Digital Asset Brokerage Firm Nonco Raises $10M Seed Funding Led by Valor Capital, Hack VC

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Digital asset brokerage firm Nonco, a subsidiary of one of Latin America’s largest over-the-counter (OTC) providers, has secured $10 million in seed capital to help serve a growing number of institutional clients in the United States.

The investment included a combination of equity and convertible notes. The round was led by former U.S. Comptroller of Currency and CEO of Binance.US, Brian Brooke’s Valor Capital Group and Hack VC, the investment firm led by founder of Dragonfly Capital’s Alex Pack.

Other participants include Morgan Creek Digital, CMCC, Lvna Capital, Theta Capital, Bullish, Bastion Trading and Libra Capital Ventures. CoinDesk is owned by Bullish.

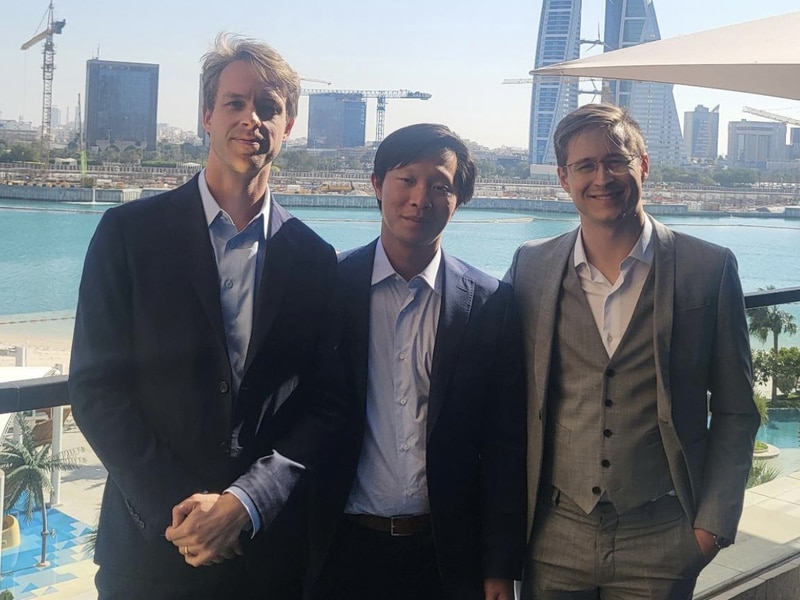

Nonco, which got its name from the word “nonconformist,” has already seen $6 billion in volume in the Latin American region since its debut in April. According to a press release, it is now seeing growing demand in the U.S.

The company was spun off from OSL Digital Limited, the Americas division of Hong Kong-based digital asset platform OSL, an over-the-counter brokerage in Asia, and consists of the same team. OSL retains a minority stake in the new venture, the statement said.

“Our aim is to become the leading brokerage firm for digital assets, and we intend to achieve this by establishing a new standard that prioritizes technology and service while ensuring institutional risk management and compliance,” Nonco’s CEO Fernando Martinez said in a statement.

The company says it offers a non-custodial approach that leverages multiple counterparty risk-mitigating settlement mechanisms.

Both Brooks and Peck will join the company as board members.

Edited by Aoyon Ashraf.