Coinbase Downgraded at Oppenheimer After Disclosing Possible SEC Charges

Given the unhealthy regulatory environment, Lau – otherwise supportive of blockchain technology and digital asset development in the U.S. – said he is becoming increasingly concerned about the “fairness of the enforcement actions, and the ability for the [crypto] ecosystem to grow with seemingly limited and shrinking support from the banking system.”

Related Posts

BlackRock’s Spot Bitcoin ETF Not The Same As Grayscale’s Product, Experts Say

Exchange Traded Fund (ETF) terminology can sometimes be tricky, and fund management giant BlackRock’s application for a spot Bitcoin ETF has raised some questions.To review, BlackRock’s (BLK) iShares unit on Thursday filed an application with the U.S. Securities and Exchange Commission (SEC) for creation of the iShares Bitcoin Trust.The name and other details of the…

Bitcoin Is Hedge Against Global Liquidity Crises: Grayscale Study

news Grayscale Investments, the cryptocurrency asset manager backed by Digital Currency Group, which acquired CoinDesk in 2016 – has released a report showing what it argues is bitcoin’s potential as a hedge against global liquidity crises. Overall, the authors suggest bitcoin ought to be considered a strategic position within long-term investment portfolios considering its transparent,…

Crypto News Roundup for Feb. 24, 2020

Feb 24, 2020 at 17:00 UTCCrypto News Roundup for Feb. 24, 2020For early access before our regular noon Eastern time releases, subscribe with Apple Podcasts, Spotify, Pocketcasts, Google Podcasts, Castbox, Stitcher, RadioPublica or RSS.Today's News:For early access before our regular noon Eastern time releases, subscribe with Apple Podcasts, Spotify, Pocketcasts, Google Podcasts, Castbox, Stitcher, RadioPublica…

Can Bitcoin Save Argentina?

Michael J. Casey is the chairman of CoinDesk's advisory board and a senior advisor for blockchain research at MIT's Digital Currency Initiative. The following article originally appeared in CoinDesk Weekly, a custom-curated newsletter delivered every Sunday exclusively to our subscribers. When people ask me what got me into bitcoin, I often answer with one word: "Argentina.…

Coinbase to Invest $2 Million USDC in DeFis Compound and dYdX

news Coinbase is putting money to work as part of a bid to grow the decentralized finance (DeFi) ecosystem. Announced Tuesday, the US cryptocurrency exchange is investing 1 million USDC each in lending protocols Compound and dYdX. Called the “USDC Bootstrap Fund,” Coinbase says the new fund will support developers by “investing USDC directly in the…

Financial Building-Blocks: Structured Products and Blockchain

Traditionally in the domain of institutional investors, structured products combine various assets and derivatives to create tailored risk-return profiles. With the advent of blockchain, the potential for this market segment is enormous, promising significant cost reductions, enhanced composability, and improved accessibility. Currently, the global structured notes market is estimated to be worth more than $2

Spiritual Reflections on the Bitcoin Halving

May 24, 2020 at 13:00 UTCAllen Farrington writes at Quillette, Areo and Merion West, as well as extensively on Medium, where he has several much longer essays on Bitcoin, finance, economics and related topics. His collected writings can be found here. He lives in Edinburgh. At approximately 8:23 p.m. GMT on Monday, May 11, the…

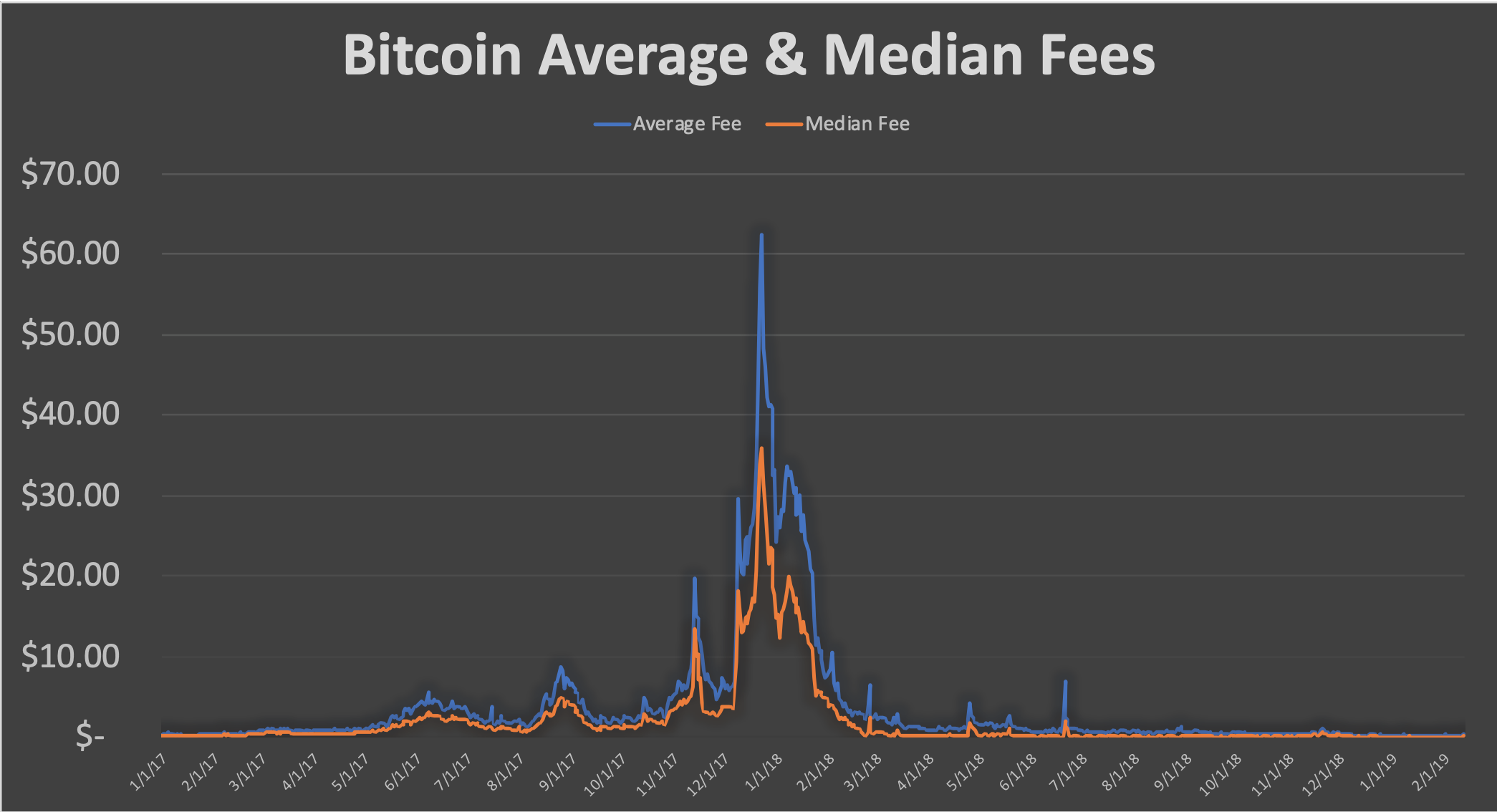

State of Blockchains: Bitcoin (BTC) Fees

opinion Transaction fees make the bitcoin blockchain go round. The miners are compensated for their efforts, not only through inflationary block rewards, but also through fees charged to users for adding their transaction to blocks. While fees on average make up about 4% of the total miner revenue per day, with the lion’s share coming…