Crypto Exchange Bullish Completes Purchase of CoinDesk: WSJ

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Cryptocurrency exchange Bullish has bought CoinDesk, the Wall Street Jornal (WSJ) reported on Monday.

Bullish, which is run by former New York Stock Exchange (NYSE) President Tom Farley, bought 100% of CoinDesk from crypto-focused investor Digital Currency Group (DCG) in an all-cash deal, the Journal said. Financial terms of the deal were not disclosed.

CoinDesk will operate as an independent subsidiary of Bullish, Farley said, according to the report. An editorial committee will also be formed, chaired by former Wall Street Journal Editor-in-Chief Matt Murray.

CoinDesk’s current management team will remain in place.

Edited by Sheldon Reback.

Related Posts

Crypto Custodian Copper Aims to Bridge Gap Between DeFi and Traditional Finance With New Tool

Nov 27, 2020 at 4:07 p.m. UTCCrypto Custodian Copper Aims to Bridge Gap Between DeFi and Traditional Finance With New ToolCrypto custodian Copper is looking to connect institutions to the emergent world of decentralized finance (DeFi) with a newly unveiled product. Announced Friday, CopperConnect is a bridge between Copper’s existing storage services and DeFi apps. In…

tZERO-Backed Startup Seeks SEC Approval to Launch Security Token Market

news A firm part-owned by Overstock’s tZERO is seeking regulatory approval to launch one of the first markets for publicly traded, registered security tokens. The Securities and Exchange Commission (SEC) on Friday released a rule change proposal that would allow Boston Securities and Token Exchange (BSTX) to create an automated equity trading platform, with ownership…

Canada Proposes Regulatory Framework for Cryptocurrency Exchanges

news Canadian financial regulatory authorities are considering putting in place rules for cryptocurrency exchanges in the country. The Canadian Securities Administrators (CSA) and the Investment Industry Regulatory Organization of Canada (IIROC) published a consultation paper on Thursday, seeking input from the fintech community on how regulatory requirements can be developed for cryptocurrency platforms. “The emergence…

Evercore Says PayPal’s Crypto Offering Could Bring Big Business Boost

Dec 14, 2020 at 3:54 p.m. UTCUpdated Dec 14, 2020 at 4:11 p.m. UTC(Benny Marty/Shutterstock)Evercore Says PayPal’s Crypto Offering Could Bring Big Business BoostAdvisory company Evercore has named PayPal (PYPL) as its top payments stock and said the firm’s recently launched cryptocurrency offering could be good for profitability.According to a Bloomberg report Monday, Evercore ISI…

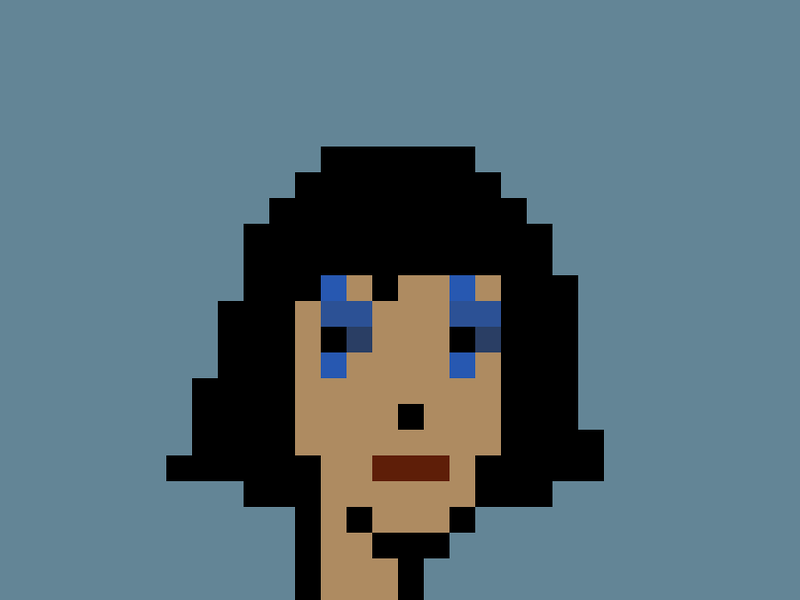

NFT Mania Is Back? Maybe Not, but a CryptoPunk Just Sold for a Record $56.3M

A hallmark of the last cryptocurrency bull market was the remarkably high sale prices for various non-fungible tokens (NFTs). The world has largely moved on from NFTs, with enthusiasm for crypto products embellished with quirky images now directed toward memecoins – so, so many memecoins. Yet, on Thursday, a sign of bull markets past returned:

Bitcoin From Rare ‘Satoshi Era’ Moves After 14 Years of Dormancy

An early crypto miner moved 50 BTC, worth over $3 million, after 14 years of inactivity, with part of the transfer ending up at crypto exchange Coinbase.The transaction joins the few instances of "Satoshi era" bitcoin movements, following other significant transfers in 2023.An early crypto miner moved 50 bitcoin (BTC) today after 14 years of

What ETF Approval Could Mean for Ethereum

The SEC recent approval of ETH ETFs might eventually prove a more important event for Ethereum than it was for Bitcoin. Bitcoin’s dominance, niche, and value proposition as a store of value are well-established and unlikely to be challenged in the near term. Ethereum, however, faces far stiffer competition, sometimes struggling to distinguish itself among

DeFi Project dForce Refunds All Affected Users After $25M Hack

Apr 28, 2020 at 09:00 UTCCredit: Ilya Pavlov/UnsplashDigital assets stolen in a hack on crypto lending platform dForce last week have been returned to customers.As reported by CoinDesk, a hack on the decentralized finance (DeFi) protocol saw $25 million in cryptocurrencies exit its wallets over three hours on April 19. Curiously, the assets were returned…