that Joseph Lubin and Dr. Gavin Wood were also involved.

Even though Ethereum is also currently based on the same Proof-of-Work consensus mechanism as Bitcoin, the team is working towards transitioning to Proof-of-Stake (PoS). With PoS, the probability of validating a new block is determined by the stake a certain person holds. In other words – it’s a matter of how many coins does one have.

With the PoS algorithm, the block validators do not receive block rewards – they collect network fees. In the case of Ethereum, that’s called gas. The native cryptocurrency of the Ethereum network is ETH.

Options to Trade ETH

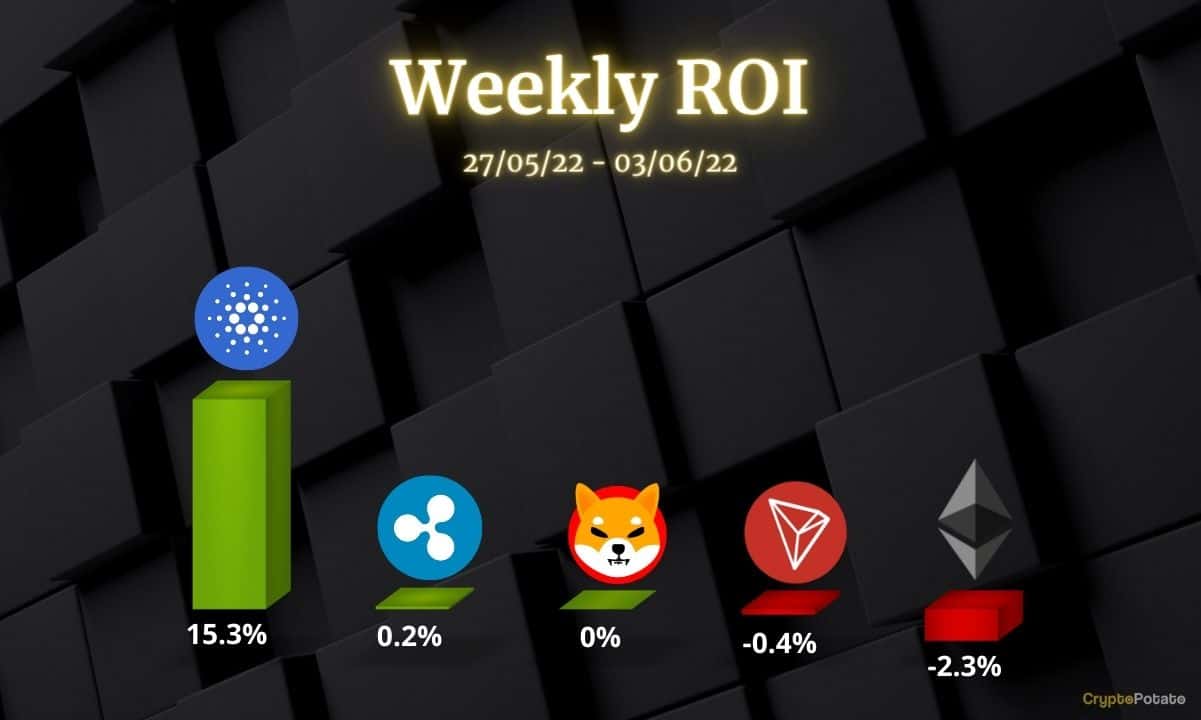

ETH is currently the second-largest cryptocurrency as it holds a market cap of around $24 billion. The price of ETH, at the time of this writing, is around $225.

As a matter of fact, ETH went through a rough few days. In the last five days alone, the cryptocurrency lost about 27% of its value. Yet, since January 1st, 2019, ETH is up about 70%.

You can trade ETH on almost every cryptocurrency trading platform available. Certain exchanges only allow the trading of crypto-to-crypto pairs so you can trade ETH against other digital currencies. If you want to receive exposure to the rate of ETH against the USD, for instance, you’d have to look elsewhere. Most exchanges allow deposit of FIAT through wired transfer.

Also, if you want to receive exposure to the price of ETH without having to own the underlying asset, you should consider the so-called contracts for difference (CFDs). These trading products allow the user to “bet” on where the price is going to go without having to worry for storing the underlying asset.

Trading CFDs on Easymarkets, for instance, allows the user to perform the trade ETH quickly without having to open up a designated cryptocurrency wallet or to register on a cryptocurrency exchange.

Additionally, it is also possible to trade ETH on margin on select cryptocurrency exchanges. These include the world’s largest one – Binance, as well as another margin trading exchange – BitMEX.

The post Ethereum: Basic Principles and Trading appeared first on CryptoPotato.