BTC Price Analysis: Bitcoin’s Anticipated Weekend Move Has Arrived. Are the Bears Done Yet?

In our previous Bitcoin price analysis, we mentioned the significant horizontal triangle pattern seen on the 4-hour chart, and that a breakout followed by a sharp move would occur in a matter of hours.

Yesterday we saw that triangle get broken to the downside. Bitcoin quickly lost $700 – leaving the $11,900 area down to the marked support level at $11,200.

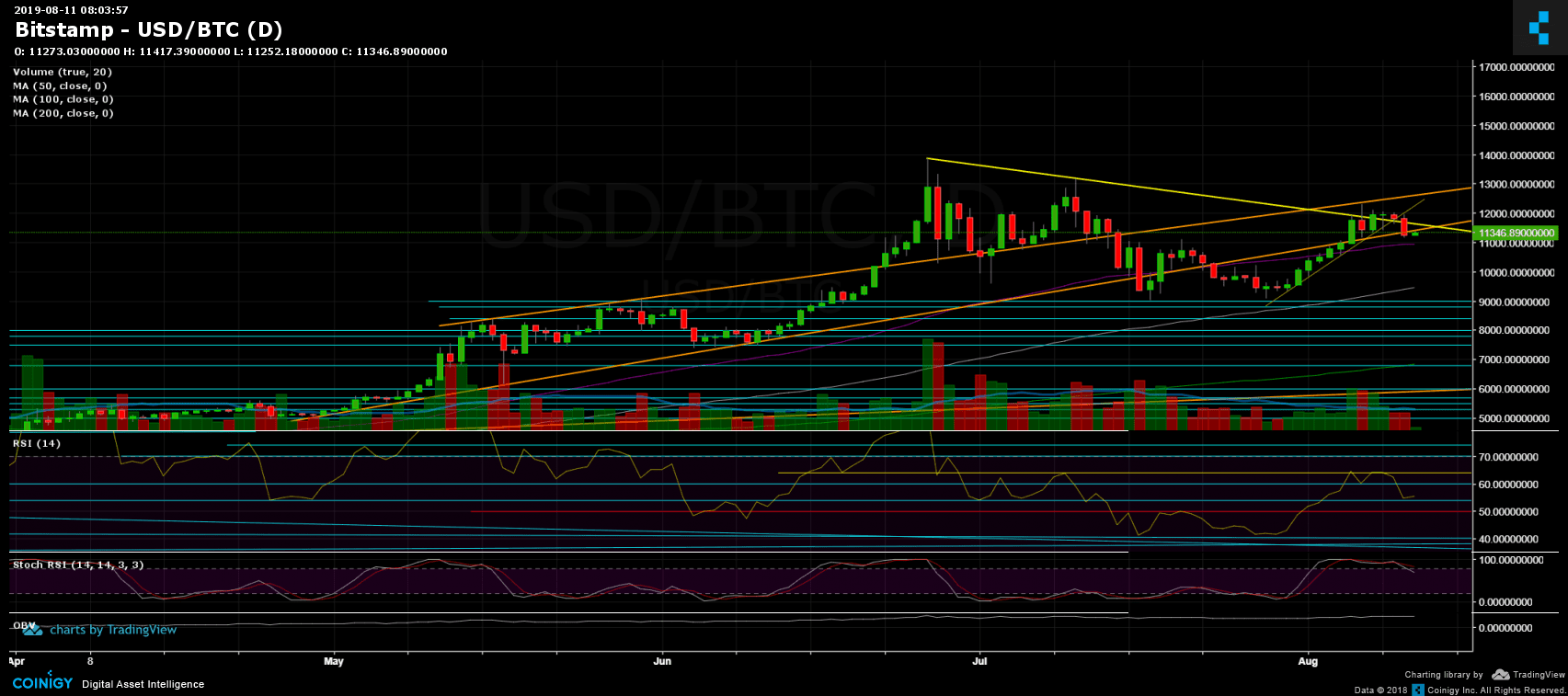

Does this mean the Bitcoin market is bearish again? It’s way too early to say. Since breaking down, Bitcoin has consolidated between the $11,200 support and the $11,500 resistance level. Such consolidation might lead to a retest of the aforementioned triangle’s descending trend line, while the price could break $11,200 on its way down to lower levels ($10,800, anyone?).

Once again, the weekend proved to be the perfect time for the whales to move the crypto markets. Another impressive thing we saw was the Bitcoin dominance index capturing 70%. However, since the $700 price drop, the dominance rate is down by 1.3%.

Total Market Cap: $295 billion

Bitcoin Market Cap: $203.6 billion

BTC Dominance Index: 68.7%

*Data from CoinGecko

Key Levels to Watch

Support/Resistance: Following the breakdown, Bitcoin is now facing the $11,200 support zone, below which lies the $11,000 support level, which contains the 50-day moving average line (marked in purple on the daily chart). Further below lies $10,800, which could be the target for this current bearish move. Further below lies $10,600, followed by $10,250 and the $10,000 mark.

From above, the $11,500-$11,600 level has become resistance. It contains the 4-hour chart triangle’s descending trend line (marked in yellow). Above are the resistance levels of $12,000 and $12,300. The latter was a resistance zone in recent days.

Daily chart’s RSI: The RSI found support at the 54 horizontal support line, still in bullish territory (above 50, marked in red). However, the stochastic RSI oscillator produced a bearish crossover in overbought territory, which might indicate that Bitcoin will see lower lows in the coming days.

Trading Volume: The past three days’ volume has been low. This was anticipated and can be explained by the consolidation preceding the weekend.

BTC/USD Bitstamp 4-Hour Chart

BTC/USD Bitstamp 1-Day Chart

The post BTC Price Analysis: Bitcoin’s Anticipated Weekend Move Has Arrived. Are the Bears Done Yet? appeared first on CryptoPotato.