Crypto-Fund Assets Hit All-Time High, With US Bitcoin Futures ETF on Cusp

Investors piled into crypto funds last week ahead of the U.S. Securities and Exchange Commission’s (SEC) approval of the nation’s first futures-based bitcoin exchange-traded fund (ETF) on Friday.

The rise of fresh capital contributed to a boost in total assets under management, now $72.3 billion, the highest on record, according to a report Monday by CoinShares.

The increase came as bitcoin’s price surged 12% last week, pushing above $60,000 for the first time since April.

Inflows to crypto funds totaled $80 million for the week ending Oct. 15, down from $225 million of inflows during the prior week.

The SEC approved the ProShares Bitcoin Futures ETF on Friday, and the product will begin trading on the New York Stock Exchange on Tuesday.

The tracking of flows into the ProShares ETF will be included in next week’s CoinShares report, a representative for the asset manager wrote Monday in an email to CoinDesk.

The U.S. ETF approval “could prompt further significant inflows in the coming weeks as U.S. investors begin to add positions,” CoinShares wrote in the report.

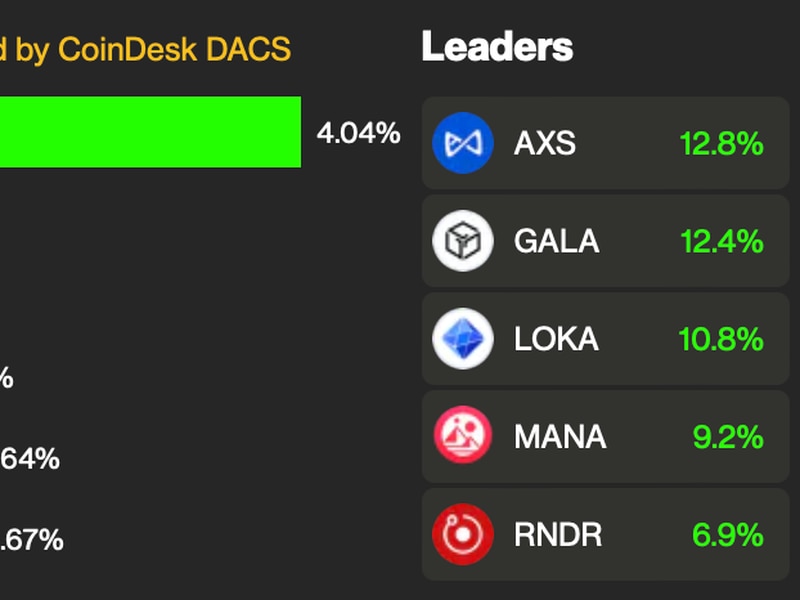

For now, bitcoin funds continue to dominate inflows, totaling $70 million last week. Polkadot and Cardano products also saw inflows totaling $3.6 million and $2.7 million, respectively.

Ethereum funds saw minor outflows totaling $1 million last week.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3WQ26LNG3REONONW2LIUVWF4ME.png )

Damanick does not own cryptocurrencies.

Subscribe to Crypto Long & Short, our weekly newsletter on investing.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.