DCG Looks to Refinance Outstanding Genesis Obligations, Raise Growth Capital

:format(jpg)/www.coindesk.com/resizer/Lky4i31E0VGlf1KEVfI5nxsXZS8=/arc-photo-coindesk/arc2-prod/public/PRTUSW5G55EPJKV5XA3VM4F6HE.jpg)

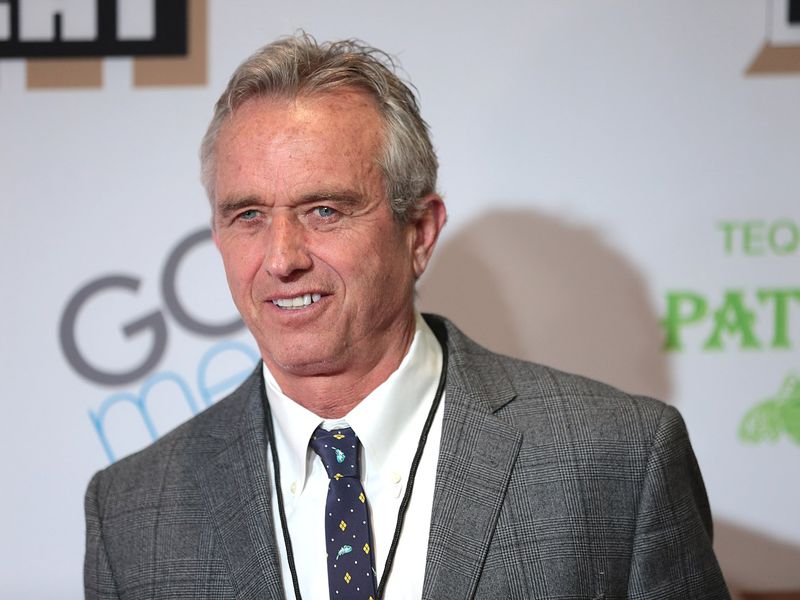

Sandali Handagama is a CoinDesk reporter with a focus on crypto regulation and policy. She does not own any crypto.

Digital Currency Group (DCG) is looking to refinance outstanding obligations with its bankrupt lending division Genesis and raise growth capital, the crypto conglomerate said on Tuesday.

Outstanding obligations can take the form of loans, receivables or any payments due between the two entities. The lending platform’s bankruptcy filings from January revealed DCG’s total debt to Genesis includes $575 million due this month, and a $1.1 billion promissory note due June 2032. CoinDesk reported in February that DCG, which is CoinDesk’s parent company, may have borrowed around $500 million in cash and as much as $100 million worth of bitcoin (BTC) from Genesis.

The move is meant to provide “further financial flexibility” as DCG engages with stakeholders in Genesis Capital’s bankruptcy proceedings, DCG said.

DCG was hit hard by the crypto market collapse last year, with its subsidiary Genesis ending up in bankruptcy court.

Parties to Genesis’ bankruptcy proceedings have agreed to a 30-day mediation period to iron out the terms and conditions of DCG’s contribution to the reorganization plan. DCG has said the mediation request reflected several creditors backing out of a previous agreement.

“We are committed to reaching a fair outcome for all and look forward to a productive resolution during this mediation period,” the notice said.

CoinDesk has reached out to DCG for further comment.

Update (May 9, 13:33 UTC): Adds more detail on DCG’s outstanding obligations to Genesis in second paragraph.

Edited by Nelson Wang.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Lky4i31E0VGlf1KEVfI5nxsXZS8=/arc-photo-coindesk/arc2-prod/public/PRTUSW5G55EPJKV5XA3VM4F6HE.jpg)

Sandali Handagama is a CoinDesk reporter with a focus on crypto regulation and policy. She does not own any crypto.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Lky4i31E0VGlf1KEVfI5nxsXZS8=/arc-photo-coindesk/arc2-prod/public/PRTUSW5G55EPJKV5XA3VM4F6HE.jpg)

Sandali Handagama is a CoinDesk reporter with a focus on crypto regulation and policy. She does not own any crypto.