Circle Restarts U.S. Treasury Purchases in BlackRock-Managed USDC Reserve Fund

Stablecoin issuer Circle Internet Financial has started buying U.S. Treasury bills as a reserve asset for its $28 billion USD Coin (USDC) after ditching all holdings amid the U.S. debt ceiling standoff last month.

The Circle Reserve Fund (USDXX), which is managed by asset management giant BlackRock (BLK), has started “building up our direct holdings of Treasuries,” chief financial officer Jeremy Fox-Geen said Wednesday during a company call that CoinDesk attended.

The fund will also keep repurchase agreements (repos) as part of the reserves, Fox-Geen added.

The development came after Circle reshuffled the backing of its stablecoin last month to protect USDC from a potential fallout if the U.S. government failed to increase its ability to borrow and default on its debt.

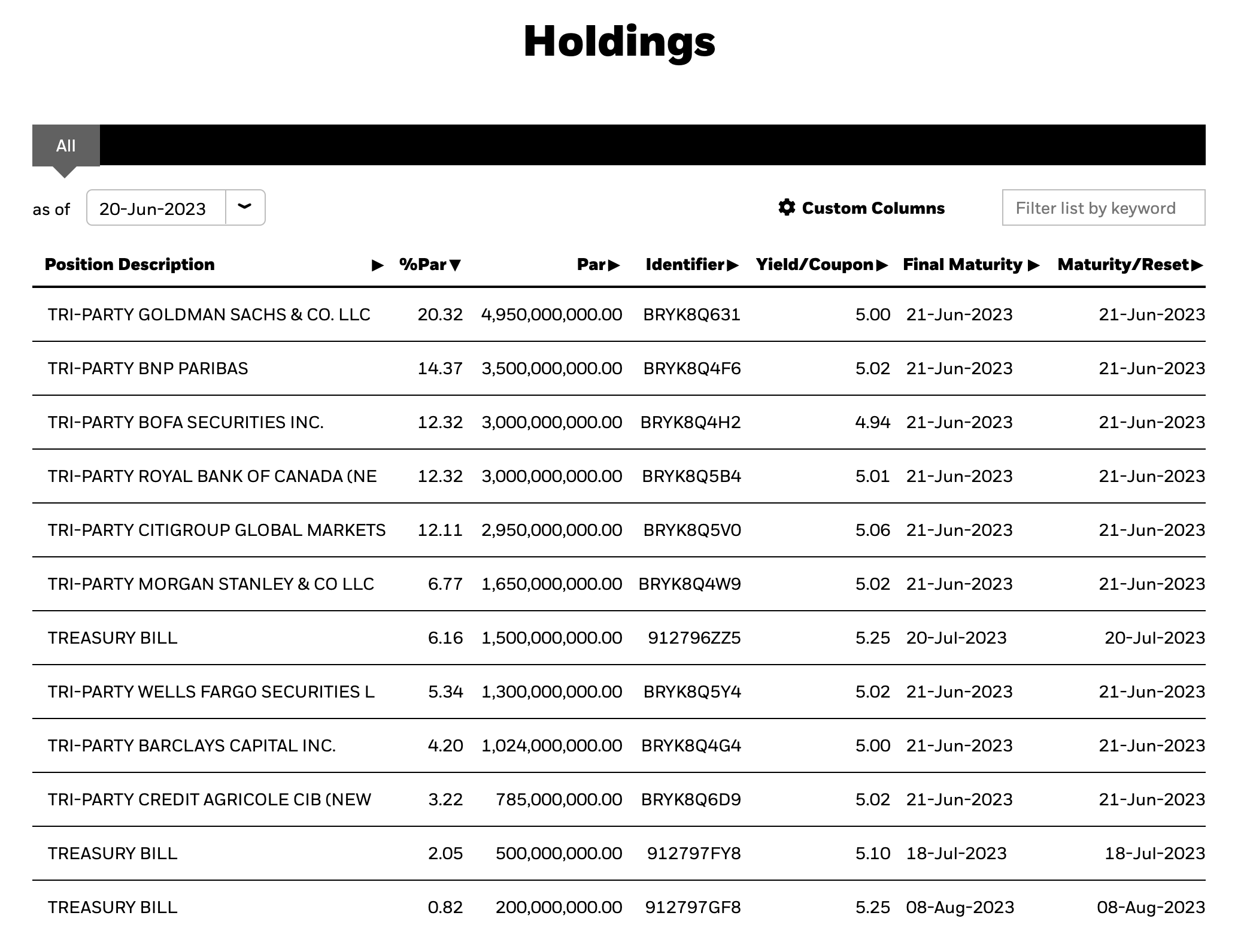

CEO Jeremy Allaire said in early May that the firm would not hold bonds maturing beyond the end of the month. By June, CoinDesk reported that the reserve fund rotated all holdings into tri-party repos involving systemically important banks such as Goldman Sachs, BNP Paribas, Bank of America and Royal Bank of Canada.

Eventually, U.S. lawmakers struck a deal to increase the nation’s debt limit and President Joe Biden signed the legislation on June 3, averting calamity on financial markets.

As of June 20, Circle added $2.2 billion of T-bills to the fund, while repos constituted some 90% of the fund’s $24.7 billion in assets, according to BlackRock’s website. The company held an additional $3.5 billion in bank deposits, the “vast majority, over 90%” stored at the Bank of New York Mellon, Fox-Geen said.

Edited by James Rubin.