BTC ATH Within Reach: Glassnode Maps Support, Warns of Underpriced Volatility

Bitcoin (BTC) is once again knocking on the door of its all-time high (ATH), trading around $109,500 early Wednesday, a mere 2% shy of its $111,800 peak set nearly three weeks ago.

Yet beneath the surface of this upward momentum lies a market defined by compressed volatility, long-term holder profit-taking, and a growing divergence between futures and on-chain sentiment.

Long-Term Holders Cash In, But Supply Stays Sticky

Glassnode’s latest Week On-Chain report outlines how BTC recovered from a local low of $100,400, where demand re-emerged after a brief but sharp 9% drawdown.

According to the analytics platform, this dip rattled investor confidence, with the Fear and Greed Index momentarily entering “Fear” territory. However, the lack of mass panic selling, with only $200 million in on-chain losses realized, showed that capitulation was limited to the newest and most speculative market entrants.

Despite the resilience, Glassnode warned of increased profit-taking activity among long-term holders (LTHs). The cohort locked in a peak of $930 million per day in realized profits, a level historically associated with overheated markets.

Interestingly, this cycle seems to be defying tradition: despite the profit-taking, the proportion of Bitcoin wealth held by LTHs has increased. The report attributed this “unique market dynamic” to intense “maturation and accumulation pressures” overwhelming selling.

A key driver appears to be the spot Bitcoin ETFs and institutional participation, effectively locking up supply in long-term custody and making LTH wealth “significantly stickier.”

Indeed, on Monday alone, six out of eleven U.S. spot Bitcoin ETFs posted $386.2 million in inflows. These signals are also mirrored by recent data from CryptoQuant, which confirmed that U.S. buyers are reasserting dominance, with the Coinbase Premium index hitting a three-month high and the 90-day Cumulative Volume Delta (CVD) flipping green for the first time in four months.

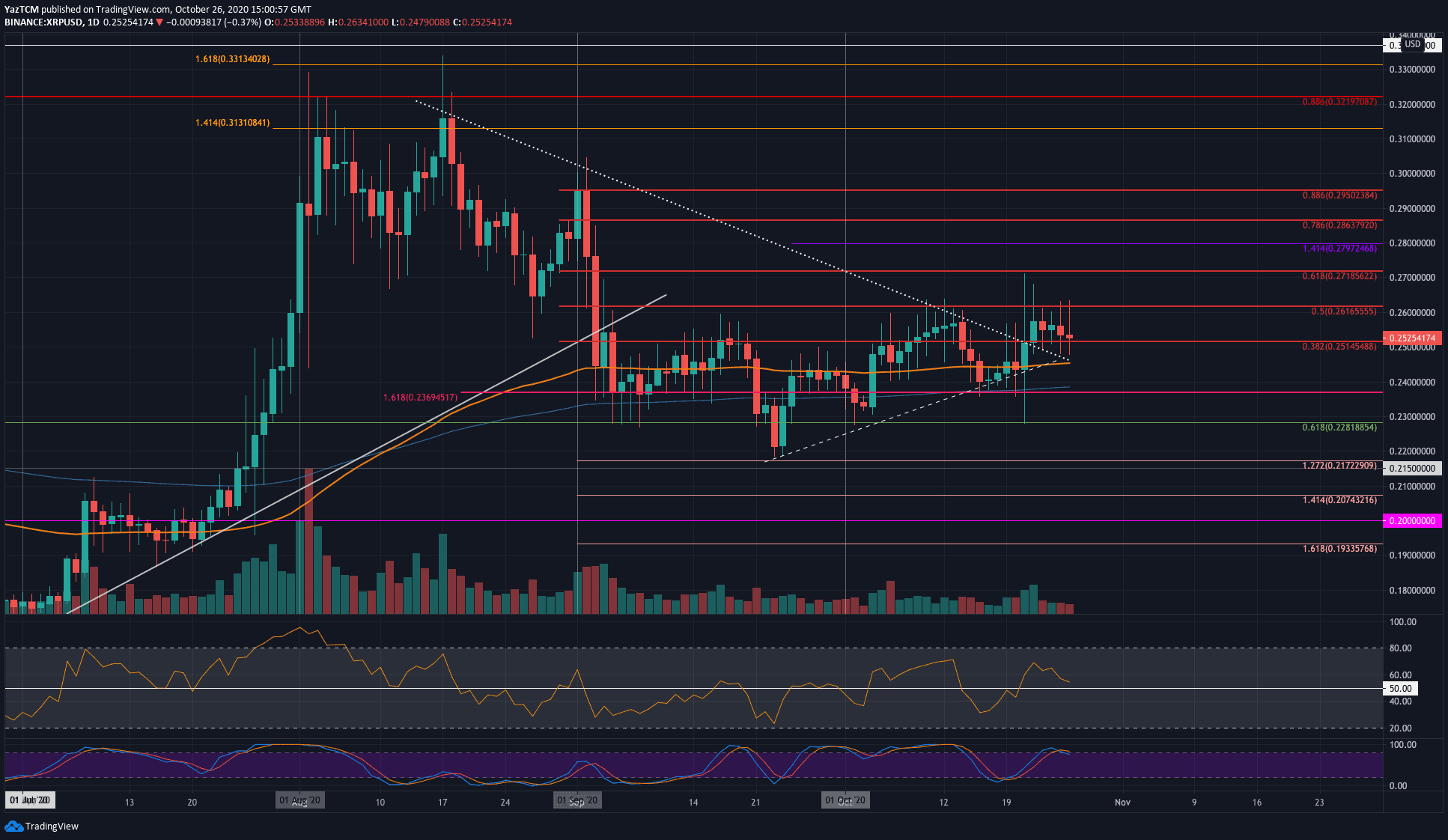

Critical Levels for the Path Ahead

Looking at the markets, at the time of this writing, BTC had posted an almost negligible uptick of 0.1% in the last 24 hours. Over the past seven days, the gains stand at 3.8%, with the asset up 5.3% for the month. Meanwhile, daily trading volume sits at $34 billion, with a circulating supply nearing 19.9 million BTC.

With Bitcoin perched just below its ATH, the Glassnode report made clear the following technical and on-chain levels:

- Downside Support: The $97,600 short-term holders (STH) cost basis is the critical floor. Holding above it will maintain a bullish structure. However, a break below risks shifting sentiment. Furthermore, strong support lies around the 111 DMA ($92,900) and 200 DMA ($95,400).

- Upside Resistance: Breaking the ATH at $111,814 is the first hurdle. Beyond that, the next major on-chain resistance zone sits at $115,400. Additionally, sparse on-chain volume above current prices suggests a potential “air gap” exists, and if demand is strong enough, a swift move higher could occur once the ATH is surpassed.

However, volatility remains a wildcard, with Glassnode warning of a dense cluster of coins acquired near the current price that could potentially amplify reactions to moves, even as options markets remain oddly subdued. At-the-money implied volatility (ATM IV) has yet to reflect these brewing tensions, potentially signaling underpriced risk.

The post BTC ATH Within Reach: Glassnode Maps Support, Warns of Underpriced Volatility appeared first on CryptoPotato.