ETH Explodes 16% Weekly, is $2K Imminent? (Ethereum Price Analysis)

Ethereum’s price has been recovering from a crucial support zone. However, there exists a notable resistance level that must be surpassed in order for the market to potentially transition into a bullish phase in the long term.

Technical Analysis

By: Edris

The Daily Chart:

The daily chart demonstrates a notable rebound around the $1600 level, where the 200-day moving average provided significant assistance last week.

Subsequently, the price has experienced a rally and successfully surpassed both the $1800 resistance level and the 50-day moving average, both of which are expected to function as support going forward.

The current focus appears to be on surpassing the psychological resistance level of $2000, followed by the important technical area around $2300.

The 4-Hour Chart:

Examining the 4-hour chart, it is evident that the price found support at the lower boundary of a significant falling wedge pattern, aligning with the $1600 support level.

Following this support, Ethereum experienced a rally, successfully surpassing both the $1750 level and the upper boundary of the wedge pattern. A bullish breakout from a falling wedge is generally viewed as a positive signal.

However, the price is currently encountering resistance around the $1900 zone. Additionally, the RSI indicator indicates overbought conditions, suggesting the possibility of a short-term pullback or consolidation.

Sentiment Analysis

By: Edris

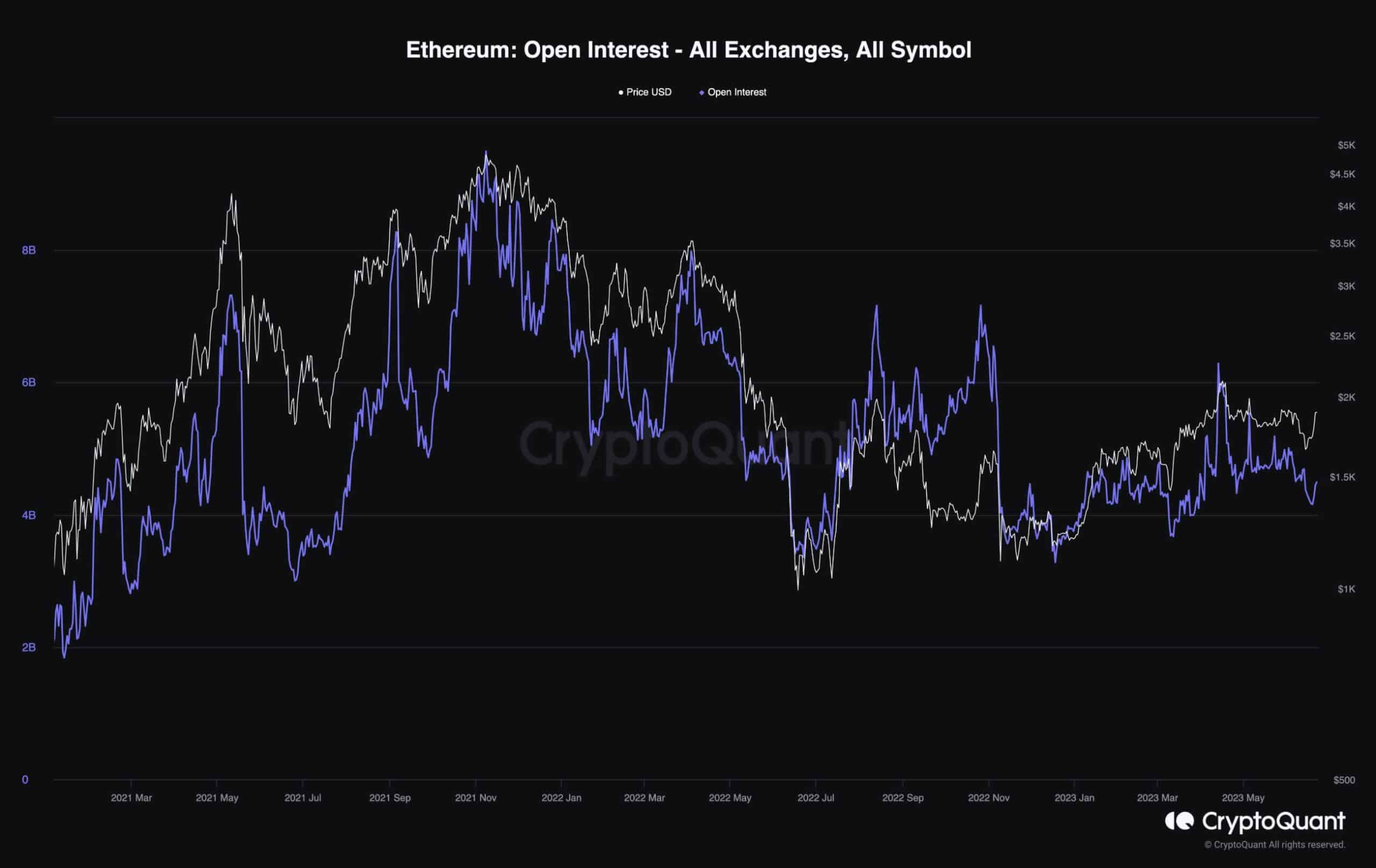

Ethereum Open Interest

Ethereum’s price has recently experienced an uptick after consolidation over the past few months. This upward movement might attract the interest of investors and traders, particularly speculators in the perpetual futures market.

The open interest metric, which indicates the number of open futures positions, currently shows a relatively low value compared to current levels.

This suggests there may be lower volatility in the market until the metric increases. Consequently, it is plausible to expect a continued upward trend in the short term unless unforeseen events disrupt the current scenario.

The post ETH Explodes 16% Weekly, is $2K Imminent? (Ethereum Price Analysis) appeared first on CryptoPotato.