EOS Block Producers Are in Risk of Bankruptcy Despite The Recent 25% Price Gain

TL;DR

- Cryptocurrency market records notable increase overnight, gaining more than $5 billion in less than 24 hours.

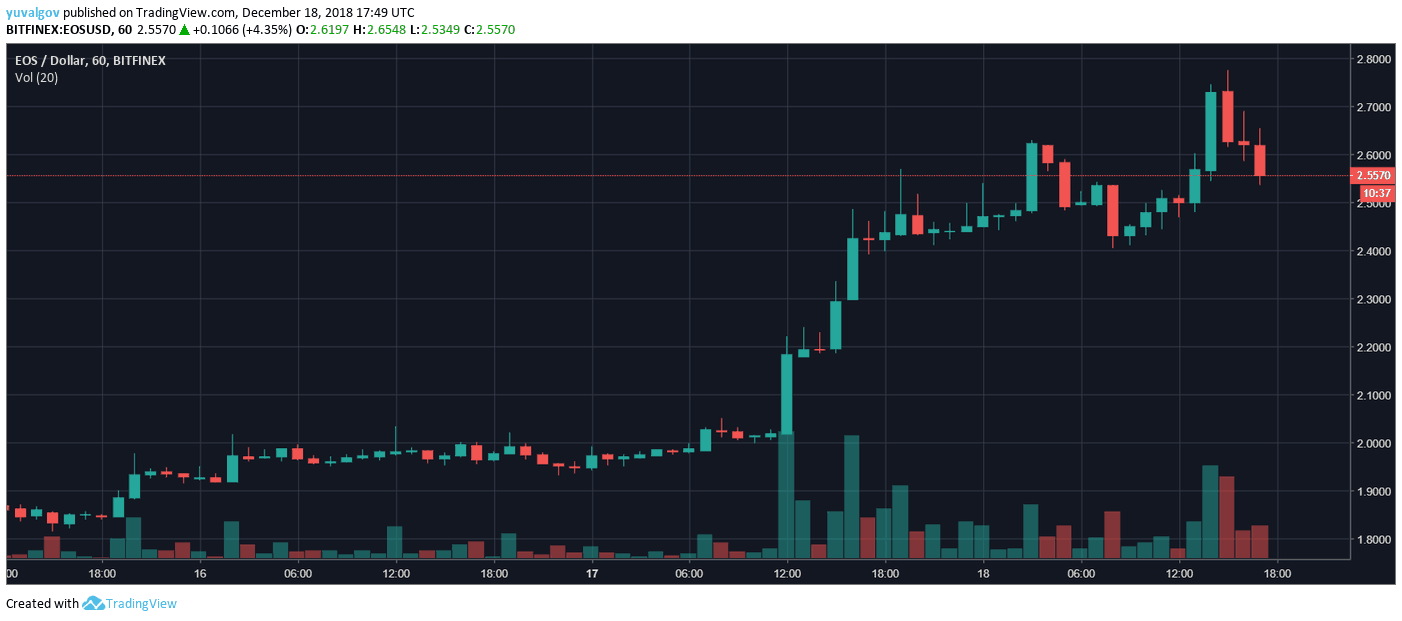

- EOS is the top performing altcoin from the top 20, gaining over 25% to its value at the time of writing.

- Despite the gains, a recent survey shows that any EOS price below $2.50 might put Block Producers in risk of bankruptcy

In a significant sign of relief, the cryptocurrency market has nicely gained $5 billion in the last 24 hours. At the time of writing this, all top 20 cryptocurrencies are trading positively except for Bitcoin SV which marks a slight 1% decrease.

EOS Skyrockets 25% In 24 Hours

EOS is the winner from yesterday’s relief rally, gaining almost 17 percent in the last 24 hours alone. After reaching almost $2.80, EOS is currently trading around $2.50. EOS surpassed Stellar (XLM) as the fourth largest cryptocurrency by market capitalization. DOGE and Ripple (XRP) are the other top 20 digital currencies which marked 15.6 and 10 percent gains accordingly.

Despite the recent price appreciation, however, EOS is nowhere near its all-time high (ATH) values of April when it peaked at slightly over $21 per coin.

At the same time, the cryptocurrency is valued at a market cap slightly over $2 billion, which is two times less than the money EOS raised during its promising year-long ICO.

Growing Fears Among Block Producers

The continuously decreasing prices, however, might take their toll on the significant EOS Block Producers (BPs). Being governed by a Delegated Proof of Stake consensus algorithm, EOS’ network relies heavily on pre-selected BPs to produce blocks and to keep the network in operation.

As it turns out, though, these entities have hard times doing so as the depreciating prices might even put them in risk of bankruptcy.

According to a recent survey carried out among block producers from different tiers, it has been revealed that the producers are nowhere near their break-even cost for them to operate properly.

The study outlines that the “average breakeven price-point was $4.14.” Even with the recent gains, EOS is still more than 80 percent below that price.

What is worse, though, is that the survey also reveals that in case of an average price of $2.50 or below, over half of the respondents would purportedly have to declare bankruptcy.

In all fairness, it’s not clear what the exact bankruptcy price is, only that it has to be below $2.50. In any case, though, with prices being as low as they are, this surely does cast thick shadows over the current state of EOS’ network.

The post EOS Block Producers Are in Risk of Bankruptcy Despite The Recent 25% Price Gain appeared first on CryptoPotato.